House Reconciliation Bill Amends Clean Energy Provisions of the IRA

On May 22, 2025, the House of Representatives passed its reconciliation bill, H.R. 1, entitled “One Big Beautiful Bill Act” (the “legislation”), which significantly amends the clean energy provisions that were enacted as part of the Inflation Reduction Act of 2022 (the “IRA”). Now the revised legislation advances to the Senate, where it is likely to be amended before both chambers reconcile their differences and finalize the legislation for the President’s approval or veto. Although the legislation is not final and could change before final enactment, its impact on the clean energy provisions enacted as part of the IRA warrants attention from investors, developers, manufacturers, and financiers that rely on these provisions. The legislation imposes a number of significant changes to the IRA, including the elimination of the investment tax credit and production tax credit under Sections 45Y and 48E, respectively, for any facilities that are not under construction prior to the date that is 60 days after enactment and a full repeal of the EV credits. Below is a summary of key provisions in the legislation most likely to affect energy and manufacturing transactions.

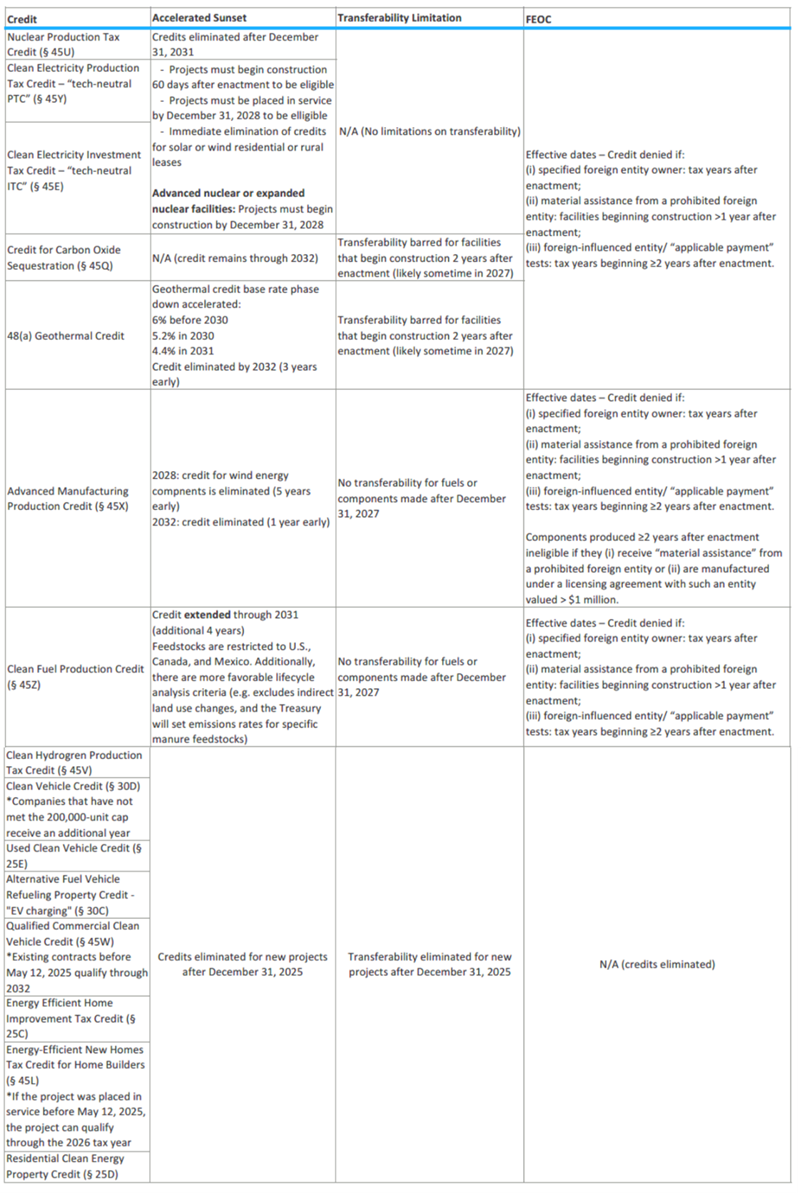

Phase-Outs and Terminations of Energy and Manufacturing Credits

Under the legislation, several energy-related credits are phased out or terminated. The legislation accelerates the sunset of numerous credits which, under current law, run well into the 2030s or have no fixed end date.

1. Clean Electricity Production Credit (Section 45Y) and Clean Electricity Investment Credit (Section 48E)

The clean electricity production tax credit (the “PTC”) and the clean electricity investment tax credit (“ITC”) are very important components of the IRA. These two tech-neutral credits apply to investments in qualifying clean electricity generation or storage property. The PTC and ITC took effect at the beginning of 2025 and are available to all new zero-emission electricity production facilities. Under current law, the PTC and ITC are scheduled to start phasing out in 2032, or when the US power sector reaches 25 percent of 2022 emissions levels, whichever is later.

The legislation significantly accelerates the elimination of these credits. The ITC and PTC are repealed for projects beginning construction more than 60 days after enactment of the legislation. Additionally, in order to maintain eligibility to receive the tax credits, the projects must be placed in service by December 31, 2028. This is a significant departure from prior repeals and sunsets of the credits, in which Congress solely used a “beginning of construction” standard as a transition rule. The two-pronged transition rule under the legislation means that developers will be required to quickly incur 5% of a project’s cost or begin physical work of a significant nature, but doing so will not grandfather the qualification of a project that fails to be placed in service by the end of 2028.

Eligible advanced nuclear facilities and expanded nuclear facilities are exempted from the 60-day beginning-of-construction requirements and instead must only comply with the placed-in-service deadline on December 31, 2028. Additionally, the legislation specifically eliminates the credit for residential wind and solar leasing arrangements beginning on the day the legislation is enacted.

The effective date of the FEOC restrictions would vary depending on the specific FEOC restriction, as follows: (i) for taxpayers who are a “specified foreign entity,” effective immediately for tax years beginning after enactment; (ii) for projects the construction of which includes any “material assistance from a prohibited foreign entity,” effective for facilities beginning construction after one year from enactment; and (iii) for taxpayers that are a “foreign-influenced entity” or make an “applicable payment” to a “prohibited foreign entity,” effective in tax years beginning two years after enactment.

In addition, 100% of ITCs claimed under Section 48E with respect to a property would be recaptured if a “specified taxpayer” makes an “applicable payment” within ten years after the property is placed in service. This is longer than the typical five-year recapture period and does not include a step-down during the recapture period.

2. Advanced Manufacturing Production Credit (Section 45X)

The Advanced Manufacturing Production Credit provides a credit for domestic production of key clean energy components like solar panels, wind turbines, batteries, and critical minerals. Under the legislation, a phased reduction of the Advanced Manufacturing Production Credit begins in 2029. Production occurring after 2031 will now no longer qualify, one year earlier than current law. In addition, under the legislation, wind-energy components cease to be eligible after 2027, and the general phase-out mirrors the 45Y/48E schedule. Under current law, full credit is available through 2029 with a softer ramp-down (75% in 2030, 50 % in 2031, 25% in 2032, and zero thereafter). Similar to 45X, the nuclear production tax credit (45U) ends on December 31, 2031, one year earlier than current law.

The legislation would apply FEOC restrictions and disallow credits to taxpayers that are a “specified foreign entity” for tax years beginning after enactment, taxpayers that are a “foreign-influenced entity” or make an “applicable payment” to a “prohibited foreign entity” with respect to any eligible component category in tax years beginning two years after enactment, and eligible components produced in tax years beginning two years after enactment that (i) include any “material assistance from a prohibited foreign entity,” or (ii) are produced subject to a licensing agreement with prohibited foreign entity valued in excess of $1 million.

3. Clean Fuel Production Credit (Section 45Z)

The Clean Fuel Production Credit offers a tech-neutral credit for the domestic production of low-emissions transportation fuels, with eligibility and credit value based on lifecycle greenhouse gas emissions. Under current law, the credit is available for transportation fuel sold before January 1, 2028. The legislation extends the Clean Fuel Production Credit to make credits available for fuels sold through December 31, 2031. Under the legislation, feedstock must be sourced exclusively from the United States, Canada, or Mexico. Credits are denied if the producer becomes a prohibited foreign entity or foreign-influenced entity.

The legislation would apply FEOC restrictions and disallow credits to taxpayers who are a “specified foreign entity” for tax years beginning after enactment and taxpayers who are a “foreign-influenced entity” in tax years beginning two years after enactment.

Foreign Entity of Concern Limitation

The legislation significantly expands the existing concept of a foreign entity of concern (“FEOC”) found in other parts of the Code by introducing new criteria and definitions of a “prohibited foreign entity,” a “specified foreign entity,” and a “foreign-influenced entity.” Under the legislation, eligibility for the credits under Sections 45, 45Y, 48, 48E, or 45X (further discussed below) may be denied where a “prohibited foreign entity” is involved in certain aspects of the facility’s development or ownership (typically requiring meaningful connections to China, Russia, North Korea, and Iran). The complexity of these rules will require careful planning to ensure compliance and no inadvertent foot fault.

- Prohibited Foreign Entity: a broad category established in the legislation encompassing both “specified foreign entities” and “foreign-influenced entities.”

- Specified Foreign Entity: any foreign entity of concern as defined in section 9901(8) of the William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021, entities identified as Chinese military companies operating in the United States, entities included on certain federal government lists, certain battery-producing entities, and any foreign-controlled entity.

- Foreign Controlled Entity: an entity owned or controlled by the government of a covered nation (e.g., China, Russia, Iran, or North Korea), citizens or residents of such a nation (excluding US citizens or lawful permanent residents), entities organized under the laws of a covered nation, or entities controlled by any of the foregoing, an entity controlled by any of the above, including subsidiaries, measured by more than 50% ownership of stock in a corporation, profits interests or capital interests in a partnership, or other beneficial interest in the entity.

- Foreign Influenced Entity: an entity will be classified as a “foreign-influenced entity” if:

- During the taxable year, (i) a specified foreign entity has direct or indirect authority to appoint a board member, executive officer, or similar individual; (ii) a single specified foreign entity owns at least 10% of the entity; (iii) specified foreign entities collectively own 25% or more of the entity; or (iv) one or more specified foreign entities collectively hold at least 25% of the entity’s debt.

- In addition, an entity will also be deemed foreign-influenced if, during the prior taxable year, it knowingly makes, or had reason to know it made, payments of dividends, interest, compensation for services, rents or royalties, guarantees, or other fixed, determinable, annual, or periodic amounts (each, an “applicable payment”) either: (i) in an amount equal to or exceeding 10% of the total of such payments to any single specified foreign entity, or (ii) in an aggregate amount equal to or exceeding 25% of the total of such payments to multiple specified foreign entities.

While “specified foreign entity” and “foreign controlled entity” are not new concepts (although, as discussed below, the legislation would expand their applicability to more credits), the “foreign influenced entity” is a new category of FEOC. Presumably, these expansions are designed to capture both direct and indirect foreign influence or control, particularly from countries or organizations deemed adversarial or high risk, and serve as the basis for restricting access to certain federal tax benefits.

As discussed in more detail below, under the legislation, a taxpayer classified as a specified foreign entity would be ineligible to claim any credit for tax years beginning after the date of enactment. For taxpayers falling into certain less restrictive categories—such as foreign-influenced entities or those making payments to prohibited foreign entities—the legislation would generally bar eligibility for credits starting two years after the date of enactment.

The legislation applies the constructive ownership rules under Section 318, excluding Section 318(a)(3) related to partnerships, to determine whether an entity qualifies as a “prohibited foreign entity.” This exclusion of partnership attribution rules may prevent the application of Section 318 in the context of partnerships, narrowing the scope of entities deemed prohibited foreign entities through partnership relationships. However, the application of the remaining Section 318 rules could still pose significant challenges when assessing whether a US entity is treated as a prohibited foreign entity under the proposed FEOC restrictions. This raises compliance and structuring concerns, particularly for multinational holding company structures, and may call for a clarification or exception to avoid unintentionally sweeping US companies into the prohibited foreign entity definition solely through constructive ownership.

Material Assistance from an FEOC

A broad restriction applies to any project that receives “material assistance” from an FEOC during construction. This is a new restriction that did not exist under the IRA. A facility is deemed to have received material assistance if:

- It includes any component, subcomponent, or applicable critical mineral (as defined under Section 45X(c)(6)) that is extracted, processed, recycled, manufactured, or assembled by a prohibited foreign entity; or

- Its design relies on a copyright, patent, trade secret, or know-how provided by such an entity.

However, the bill carves out a limited exception for assembly parts or “constituent materials” that are not uniquely designed or formulated for use in qualified facilities or eligible components under Sections 45Y, 48E, or 45X and are not predominantly produced, processed, or extracted by prohibited foreign entities. Although this exception is potentially helpful to the industry, the breadth of this exception may depend, in part, on how broadly “uniquely designed or formulated” is defined in subsequent guidance.

As discussed below, this “material assistance” restriction would generally bar eligibility for credits starting one or two years after the date of enactment, depending on the specific credit.

Transferability of Certain Clean Energy Credits Repealed for Future Years

The IRA permits most clean-energy credits to be sold by taxpayers, which has created a robust secondary market that has allowed sponsors with limited or no tax capacity to efficiently monetize these credits directly to raise capital. The legislation would unwind this regime for some forms of tax credits. The affected credits are those generated under Sections 45Q and Section 48(a)(3)(vii) (i.e., geothermal heat pump systems). The legislation would repeal transferability for projects that “begin construction” two years after the date that the legislation is enacted, which could be as early as July and most likely by August 2025. Accordingly, we expect the familiar “beginning of construction” rules (i.e., 5% safe harbor and physical work test) will apply to grandfather 45Q and geothermal projects that begin construction during the two-year window. Project developers should consider entering into beginning-of-construction arrangements, particularly the 5% safe harbor which is not project specific, to preserve the option of transferability, keeping in mind that a project generally must be placed in service within four years of the date upon which it began construction.

For Sections 45Z and 45X, transferability of credits is terminated after December 31, 2027, for electricity generated or fuels or components made after that date. The legislation does not retroactively disturb transfers executed for 2023-2025 credits, and market participants can still transact in credits generated before the repeal dates.