UK Sustainability Disclosure Framework FCA publishes final rules on Sustainability Disclosure Requirements and investment labels

On 28 November 2023, the UK's Financial Conduct Authority ("FCA") published its "Sustainability Disclosure Requirements ("SDR") and investment labels" policy statement (PS23/16) (the "Policy Statement"). The Policy Statement introduces a set of new rules aimed at tackling greenwashing, including investment product sustainability labels and restrictions on how terms like "ESG", "green" and "sustainable" can be used.

Background

In October 2022, the FCA published a consultation paper (CP22/20) on a package of mea

sures aimed at addressing greenwashing (the "Consultation Paper"). Once the consultation period closed in January 2023, the FCA engaged with a number of stakeholders, including industry and consumer groups, before revising its proposals. The FCA has now published these revised proposals in the form of the Policy Statement. For further information on the background to the SDRs and the Consultation Paper, please read our earlier update here.

Scope

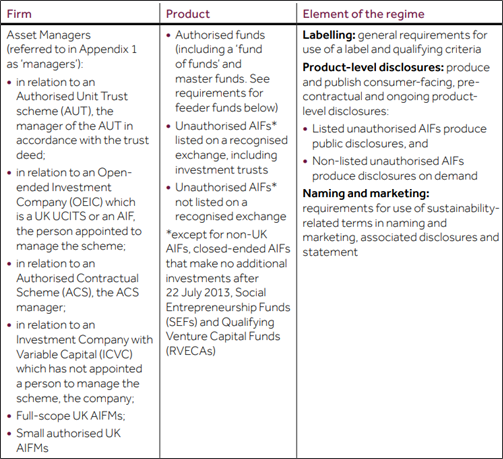

All FCA-authorised firms (as defined in the FCA Handbook) will be subject to the "anti-greenwashing" rule set out in paragraph 1 below. UK Asset Managers (as defined in the below table extracted from the Policy Statement) will be subject to the rules set out in paragraphs 2, 3, 4 and 5 below, whilst UK firms that distribute authorised funds and unauthorised AIFs to retail investors will be subject to the rules in paragraph 6 below.

In what marks a deviation from the Consultation Paper, portfolio management products and services have been excluded from the scope of the rules set out in paragraphs 2, 3, 4 and 5 below. The FCA does, however, intend to consult on labelling proposals for portfolio management products and services in Q1 2024.

All of the new rules focus on products offered by UK funds to retail investors in the UK. The rules set out in paragraph 5, however, apply to products offered to both retail and institutional investors in the UK.

The FCA has also expressed an intention to later expand the scope to overseas products offered by FCA-regulated firms, but has stated that this is a matter for HM Treasury.

Please see the below table extracted from the Policy Statement for further detail on the scope of the new rules.

The new rules

The Policy Statements introduces:

1. An anti-greenwashing rule;

An "anti-greenwashing rule" will apply to all FCA-authorised firms. It remains in substantially the same form as in the Consultation Paper, in that it provides a general rule that all claims made about the sustainability characteristics of a product or service must be clear, fair and not misleading. Sustainability characterises can relate to the environmental and/or social aspects of a product or service.

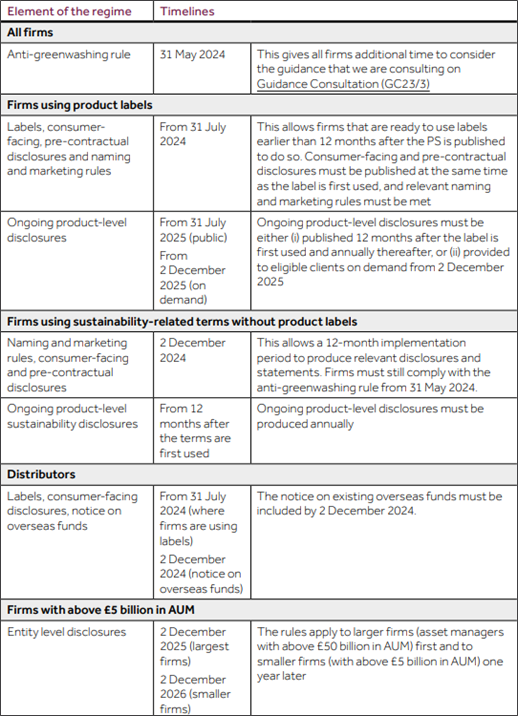

The FCA has also simultaneously published a guidance consultation paper, "Guidance on the Anti-Greenwashing rule (GC23/3)" (the "Guidance"), with the aim of helping in-scope firms better understand the FCA's expectations under the anti-greenwashing rule. The consultation period for the Guidance is open until 26 January 2024 and the anti-greenwashing rule will come into effect after the consultation period has closed (see the FCA's proposed timelines below).

2. Four sustainable investment product labels;

The Consultation Paper proposed introducing three categories of sustainable investment product labels, but the Policy Statement has added a fourth category (together, the "Product Labels"). The Product Labels aim to distinguish between products according to whether they aim to invest:

- in assets that are environmentally and/or socially sustainable ("sustainable focus");

- to improve the environmental and/or social sustainability of assets over time, including in response to the stewardship influence of the firm ("sustainable improvers");

- in solutions to environmental or social problems, to achieve positive, real-world impact ("sustainable impact"); and

- in a mix of assets that either focus on sustainability, aim to improve their sustainability over time, or aim to achieve a positive impact for people or the planet ("sustainable mixed goals").

The Product Labels are underpinned by a set of general objective criteria, which, in summary, covers:

- Sustainability objective: all products must have a sustainable investment objective to improve or pursue environmental and/or social outcomes as part of their investment objectives. Firms must also identify and disclose whether pursuing the sustainable investment objective may result in material negative outcomes;

- Investment policy and strategy: at least 70% of the product's assets must be invested in accordance with its sustainability objective, whilst firms must also disclose and explain any other assets held in the product for other reasons;

- KPIs: firms must identify KPIs to measure progress against the sustainability objective;

- Resources and governance: firms must ensure there are appropriate resources, governance and organisational arrangements to support delivery of the sustainability objective; and

- Stewardship: firms must identify and disclose the stewardship strategy needed to support the delivery of the sustainability objective.

Each Product Label also has its own specific criteria that must be complied with.

Asset Managers that elect to use the Product Labels will need to provide clear and simple information on: (a) what the sustainability goal is; (b) the approach to achieving it; and (c) annual updates on progress towards the goal. However, in what marks a deviation from the Consultation Paper, Asset Managers are no longer required to use the Product Labels and they can, instead, promote non-labelled products with ESG characteristics (see paragraph 3 below for more information).

3. Naming and marketing rules for investment products;

Asset Managers that elect to promote non-labelled products with ESG characteristics can use labels such as "ESG", "green" or "low carbon" when marketing products to retail investors. However, promoters cannot use the words "sustainable" or "impact" if they are not using Product Labels. If Asset Managers elect to use such other labels, they must include a statement explaining why they are not using the Product Labels and how the products are invested.

The FCA has also published guidance to help consumers identify sustainable investment labels.

4. Consumer-facing product level disclosure requirements;

Asset Managers will be required to make several consumer-facing product-level disclosures, which include (but are not limited to) disclosing the investments that consumers may not expect to be held in the investment product.

5. Pre-contractual, ongoing product-level and entity-level disclosures requirements; and

Asset Managers will be required to make more granular disclosures at both a product and entity level that are suitable for a broad range of stakeholders, such as institutional and retail investors. The Policy Statement provides that such disclosures should take the form of:

- in assets that are environmentally and/or socially sustainable ("sustainable focus");

- to improve the environmental and/or social sustainability of assets over time, including in response to the stewardship influence of the firm ("sustainable improvers");

- in solutions to environmental or social problems, to achieve positive, real-world impact ("sustainable impact"); and

- in a mix of assets that either focus on sustainability, aim to improve their sustainability over time, or aim to achieve a positive impact for people or the planet ("sustainable mixed goals").

6. Requirements for distributors.

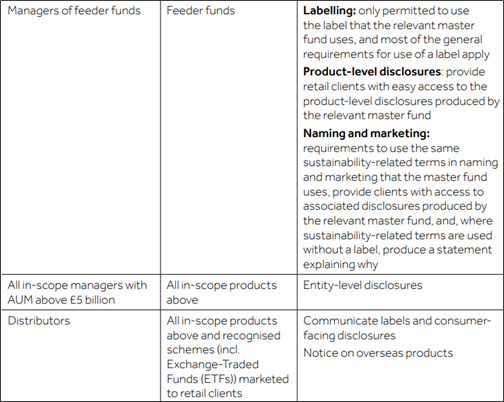

Distributors of products, such as investment platforms, will be required to ensure that any sustainable investment labels (Product Labels or otherwise) and consumer-facing disclosures are accessible and clear to consumers and investors.

Timelines

The below table extracted from the Policy Statement summarises the implementation timelines of the new rules:

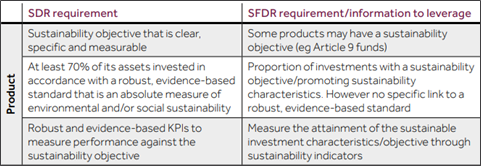

How do the SDRs compare to the EU's Sustainable Finance Disclosure Regulation ("SFDR")?

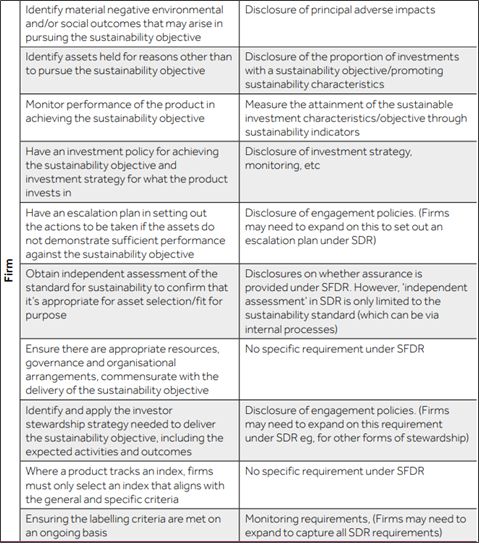

The Policy Statement "maps" the new rules to the SFDR requirements:

As can be seen from the above table, the SDRs and the SFDR are compatible, and firms should be able to use much of the information they use for their product categorisation and disclosures under the SFDR to meet the qualifying criteria and disclosure requirements under the Policy Statement.