Mayer Brown is pleased to sponsor the 2025 Covered Bonds Congress, hosted by FT Live and the European Covered Bond Council (ECBC), in Seville. The congress will bring together the international covered bond market, gathering over 1,100 issuers, investors, dealers, and policymakers, from more than 45 jurisdictions globally.

Mayer Brown Partner Patrick Scholl will participate in “The Global Regulatory Landscape” roundtable.

For more information, visit the event webpage.

Mayer Brown Partner Patrick Scholl will participate in “The Global Regulatory Landscape” roundtable.

For more information, visit the event webpage.

The Cover(ed) Story

Mayer Brown lawyers have played a leading role in the development of the covered bond market. From advising clients on the first covered bonds undertaken by a US depository institution, to advising Canadian and other non-US banks on their covered bond issuances, to undertaking the first US public offering of covered bonds in the United States, Mayer Brown lawyers have been front and center. Our long experience with covered bonds and our knowledge of bank regulatory issues, the mortgage markets, financial institutions and financing techniques makes us a worthy partner to our issuer, dealer, initial purchaser, and underwriter clients.

阅读更多

Financial Services

At Mayer Brown, we know financial services—we achieve, innovate, and move beyond conventional approaches.

阅读更多

Commercial Paper and Asset-Backed Commercial Paper at a glance

Commercial paper is a form of short-term, unsecured debt, usually issued by corporates and financial institutions. Asset-backed commercial paper (ABCP) is a type of commercial paper collateralized by financial assets and usually issued by a conduit or special funding vehicle established by a financial institution to own the collateral assets from asset sellers.

阅读更多

Covered Bonds at a Glance

Covered bonds are senior, secured debt securities of a regulated financial institution. If the issuing bank defaults, the collateral, referred to as the cover pool, is used to make up any payment shortfall due on the covered bonds. So long as there is sufficient collateral, covered bonds are not accelerated, but rather paid on their scheduled payment dates. If the cover pool at any time is inadequate to make all scheduled payments, all outstanding covered bonds are accelerated and paid pro rata from the proceeds of the cover pool.

阅读更多

What's the Deal?

We are one of the leading securities and capital markets law firms in the world, advising issuers, underwriters and agents in domestic and international private and public financings.

阅读更多

IFLR | Structuring Liability Management Transactions

Mayer Brown lawyers regularly represent issuers, as well as dealer-managers, solicitation agents, information agents and other parties in connection with liability management transactions, including repurchases, exchange offers, tender offers, issuer self-tenders and consent solicitations.

阅读更多

Debt Capital Markets

Our debt capital markets team in Europe has extensive experience advising both issuers and underwriters on all forms of debt capital markets products.

阅读更多

CREDIT RISK TRANSFER CAPABILITIES

Mayer Brown offers a “one-stop shop” of cutting-edge legal advice for credit risk transfer trades that is delivered with practical experience from serving every part of the market. We are at the forefront of advising on the special and complex features of CRT transactions across asset classes, delivering our world-class services to both our

clients and the investors and companies that they support.

阅读更多clients and the investors and companies that they support.

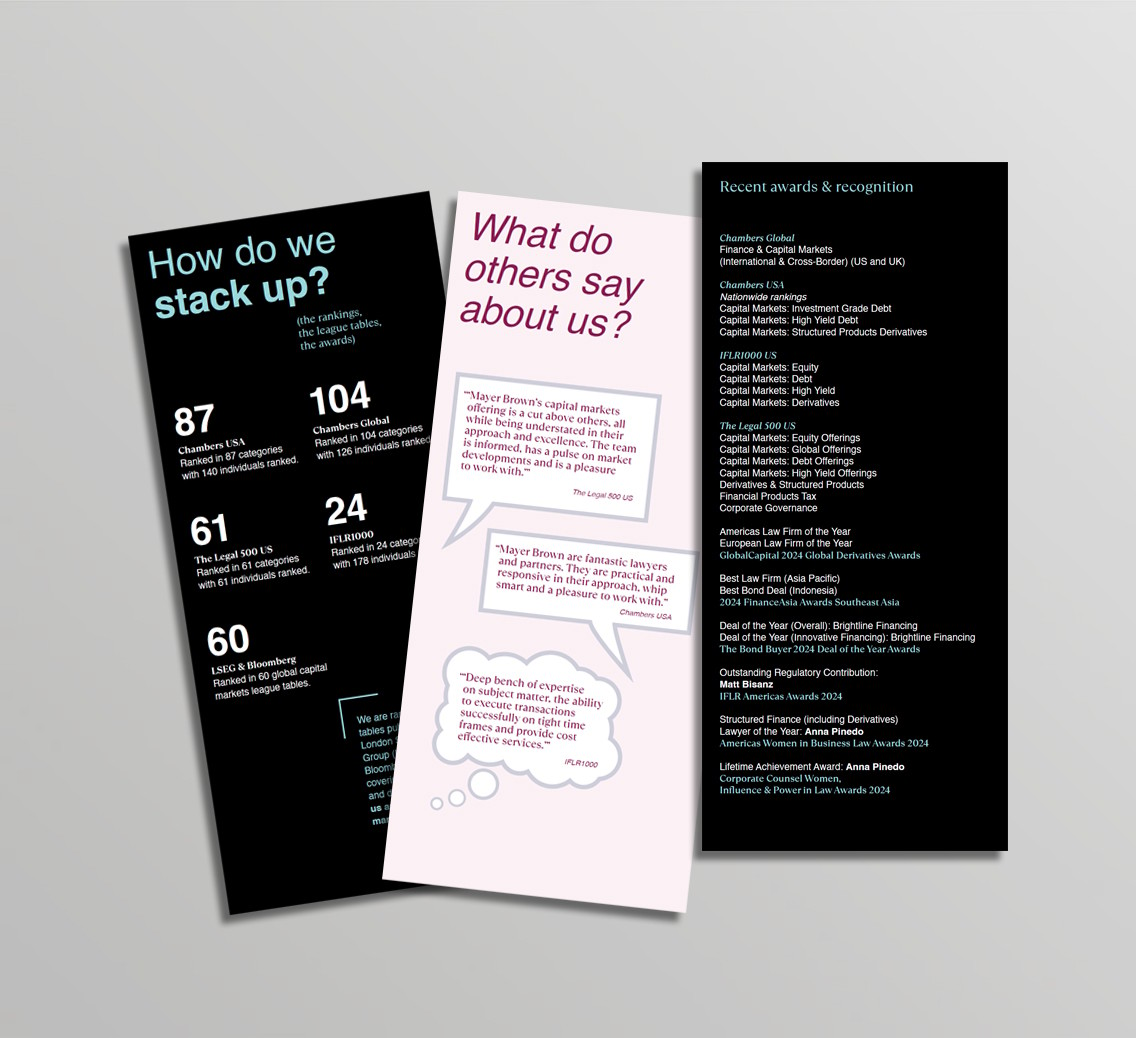

MORE ABOUT OUR CAPITAL MARKETS PRACTICE

Mayer Brown has one of the leading capital markets practices in the world. Our practice is comprised of some of the top corporate and securities lawyers, advising issuers, underwriters and agents in domestic and international, private and public financings of equity-linked and debt offerings.

阅读更多