Collateralized Fund Obligations: A Growing CDO/CLO and Fund Finance Liquidity Solution

Executive Summary

One of the hottest fund finance trends is an alternative investment vehicle that has become increasingly popular. A close sibling of collateralized debt obligations ("CDOs"), collateralized fund obligations ("CFOs") are a vehicle for securitizing portfolios of alternative or real assets, including interests in private equity funds, hedge funds, private credit funds, infrastructure and real estate debt and equity, and other similar investments ("Underlying Fund Interests"). In this Legal Update, we explain the history, structure, and variations of these alternative financing vehicles, so sponsors and investors can determine if a CFO transaction aligns with their business objectives.

Background and History

CFOs first emerged in the early 2000s, but were only infrequently used. According to rating agency Fitch, between 2003 and 2006, six private equity versions of CFOs were issued. Our first private equity CFO was in 2004, and our first hedge fund CFOs were in 2006.

In the years following the financial crisis, from 2007 to 2013, no CFOs were issued. Over the past decade, however, CFOs have been issued with increased frequency as a way for portfolio investors, secondary funds, and funds of funds (each, an "Investor") to layer rated capital markets financing vehicles on top of pools of Underlying Fund Interests with diverse characteristics. Additionally, CFOs can facilitate the monetization of certain holdings in their investment portfolio earlier by generating short-term liquidity without forgoing the longer-term upside of the Underlying Fund Interests.

Discussion

What is a Collateralized Fund Obligation?

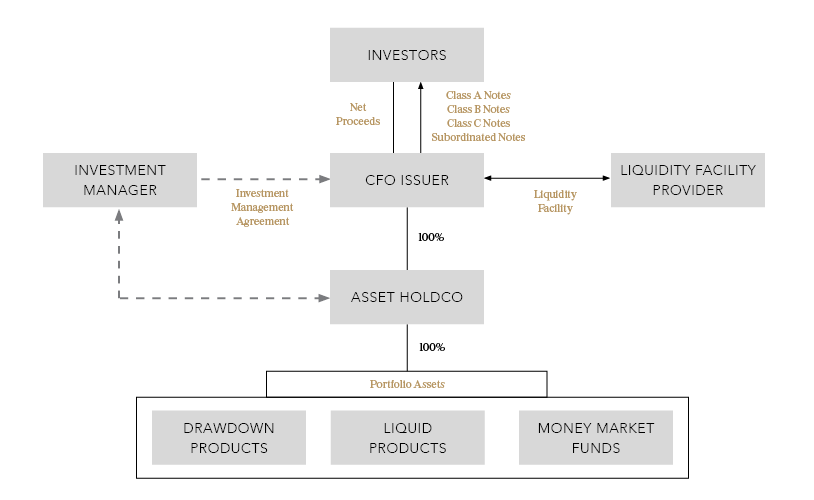

While CFOs can take various forms, they are essentially created when a bankruptcy-remote special purpose entity (“CFO Issuer”) acquires a diversified portfolio of Underlying Fund Interests. To finance that acquisition, the CFO Issuer issues tranches of rated notes and equity (collectively, “CFO Securities”), which are secured by the Underlying Fund Interests owned by the CFO Issuer or its subsidiary. More senior tranches benefit from credit enhancement features, and, when necessary, interest and principal payments that would otherwise be allocated to junior tranches are redirected to the senior tranches.

How are CFOs Structured?

In many ways, CFOs resemble a hybrid of a net-asset-value (“NAV”) facility and a CDO. CFOs utilize the tranche and collateral structure of CDOs while incorporating the loan-to-value metrics found in NAV facilities.

In light of typical restrictions on transfer of limited partner interests, the Underlying Fund Interests are typically held by a subsidiary of the CFO Issuer ("Asset HoldCo"). In this structure, the payments on the Securities are secured by a security interest in the equity interests issued by the Asset HoldCo to the CFO Issuer, rather than a direct pledge of the Underlying Fund Interests.

Consider a sample CFO structure: An investment company—the CFO Issuer—acquires a stake in a pool of private equity funds through its subsidiary, Asset HoldCo. The CFO Issuer also acquires interests in other portfolio assets, such as money market funds and other liquid products.

CFOs can be tailored to meet many different needs and situations. Some of the more common variations include:

- Type of Underlying Investments and Strategies. Most CFO Underlying Fund Interests consist of limited partner (LP) interests in private equity funds, hedge funds, energy funds, infrastructure funds, and venture capital funds. In addition, some CFOs include a broader range of investments such as equity stakes in CLOs or other asset-backed securitizations, co-investments in portfolio companies or syndicated loan assets. Including fixed income assets in the portfolio can help to ensure sufficient regular cash flow to satisfy payments on the CFO's liabilities and capital calls on the Underlying Fund Interests.

- Fixed Portfolio vs. Adjustable Portfolio. Some CFOs have a fixed portfolio at closing, and the CFO Issuer does not reinvest in other funds throughout the life cycle of the CFO. In other CFOs, the CFO Issuer may not have the intended final portfolio at closing, and may initially invest in liquid positions pending the identification and investment in such final portfolio. The CFO may be able to reinvest proceeds during a specified period post-closing (e.g., three years) to optimize the duration for the Underlying Fund Interests.

- Amortization and Repayment of Principal. Most CFOs have an amortization period of up to five years. During this time, the CFO Issuer will pay down its debt to Investors according to a pre-defined amortization schedule. If the CFO Issuer cannot pay down the principal as required, interest payments may be subject to a stated increase.

- Loan-To-Value Test Breaches. If the CFO Issuer breaches the specified loan-to-value (“LTV”) test, the CFO terms will likely require the CFO Issuer to restrict distributions to Investors in the equity or even mezzanine tranches. Typically, the LTV breach will not trigger a default under the terms of the CFO.

- Pool Breadth and Depth. Some CFOs acquire and hold Underlying Fund Interests only in funds managed by the CFO manager (or its affiliates) while others allow Underlying Fund Interests with third-party managers. CFOs can be structured variously with pool sizes ranging from fewer than ten Underlying Fund Interests up to a hundred or more Underlying Fund Interests.

- Maturity of Investment Pool. Underlying Fund Interests can also have a range of anticipated maturity dates. Older vintages will distribute cash early on in the life of the CFO; younger vintages will distribute cash later. A staggered vintage strategy supports consistent cash flow during the term of the CFO. For CFOs with Underlying Fund Interests that permit redemption, redeeming such funds may also provide required liquidity or available funds for scheduled payments or other distributions.

- Outstanding Capital Commitments of Investments. When some or all of the Underlying Fund Interests are not fully drawn and have outstanding capital commitments, the CFO Issuer typically must ensure ongoing available capital to fund the capital commitments through a capital call facility, delayed draw notes, or a cash reserve account.

Are there Any Structuring Challenges?

CFOs have two primary structuring challenges. First, since many Underlying Fund Interests don't have specified or consistent periodic payments (and may themselves be leveraged with senior secured and mezzanine debt), the timing of dividends and other distributions paid to Investors on these investments are difficult to predict. Accordingly, the capital structure of the CFO must include the ability to defer or capitalize significant current interest or other payment obligations otherwise owing. Alternatively, a CFO might utilize a liquidity facility, cash flow swap, or a similar arrangement to ensure timely payments of scheduled principal and interest on CFO Securities. Delayed draw notes, or a cash reserve account, can also help mitigate the risk that cash flow disruptions could impede payments to Investors.

Second, most private equity investments require an investor to commit to making capital contributions when called. Accordingly, in a CFO, unless the Underlying Fund Interests are fully funded when acquired by the CFO Issuer, the capital structure of the CFO must include available capital with sufficient flexibility to allow the CFO Issuer to make its required capital contributions. This flexibility can also be obtained through a revolving liquidity facility (discussed below), issuing delayed draw notes, or by establishing a cash reserve account.

How are Funds Distributed?

As mentioned above, because the CFO may have variable liquidity, interest and principal payments may be more variable than in a CLO or ABS transaction. Additionally, a CFO has more restrictions on distributions to the equity tranche. For instance, the terms of the CFO may prohibit any distributions to equity tranche for the first several years of the CFO. In addition, if the CFO allows the CFO Issuer or CFO Manager to reinvest proceeds from Underlying Fund Interests, distributions to the equity tranche may also be deferred.

Depending on cash flow and the specific terms of the CFO transaction, payments and distributions of the collections on the Underlying Fund Interests are generally made according to a priority structure similar to the below:

1st – Administrative expenses (and management fees, if applicable), subject to a periodic cap

2nd – Fees, expenses, and interest payments of liquidity facility (if one exists)

3rd – Principal payments of liquidity facility (if one exists)

4th – Interest payments to noteholders

5th – Principal payments to noteholders (according to amortization schedule and subject to deferral/capitalization if there is insufficient available cash and no liquidity facility funds)

6th – Administrative expenses that remain unpaid due to the cap

7th – Distributions to equity

How Does a CFO Access Required Funds and Short-Term Liquidity?

Many CFOs provide that CFO Issuers are only required to make interest payments on senior notes if there is adequate cash flow. If the CFO Issuer lacks sufficient cash, the interest payments may be deferred until the next payment date. However, some CFOs require that the CFO Issuer—or Asset HoldCo, if one is used—hold some percentage of its assets in money market funds or other lower-risk liquid assets. Additionally, the CFO Issuer will often enter into a revolving liquidity facility with a third-party lender, such as a bank, to ensure that the CFO Issuer has adequate funds to make scheduled interest payments to Investors if it lacks sufficient cash.

Although the liquidity facility may not need to be fully utilized, its availability reduces the risk that the CFO Issuer won't be able to make interest payments or meet its amortization schedule. In addition, a liquidity facility protects against default provisions and the adverse consequences of failing to fund capital commitments on the Underlying Fund Interests. Accordingly, a liquidity facility helps the CFO achieve its enhanced credit ratings (and may be subject to counterparty rating requirements imposed by the rating agency).

Next Steps

As CFOs become increasingly popular, investors will want to understand the history, structure, and variations of these alternative financing vehicles so they can determine if a CFO transaction aligns with their investment strategy. For additional information on CFOs, you can read the following Legal Updates:

Contact Us

Structured Finance:

Michael P. Gaffney, Partner

Jennifer T. Hartnett, Partner

Arthur S. Rublin, Partner

Ryan Suda, Partner

Sagi Tamir, Partner

J. Paul Forrester, Senior Counsel

Fund Finance:

Kiel A. Bowen, Partner and Global Co-Head of Lending

Todd N. Bundrant, Partner

Mark C. Dempsey, Partner

Ann Richardson Knox, Partner

Insurance Regulatory:

Lawrence R. Hamilton, Partner