US NAIC Update: Restructuring Mechanisms (E) Working Group

At its recent meeting on April 4, 2023, the Restructuring Mechanisms (E) Working Group (the “Working Group”) of the US National Association of Insurance Commissioners (“NAIC”) continued to advance the best practices framework it is developing for Insurance Business Transfers (“IBTs”) and Corporate Divisions (“CDs”) in the United States.

An IBT is a transaction whereby a transferor insurer transfers existing insurance obligations to a transferee insurer without policyholder consent, but subject to regulatory and/or court approvals. As a result of an IBT, the transferee insurer becomes directly liable for the policyholders and the transferor insurer’s obligations in respect of the transferred policies are extinguished. By contrast, a CD is the division of one insurer into two or more resulting insurers, with assets and liabilities allocated among the resulting insurers, without policyholder consent but subject to regulatory and/or court approvals.

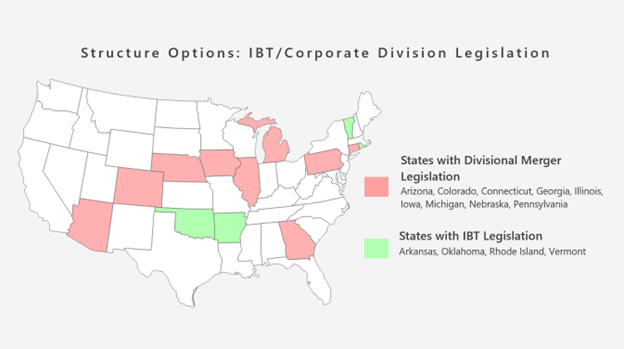

Currently, only a handful of states have laws that authorize IBTs or CDs and even in those jurisdictions, there are often restrictions related to lines of business that may be the subject of an IBT or CD, uncertainty with respect to the scope of regulatory review, and other similar concerns that make such restructuring transactions less appealing under the existing US framework.

Within this context, the Working Group has been working on its best practices framework for IBTs and CDs. At its April 4, 2023 meeting, the Working Group heard comments on and discussed revisions to the most recent draft of the Working Group’s “Best Practices Procedures” document. The discussion focused on the following areas:1

- Guaranty Fund Coverage. The transfer of policies to a transferee insurer through an IBT or to a newly created insurer through a CD may affect the availability of state guaranty fund coverage. The Working Group is seeking to ensure that the rights of claimants are unaffected following an IBT or CD. To address this issue, the Working Group has requested assistance from the NAIC Receivership and Insolvency (E) Task Force (“RITF”). The RITF is currently considering a “surgical” revision to the Property and Casualty Insurance Guaranty Association Model Act # 540 to reduce or eliminate the impact on the availability of guaranty fund coverage following an IBT or CD. It is unclear at this stage what revisions may yet be proposed regarding guaranty fund coverage for lines of business other than property and casualty. The Working Group is expected to defer to whatever recommendations are made by the Task Force given the Task Force’s greater expertise in this area.

- Insurer Licensing. The transferee insurer in an IBT or the newly created insurer in a CD must be generally licensed for the lines of business in all the jurisdictions where insurance obligations are being assumed by the transferee insurer or the newly created insurer. The consensus in the Working Group is that such licensing of the transferee insurer in an IBT or a newly created insurer in a CD, should be required but not automatic. Although the Working Group has not yet grappled with this particular issue in detail, the members of the Working Group are adamant that any best practices standard must maintain adherence to state-based licensing requirements that apply generally to insurers doing business in the state.

- Policyholder Interests. The Working Group’s best practices standards will be tailored to mitigate to the extent possible any adverse effect on policyholders as a result of an IBT or CD. Many members of the Working Group support a standard for protection of policyholders similar to that used under the UK’s Part VII transfer framework, where the transaction may be consummated only if there is “no material adverse” impact on policyholders. Other standards under consideration by the Working Group are a “no worse off” standard, a “no adverse effect” standard, and a “best interest of the policyholders” standard. The standard for protection of policyholders could differ depending on whether the companies undergoing the transaction are direct writers or reinsurers (i.e., a lower standard may apply to reinsurers). Evaluation of the transaction’s impact on policyholders is tied to the overarching financial analysis of the transaction, which is itself primarily a function of the evaluation of the transaction by an independent expert. The current draft of the “Best Practices Procedures” document only requires independent expert review for an IBT but, because of the Working Group’s desire to mitigate any potential adverse effects to policyholders, the Working Group is considering requiring the use of an independent expert for CDs as well. In connection with this issue, during the meeting, Virginia’s Deputy Commissioner stated that the state has an anti-novation statute which includes a best interests of policyholders standard and that “nothing being done here by the Working Group is going to change that law.”

- Due Process Considerations. The due process issues under consideration by the Working Group include: who provides notice of the transaction (the companies involved in the transaction, regulators in the reviewing state or domicile state, or both), who should receive notice and opportunity to challenge the transaction, how much coordination should occur among state regulators, what an adequate notice standard would be, and when hearings should be required. There was broad support among members of the Working Group for a best practices standard that requires regulators and the companies involved in the transaction to work together to develop a public communication plan regarding the proposed transaction. The Working Group does not expect to require policyholder consent for either an IBT or CD, but the Working Group wants to ensure that all impacted stakeholders are adequately apprised of the transaction and have an opportunity to respond in a meaningful way. Regarding the notice and opportunity to respond in connection with a CD, members of the Working Group support a notice and hearing procedure that closely mirrors the procedures currently used by states in evaluating a “Form A” application for the acquisition of control of a domestic insurer.

- Other Application Standards. In addition, the Working Group is developing specific application requirements for insurers seeking to undertake an IBT or CD. The finalized best practices standards developed by the Working Group will ensure that reviewing regulators receive key financial information about the insurer(s) involved in the transaction, including historical financial information, projected financial information, actuarial reports, RBC calculations and other related materials.

Next Steps: The Working Group has exposed the current draft of the “Best Practices Procedures” document for a comment period ending April 26, 2023. The comments will then be considered at the next meeting on May 4, 2023. This accelerated timeline reflects the Working Group’s goal of completing a final draft of the “Best Practices Procedures” document to present to the Financial Condition (E) Committee at the NAIC Fall 2023 National Meeting, which is scheduled to be held in Orlando, Florida from November 30 to December 4, 2023.

To view additional updates related to the NAIC, visit our US NAIC Spring 2023 National Meeting highlights page.

1 There was previously a Restructuring Mechanisms Subgroup, but the Working Group announced that the subgroup was “merging back into” the Working Group in order to make the process of developing best practices for IBTs and CDs more efficient.