US BOEM Announces Provisional Winners of California Offshore Wind Auction

On December 6 and 7, 2022, the Bureau of Ocean Energy Management (BOEM) held a competitive auction for five lease areas off the coast of California. The lease sale represents the first ever offered along the Pacific coastline and the third major sale this year. While there were over 40 companies qualified to participate in the auction, only seven companies actually participated. The online auction concluded midday through the second day of the auction with bids from five companies totaling $757.1 million. Notably, the total amount to be paid by the five companies is considerably smaller than the $4.37 billion that companies collectively paid for the six offshore wind leases in the New York Bight.

Here are the provisional winners of the California lease areas:

| Lease 0561 | Lease 0562 | Lease 0563 | Lease 0564 | Lease 0565 | |

| Provisional Winners | RWE Offshore Wind Holdings, LLC | California North Floating, LLC | Equinor Wind US, LLC | Central California Offshore Wind, LLC | Invenergy California Offshore LLC |

| Total Lease Amount | $157,700,000 | $173,800,000 | $130,000,000 | $150,300,000 | $145,300,000 |

| Developable Acres | 63,338 | 69,031 | 80,062 | 80,418 | 80,418 |

Lease Area Details

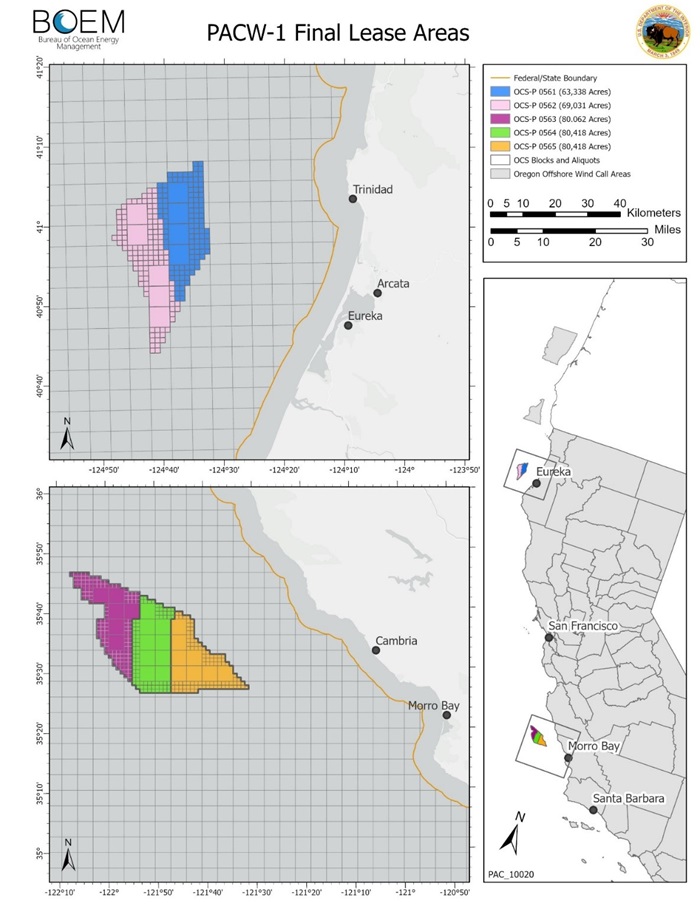

Figure 1: Map of California Lease Areas. See California Activities | Bureau of Ocean Energy Management (boem.gov)

The auction offered five lease areas covering 373,268 total acres off central and northern California, including three lease areas in the Morro Bay Wind Energy Area (WEA) off central California (OCS-P 0563, OCS-P 0564, and OCS-P 0565) and two lease areas in the Humboldt WEA off northern California (OCS-P 0561 and OCS-P 0562). The lease areas have the potential to produce over 4.6 GW of offshore wind energy, enough to power more than 1.5 million homes, and support thousands of new jobs.

Auction Format

Instead of having two simultaneous auctions, as proposed in the Proposed Sale Notice, BOEM simplified the sale format to be a single auction in which all the lease areas were offered. In each round of the auction, a bidder was able to bid for, at most, one of the offered leases at a time. Bidders were able to switch between different lease areas from round to round but were required to bid in each round and ultimately could acquire, at most, one of the leases in the auction.

BOEM also added a 5 percent bidding credit for bidders who were committed to a qualifying General Community Benefit Agreement (CBA); increased the amount of the credit offered for the Lease Area Use CBA bidding credit from 2.5 to 5 percent; and removed the requirement for a 25 percent commitment of funds associated with the workforce training and/or supply chain development bidding credit at the time of the submission of the lessee’s first Construction and Operations Plan.

Next Steps

As it did with the recent New York Bight and North Carolina auctions, BOEM will release round-by-round details of the auction in the coming days that identify the entities that participated and how they bid in each round.

Next, the US Department of Justice (DOJ) has 30 days to conduct an antitrust review of the auction. After the DOJ review is completed, BOEM will send copies of the lease to each winner with instructions on how to execute the lease. Within 10 business days of receiving the lease, the auction winners must post financial assurances, pay any outstanding balance of their bonus bid (i.e., winning monetary bid minus bid deposit), and sign and return the lease. Once BOEM has received the signed leases and verified that all other required materials have been received, BOEM will execute the leases.

Related Legal Updates

US BOEM Announces First Offshore Wind Auction Off California | Perspectives & Events | Mayer Brown

US Offshore Wind – Financing Considerations and Development Challenges