Subscription Finance: Cascading Pledges

De un Vistazo

Background

Private investment funds often use feeder funds – investment vehicles that accept capital contributions from investors and subsequently invest that capital into a separate “master fund” – to pool investment capital, create separate categories of investors, and avoid the complexities of multiple share classes while offering investors customized investment options.

A master-feeder structure includes at least two funds, including one or more downstream master funds and one or more upstream feeder funds. Third-party investors may subscribe to the master fund and/or feeders funds as limited partners. The feeder fund aggregates the capital contributions of the feeder fund investors and invests those amounts in the master fund. Through this investment, the feeder fund becomes a limited partner in the master fund with a capital commitment equal to the capital commitment of the aggregate feeder fund investors.

Feeder funds are created for a variety of reasons, including separating investors by type (such as tax-exempt and foreign investors), geographic location, or investment size. This master-feeder structure provides tax benefits and a simplified capital call process for the feeder fund investors and centralizes oversight of investments by the master fund.

A cascading pledge provides the lender with full collateral rights over all fund investors. This also permits the master fund to gain borrowing base credit for feeder fund investor capital commitments and for a more diverse borrowing base.

What to Know About Cascading Pledges in Subscription Credit Facilities

Mechanics of a Cascading Pledge

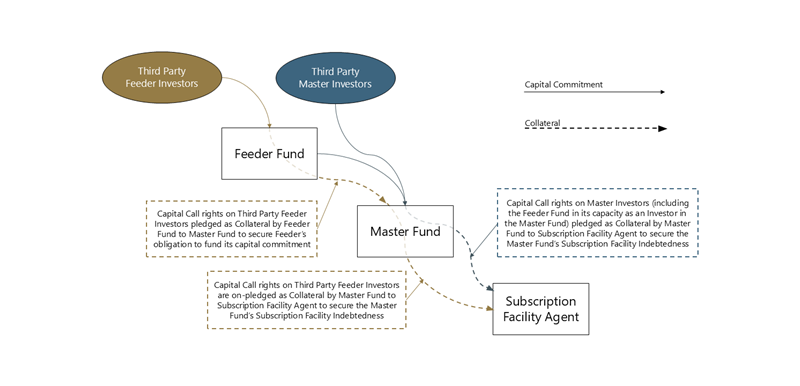

If a subscription credit facility includes a feeder fund in its collateral structure, the fund may request that the subscription lender rely on a cascading pledge – a two-tiered collateral structure – to access the ultimate source of the capital commitments rather than using a co-borrower or guarantor structure. Transactions sometimes encounter issues triggered by ERISA (e.g., prohibited transactions),1 tax-exempt investors (e.g., unrelated business taxable income (“UBTI”)) and/or foreign investors (effectively connected income (“ECI”))2, and addressing these potential complications may necessitate that the feeder fund and the subscription lender not be in privity. A cascading pledge keeps the transactions of the feeder fund separate from those of the subscription lender, while still capturing the rights of a feeder fund with respect to capital commitments of the feeder fund investors.

Two-Tiered Collateral Structure:

- In the first tier, the feeder fund and its general partner enter into a security agreement with the master fund, pledging the rights to call capital commitments from the feeder fund investors and securing the feeder fund’s obligation to make capital contributions to the master fund. This structure collateralizes only the feeder fund’s obligation to fund capital calls made by the master fund in accordance with the feeder fund’s constituent documents. The feeder fund does not pledge any collateral directly to the credit facility and there is no privity with the lender. Accordingly, there is no direct liability to the lender for the feeder fund.

- In the second tier, the master fund enters into a security agreement directly with the lender and on-pledges the capital call rights to all of its interests in the first tier collateral (the corresponding enforcement rights of the feeder fund’s collateral) to the lender. This on-pledge directly secures the master fund’s repayment obligations to the lender.

- This two-tiered structure avoids privity of the feeder fund with the subscription lender, addressing the aforementioned tax and ERISA issues. As a result of this cascading pledge structure, the capital commitments of the feeder fund investors are indirectly pledged as collateral under the subscription credit facility and the feeder fund avoids a direct pledge to the subscription lender. Instead, because the feeder fund is a master fund investor itself, the feeder fund’s rights to the capital commitments of the feeder fund investors cascade downstream to the master fund to be pledged to the subscription lender by the master fund.

Feeder Liability and Waterfall:

Upon the occurrence of an event of default, there is a collateral “waterfall” whereby the lender has (a) the right to initiate capital calls on the capital commitments of the master fund’s investors (including the feeder fund) and (b) the right to step into the shoes of the master fund as secured party under the feeder fund cascading pledge documents and exercise the master fund’s right thereunder to initiate capital calls on the capital commitments of the feeder fund’s investors. This cascading pledge structure ensures that the lender has the ability to cause a capital call to be made on all of the ultimate investors in the fund structure while addressing the tax and/or ERISA structuring referenced above.

How to Properly Document Cascading Pledges in Limited Partnership Agreements

To facilitate a cascading pledge, the related master fund and feeder fund limited partnership agreements (LPAs) should be tailored to accurately describe the manner in which each respective fund pledges collateral in support of a subscription credit facility. At the master fund level, the LPA should allow a direct pledge of the applicable collateral from the master fund to the subscription lender. At the feeder fund level, the LPA should permit an indirect pledge of collateral from the feeder fund for the ultimate benefit of the subscription lender by:

(1) expressly permitting a pledge of assets from the feeder fund to its master fund to secure the feeder fund’s obligation to contribute capital to the master fund, and

(2) expressly permitting the master fund to on-pledge its rights to those assets to the lender to secure the master fund’s obligations under the credit facility.

In practice, feeder fund LPAs sometimes address the pledge of collateral via a cascade to varying degrees. For example:

- The feeder fund LPA might duplicate the direct pledge language included in the master fund LPA, inaccurately capturing the manner in which the feeder fund is actually pledging capital commitments and capital call rights and neglecting to acknowledge the cascading pledge; or

- The feeder fund LPA might only include the first step described above – a direct pledge to the master fund – without expressly contemplating the on-pledge of rights from the master fund to the lender in step two.

Clear and express language with regard to cascading pledge mechanics in the feeder fund LPA avoids ambiguity and reduces the risk of investor challenges in a downside scenario, particularly when a lender seeks to enforce the cascading pledge and call capital for repayment of the facility. Potential subscription lenders may also take comfort in feeder fund LPAs that include certain waivers of defenses to payment by the feeder fund investors and are specifically drafted to address the two-tiered structure. Particular concerns around cascading pledge language in LPAs may arise in certain jurisdictions, such as Luxembourg, where feeder funds and/or master funds are often domiciled and should be addressed with local counsel in the applicable jurisdiction(s).

Key Takeaways

Cascading pledge structures allow master funds with feeder fund investors to enter into subscription credit facilities while avoiding UBTI and ECI taxation, addressing ERISA concerns, and avoiding violations of the fund constituent documents. The two-tiered pledge agreements leverage the commitments of a broader investor pool and can diversify the borrowing base while limiting liability to the feeder funds themselves. Lenders must carefully implement these agreements and a collateral waterfall to mitigate risks when leveraging multi-tiered capital commitments in a feeder fund structure.

To effectively document and rely on a cascading pledge in a subscription credit facility, lenders and funds should ensure that feeder fund LPAs expressly permit, first, the pledge of capital commitments and capital call rights from the feeder fund to the master fund and, ideally, second, the on-pledge of the master fund’s rights to those capital commitments and capital call rights of the feeder fund to the lender. The master fund LPA, in turn, should include customary language permitting the master fund to directly pledge those rights to the lender. With proper structuring of constituent documents and loan documents, a cascading pledge can unlock capital and expand credit availability for private investment funds.

Special thanks to Jared Goldberger and Erika Gosker for their thoughtful review and revisions.

***

Sample Feeder Fund LPA Language to Accommodate a Cascading Pledge

The limited partners hereby consent to and direct the general partner to, in its own capacity and on behalf of the partnership, in connection with the incurrence or assumption of debt by the master fund:

(1) enter into and execute any pledge, transfer and/or assignment in favor of the master fund, which pledges, transfers and/or assigns to the master fund:

(a) the right, title and interest of the partnership and the general partner in and to the capital commitments, the unused capital commitments, the capital contributions, the account into which capital contributions must be funded, and other customary collateral; and

(b) the right of the partnership and the general partner to make capital calls of the capital commitments and the unused capital commitments, to call for and receive capital contributions, and to issue, deliver and enforce capital call notices; and

(2) acknowledge, consent to and agree that any such assets (including, without limitation, the right to call for and receive capital contributions and rights in any account into which such capital contributions are paid) may be assigned, transferred and/or pledged by the master fund to any creditor of the master fund, including entering into any pledge, mortgage, charge, delegation, assignment, instrument or other agreement.

1 Once an entity such as a fund or a feeder fund accepts investors that are subject to ERISA or Section 4975 of the Code, the entity could itself become subject to the fiduciary and prohibited transaction rules under ERISA and Section 4975 of the Code if the assets of such entity are deemed to be “plan assets” of such investors. The rules governing when the assets of an entity are treated as plan assets are generally set forth in Section 3(42) of ERISA and a regulation, known as the “plan asset regulation,” published by the U.S. Department of Labor. Except where specifically exempted by statute or by the Department of Labor, ERISA and Section 4975 of the Code impose prohibitions on specified transactions between investors that are subject to ERISA or Section 4975 of the Code and a wide class of persons (alternately referred to as “parties in interest” or “disqualified persons”) who, by reason of position or relationship, might be in a position to influence a plan fiduciary’s exercise of discretion. One of the specified transactions is any loan or other extension of credit. Feeder funds are frequently permitted to hold “plan assets.” If documented properly, the two-tiered cascading structure discussed above avoids direct privity between the feeder fund and the lender and, therefore, mitigates the prohibited transaction risk under ERISA and Section 4975 of the Code.

2 Feeder funds are often formed to pool investments from U.S. tax-exempt investors or foreign investors. These investors want to avoid UBTI or ECI that could be triggered by direct investment activities in the U.S. If a feeder fund with tax-exempt and foreign investors directly participates as a guarantor or collateral provider in a subscription facility provided by a U.S. lender, this could generate UBTI or ECI and the fund’s tax-exempt and foreign investors may have to file a US tax return. However, if the LPA and loan documents are drafted properly, there is no direct transaction between the feeder fund and the lender. Thereby, a cascading pledge reduces the risk of potential UBTI or ECI taxation for tax-exempt or foreign investors.