The Evolution of Defined Contribution Plan Class Action Litigation in 2025

We are entering the home stretch of a memorable year. While benefits litigation may not be the first thing that comes to mind, it has been a very busy year for ERISA class actions, particularly for defined contribution plans (including 401(k) and 403(b) plans). 2025 has seen an increase in class action lawsuits targeting defined contribution plans—catalyzed by the ongoing wave of new forfeiture lawsuits. In this Legal Update, we provide an overview of the ERISA class action litigation developments and trends impacting defined contribution plans, starting with the recent forfeiture lawsuits.

Forfeiture Lawsuits

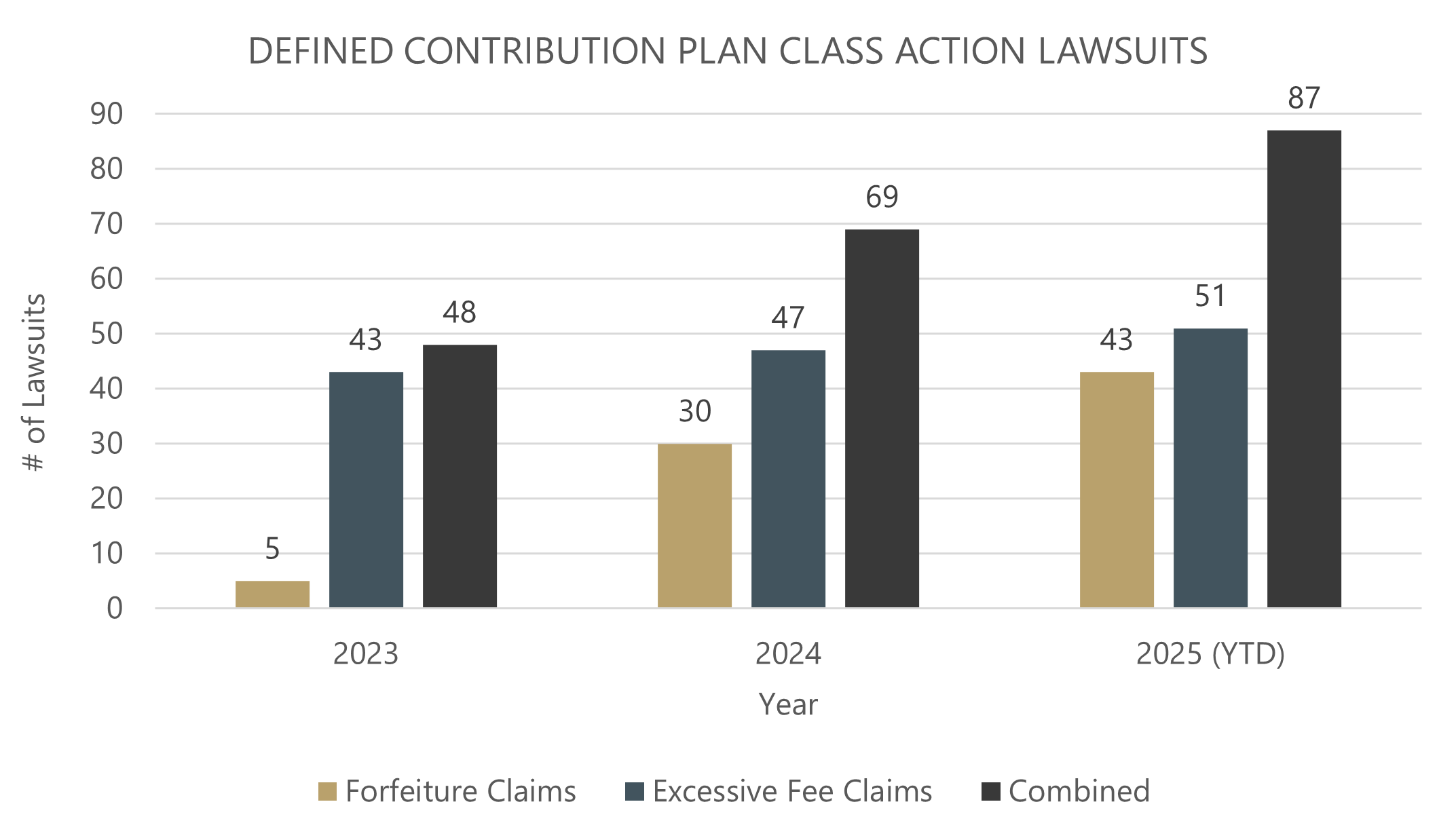

Since the first ERISA forfeiture lawsuits were filed in September 2023, ERISA plaintiff’s firms have now filed almost 80 ERISA class actions alleging forfeiture claims. The number of new forfeitures cases has increased year over year, with five cases filed in 2023, 30 cases filed in 2024, and 43 cases filed so far in 2025 (for a pace of more than 50 new forfeiture cases by year end). While these forfeiture lawsuits were initially filed by a single plaintiff’s firm in federal district courts in California, they are now being filed by a growing number of plaintiff’s firms against companies all over the country.

We recently published a series of Legal Updates describing the ERISA plaintiff’s bar’s new forfeiture theory and how courts are responding to the wave of forfeiture lawsuits. As of our most recent publication, 24 courts had ruled on motions to dismiss in forfeiture cases, with 18 courts granting motions to dismiss and six courts denying motions to dismiss. Since then, another federal court has granted a motion to dismiss, for a total of 19 motion-to-dismiss victories for plan sponsors.1

Although the large majority of motion to dismiss decisions have favored plan sponsors, the plaintiff’s bar appears undeterred, as they have filed almost 20 new forfeiture lawsuits since July alone, averaging five new cases per month. However, with appeals of forfeiture lawsuit dismissals now pending in four US Courts of Appeal (Third, Eighth, Ninth, and Eleventh Circuits), and the US Department of Labor weighing in with an amicus brief supporting a plan sponsor in the Ninth Circuit, we may see a material shift in the forfeiture lawsuit landscape in 2026.

ERISA Excessive Fee Lawsuits

Over the past three years, we have seen a modest, but notable, increase in the number of new ERISA defined contribution plan “excessive fee” lawsuits, with 43 cases filed in 2023, 47 filed in 2024, and 51 filed so far in 2025 (for a pace of more than 60 cases by year end).2 To provide a more fulsome overview of the defined contribution class action landscape, the chart below shows, by year: (i) the number of new ERISA class actions with forfeiture claims; (ii) the number of new ERISA class actions with excessive fee claims; and (iii) the combined totals.

Largely due to the recent wave of forfeiture lawsuits, we have seen almost double the number of new defined contribution plan class actions filed so far this year compared to 2023.

Most Popular Claims in ERISA Excessive Fee Lawsuits

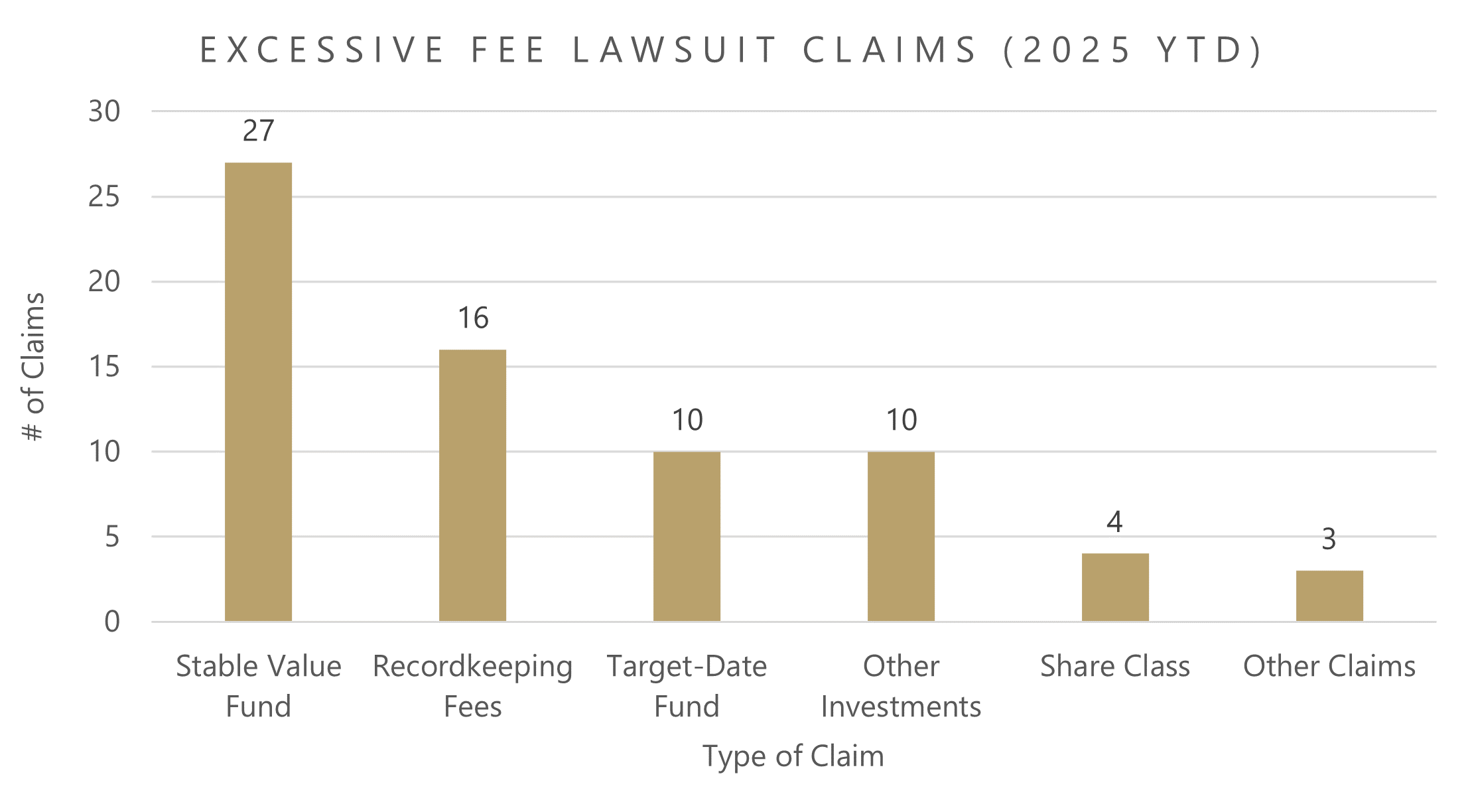

2025 has also brought an evolution in the claims being asserted in ERISA excessive fee lawsuits. While plan investment challenges continue to be the most popular claim, we have seen a notable shift in the types of investments being challenged. Unlike in recent years when target-date funds were the most popular target, stable value funds have been the primary focus this year. So far, we have seen 27 excessive fee lawsuits with stable value fund challenges, representing a more-than 500% increase compared to 2024.3 These new lawsuits allege that plan sponsors and fiduciaries breached their fiduciary duties by offering stable value funds in their defined contribution plans that allegedly had lower crediting rates (i.e., rates of return) than an assortment of other allegedly comparable—but, in reality, materially different—fixed income products.

The chart below lists the most popular claims asserted in the excessive fee lawsuits filed in 2025. After stable value funds, recordkeeping fee challenges (a long-time favorite of the ERISA plaintiff’s bar) have been the second most popular claim, followed by challenges to target-date funds and other plan investments (i.e., not stable value funds or target-date funds). Notably, the number of share class claims this year is significantly lower than in recent years when share class challenges were often filed in parallel with performance-related plan investment challenges.

Prohibited Transaction Claims after Cunningham

In addition to the fiduciary duties set forth in ERISA § 404, ERISA § 406 includes a list of “prohibited transactions.” Among other things, those prohibited transactions include the “furnishing of . . . services . . . between the plan and a party in interest,” see ERISA § 406(a)(1)(C). Because Section 406 casts a wide net, potentially encompassing many routine service provider arrangements, Section 408 includes a number of prohibited transaction exemptions, including when a plan pays “reasonable compensation” for “services necessary for the establishment or operation of the plan.” See ERISA § 408(b)(2).

Historically, some ERISA plaintiff’s firms would plead parallel prohibited transaction claims when they were asserting fiduciary breach claims for allegedly excessive recordkeeping or administrative fees. Over time, however, fewer excessive fee lawsuits included prohibited transaction claims because, as a practical matter, those claims would often rise or fall with the fiduciary breach claims, and there was little monetary incentive for plaintiff’s firms—who are often seeking class action settlements—to plead or try to prove up a separate prohibited transaction claim.

However, on April 17, 2025, in Cunningham v. Cornell University, the US Supreme Court held that a plaintiff need only plead that a fiduciary caused a plan to engage in a prohibited transaction with a party in interest, and need not preemptively address any applicable prohibited transaction exemptions. As noted above, because many routine service provider arrangements potentially fall within the purview of ERISA § 406(a) (but are subject to an applicable exemption), many in the benefits industry were concerned that the Supreme Court’s ruling would result in even more frivolous ERISA excessive fee lawsuits being filed.

While it has only been six months since the Supreme Court’s decision, Cunningham has not yet resulted in a material increase in recordkeeping fee challenges or ERISA excessive fee lawsuits. As explained above, stable value funds have been the primary target in excessive fee lawsuits this year and investment challenges have significantly outnumbered recordkeeping fee challenges. However, it is worth noting that many of the post-Cunningham excessive fee lawsuits with recordkeeping fee claims also include a related prohibited transaction claim. How district courts handle those claims at the pleading stage will likely shape the plaintiff’s bar’s strategy going forward.

ERISA Excessive Fee Settlements

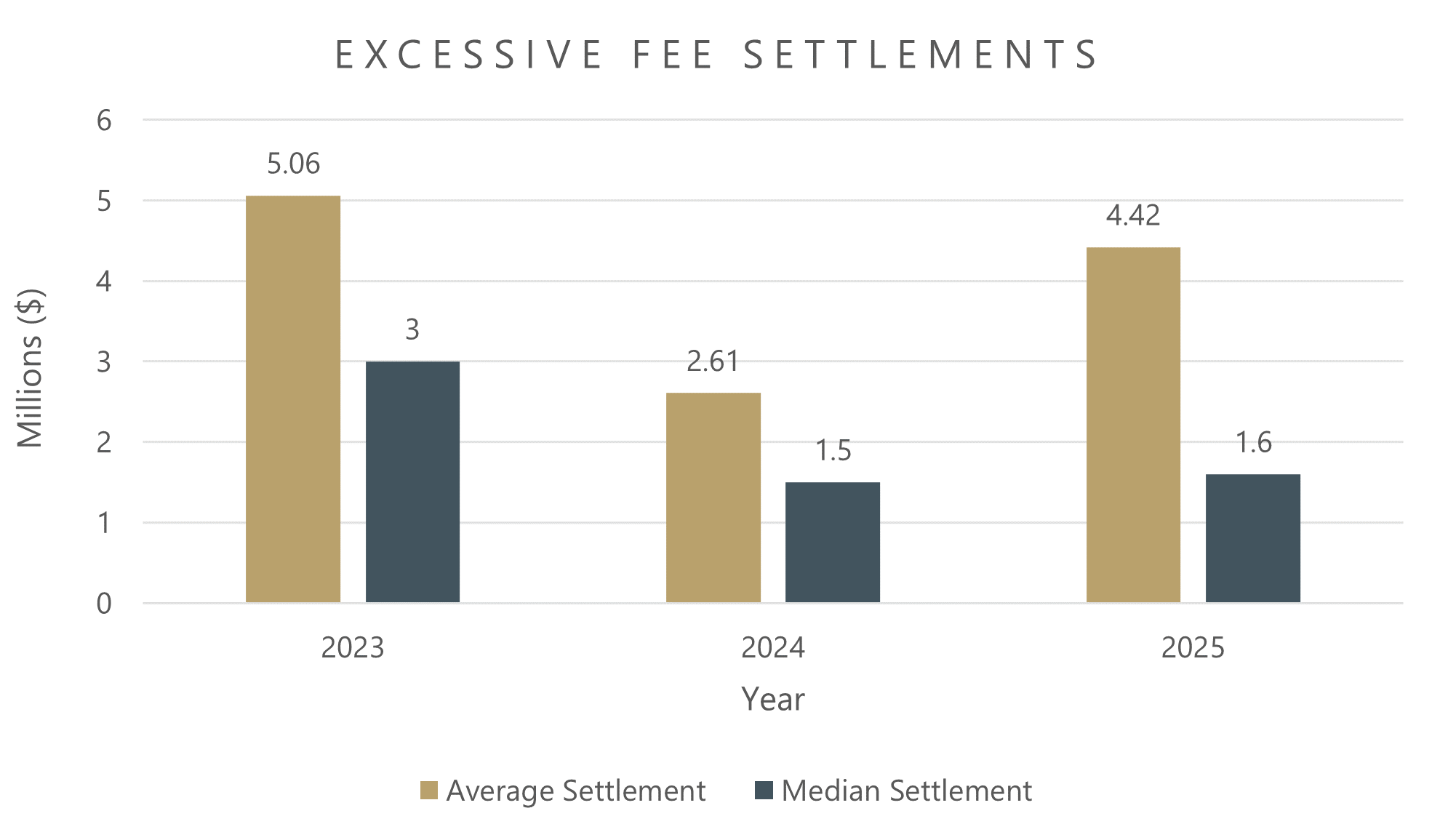

Since 2023, there have been more than 120 class settlements in ERISA excessive fee lawsuits, totaling more than $665 million. While settlement amounts inevitably vary from case to case, we have seen a trend toward lower settlements, including a growing number of six-figure settlements. While a handful of outlier high-dollar settlements (typically in cases with unique factual circumstances and alleging more than excessive recordkeeping fees) continue to impact the annual average settlement amount, the median settlement amount has decreased. Notably, the median settlement in 2025 is approximately half of the median settlement in 2023 ($1.6 million vs. $3.0 million). This may ultimately lead to fewer cases, as plaintiff’s firms are less incentivized to file new excessive fee lawsuits when settlement amounts are lower.

Takeaways for Plan Sponsors

The ERISA plaintiff’s bar is opportunistic, and they are constantly looking for new legal theories to target plan sponsors and fiduciaries. This is demonstrated by the fact that forfeitures and stable value funds have been the primary targets of ERISA defined contribution class action litigation in 2025. However, because a growing number of plaintiff’s firms (including firms new to ERISA litigation) are now filing copycat lawsuits, targeting as many plan sponsors as possible with the same allegations and theories, many of the new cases are susceptible to strong motions to dismiss. Moreover, when plan sponsors fight these lawsuits through summary judgment or trial, we continue to see that they prevail the large majority of the time. And with the US Department of Labor starting to push back on ERISA class action litigation with its forfeiture amicus brief, and the vast majority of district courts rejecting the ERISA plaintiff’s bar’s new forfeiture theory, we will hopefully see fewer ERISA-defined contribution class actions filed in 2026.

1 See Polanco v. WPP Group USA, 2025 WL 3003060 (S.D.N.Y., Oct. 27, 2025).

2 For counting purposes, we have included any ERISA class action with a traditional excessive fee claim, including challenges to recordkeeping and other administrative fees, challenges to plan investments and share classes, prohibited transaction claims, etc. Some of these excessive fee lawsuits also include forfeiture claims.

3 There were fewer than five lawsuits with stable value fund challenges filed in all of 2024.