We present to you the Summer 2025 edition of the Asia Tax Bulletin. It contains tax developments in Asia on a host of topics, such as Hong Kong’s and Japan’s tax legislation to implement the Minimum Global Tax (also referred to as Pillar 2 tax) on large MNCs, Malaysia’s expanded Service Tax to include, inter alia, financial services, the PRC’s tax credits for reinvestments by foreign investors in qualifying businesses and Indonesia’s new regulation setting out the process for tax audits, amongst other topics.

We want to devote a special word to the Vietnamese developments, which include a new corporate tax code. One of the aspects of this new corporate tax code is new legislation with respect to taxing transfers of ownership of Vietnamese companies, including indirect transfers (where the seller sells the shares of a foreign holding company which directly or indirectly owns Vietnamese shares). The new tax provisions, which are scheduled to take effect on 1 October 2025, will tax such transfers based on a percentage of gross sales proceeds and no longer based on net gains. At the time of going to press, the Vietnamese Ministry of Finance issued a draft regulation on 9 July 2025 which proposes a rate of 2% of gross sales proceeds in cases where the transferor does not directly manage the Vietnamese company, which suggests that it applies to indirect transfers. The latest draft is still silent on how the sales proceeds must be determined if the indirect transfer includes shares of non-Vietnamese companies. We expect that this will be clarified in the final decree or in a further decree to be issued on the subject.

Tax information reporting for Digital Platform Operators

Courtesy IBFD it was reported that China's State Administration of Taxation (SAT) has announced new regulations, requiring digital platform operators to submit tax-related information reporting (Order of the State Council No. 810). The regulations have taken effect from the same date as the announcement was made, i.e. 20 June 2025.

According to the Order, digital platform operators must report tax information, such as identities and revenues of enterprises and individuals conducting such activities on their platforms, to the competent tax authorities in digital format.

Information on Platform Operators

Digital platform operators are required to provide the competent tax authorities with their domain name, type of business, the name and Unified Social Credit Code of the main operating entity within 30 days of the date of implementation or business commencement.

Information on Enterprises and Individuals Conducting Business on Platforms

Digital platform operators must provide a quarterly report on identities and revenues of the enterprises and individuals conducting activities on their platforms within 1 month following the end of a quarter. Platform operators have the obligation to verify the information submitted but are not accountable for any false, inaccurate or incomplete information provided by the enterprises and individuals conducting activities on their digital platforms. In case of a tax audit, the tax authorities have the authority to request platform operators to provide contracts, details of transactions, bank accounts and logistic data within the time limit and format prescribed by them.

Tax information related to the periods prior to the announcement of the regulations will not fall within the scope of reporting.

Exemptions

The reporting obligation is not required for individuals engaged in delivery services, transportation and household services who are eligible for tax incentives, exempt from tax, or who have tax filings withheld in place by the platform operators.

Foreign Digital Platform Operators

Foreign digital platform operators providing profit-making services in China must report the tax information on the enterprises and individuals conducting activities on their platforms in accordance with the SAT regulations.

Tax Administration

Implementation rules of these regulations will be published by the relevant department of the SAT in due course. Any non-compliance may result in fines from CNY 20,000 to CNY 500,000, or business suspension.

The State Taxation Administration (STA) has published Announcement of the STA [2025] No. 16 (the Announcement) to clarify the tax filings and withholding tax procedures with respect to individuals who receive remunerations for services from internet platform enterprises. The Announcement came following the publication of the recent regulations that require digital platform operators to submit tax-related information. The Announcement will take effect from 1 October 2025.

Individual Income Tax

Individual platform users who receive remunerations for services rendered through internet platform shall be subjected to withholding tax with reference to the Announcement of STA on Withholding of Individual Income Tax [2018] No. 61. The formula of the tax calculation is as follows:

The amount of tax withheld of the current period = the aggregated revenue – the aggregated expense – the aggregated exempt revenue – the aggregated deductible expense – other lawful deductions) x withholding rate – quick deductions – the aggregated exempted tax amount – the tax amounts withheld.

"The aggregated expense" is calculated as 20% of the cumulative income, while the standard deduction is determined by multiplying CNY 5,000 by the number of consecutive months in which the platform user has received income—excluding the month in which withholding occurs.

Value Added Tax (VAT)

Individual platform users who receive services income from internet platform enterprises are subject to VAT. The internet platform enterprises are liable to withhold the VAT and additional charges/fees on behalf of such users. The small-scale taxpayer regime may apply, such as that monthly sale proceeds below CNY 100,000 are exempted from VAT, and where applicable, VAT will be imposed at the reduced rate of 1% (standard collection rate for small-scale taxpayer is 3%). If an individual platform user's total income exceeds CNY 5 million within 12 consecutive months, the internet platform enterprise shall advise the individual user to register as a VAT filing entity and handle the filing independently. In cases where an individual platform user derives revenues from multiple platforms that collectively exceeds the VAT exemption threshold, the tax authority shall notify the relevant internet platform enterprises to withhold and to remit the taxes on behalf of the platform user.

Deductibility of Remuneration/Income Paid to Individual Platform Users for Corporate Income Tax Purposes

Internet platform enterprises may deduct the payments remuneration or income paid to individual platform users for its own corporate income tax purposes. The internet platform enterprises must ensure all the withholding of individual income tax, VAT and other charges/fees have been carried out and proper documentation is kept.

Tax credit for reinvestments by foreign investors

Courtesy IBFD it was reported that to encourage foreign reinvestment in eligible domestic industries, China has introduced a tax incentive to grant a tax credit on the reinvestments by foreign investors from 1 January 2025 to 31 December 2028. Under this initiative, the current year's tax payable of a foreign investor may be credited up to 10% of the reinvestment amount that are distributed from Chinese resident enterprises. The tax payable refers to the corporate income taxes on dividends, interest and royalties due after the reinvestment date. If an applicable preferential tax treaty specifies the tax rate on dividends/profits is lower than 10%, the lower rate will be applied accordingly. The remainder of the unused tax credits can be carried forward.

Foreign investors are eligible for the tax credit if the following conditions are fulfilled:

- the profits received must be dividends and bonuses equity income distributed from retained earnings by Chinese resident enterprises within China;

- reinvestments made from the distributed profits must be used for direct investments including equity investment such as capital increases, establishment of a new enterprise, or acquisition of equity interest from an unrelated party. However, this excludes new share issuances, conversion of profits to share capital, and equity acquisition of a listed company;

- the invested enterprises must operate in the industries and sectors listed in the "Catalogue of Encouraged Foreign Investment" throughout the investment period;

- the investments must be held for more than 5 consecutive years (60 months); and

- for cash investments, the funds must be transferred directly from the distributing enterprise's bank account to the invested enterprise or the equity interest seller. In the case of investments in kind, the ownership of assets or securities must be transferred directly from the distributing enterprise to the invested enterprise or the equity interest seller. Circumventing the funds or transfer prior to the reinvestment is strictly prohibited.

Qualified foreign investors may provide the required documentation to the profit-distributing enterprise and the latter is not required to withhold any taxes.

The deferred tax amounts that are recaptured at the withdrawal of investments after expiration of 5 years (60 months) can be used against any remaining carried-forward tax credits.

According to this Announcement, "foreign investors" refer to non-resident enterprises under paragraph 3 of Article 3 of Enterprise Income Tax Law. "Resident enterprises within China" refer to resident enterprises established in accordance with Chinese laws and regulations. The tax credit also applies to qualified reinvestments made between 1 January 2025 and the date of this announcement. An enterprise undergoing restructuring that is eligible for this special tax treatment may continue to utilize the tax credit.

This tax incentive is laid down in Announcement of the Ministry of Finance, State Taxation Administration and the Ministry of Commerce [2025] No. 2.

Tax treaty with Brazil

On 14 June 2025, the amending protocol, signed on 23 May 2022, to the Brazil - China Tax Treaty has entered into force. The protocol generally applies from 1 January 2026 for withholding and other taxes. It provides for the following withholding tax rates:-

- 10% withholding tax on dividends for participation of 10% throughout a year period and 15% in all other cases. 5% withholding tax on dividends if the beneficial owner of the dividend is the other contracting state or a government institution listed in paragraph 2 of article 8 of the protocol;

- 10% on interest in respect of loans and credits granted by a bank for at least 5 years to fund public works and acquisition of equipment or supplying of industrial or scientific equipment and 15% in all other cases, subject to an exception of interest if the beneficial owner is the other contracting state or a designated government bank/institution as listed in article 9 of the protocol; and

- 15% on royalties arising from the use or the right to use trademarks and 10% in all other cases.

- The abovementioned withholding tax rates are generally higher than the current domestic withholding tax rate (10%) in the PRC and thus the 10% rate should apply in those cases where the tax treaty rate exceeds 10%.

The most favoured nation (MFN) clause applies to Brazil in respect of withholding taxes on dividends, interest and royalties. However, in the case of dividends, the rate shall not be lower than 5% and in the case of interest and royalties, the rates shall not be lower than 10%.

The protocol permits both states to levy a branch profits tax up to a maximum of 10%.

Finally, the protocol stipulates that the provisions of the treaty shall not prevent a contracting state from applying its domestic legislation aimed at countering tax evasion and avoidance including thin capitalization and CFC legislations.

Inbound re-domiciliation regime

The Hong Kong Legislative Council has passed legislation to set up a simple and accessible mechanism for company re-domiciliation in Hong Kong. The Companies (Amendment) (No. 2) Bill 2024, with amendments, was passed on 14 May 2025 and will take effect on 23 May 2025. The company re-domiciliation regime is open for application on the same day.

Under the Company Re-Domiciliation Regime, non-Hong Kong-incorporated companies that fulfil the requirements regarding company background, integrity, member and creditor protection, solvency, etc. may apply for re-domiciliation to Hong Kong while maintaining their legal identity as a body corporate and ensuring business continuity.

The property, rights, obligations and liabilities as well as the relevant contractual and legal processes of the companies would not be affected during the process. If a company's actual similar profits are also taxed in Hong Kong after re-domiciliation, the government will offer unilateral tax credits for elimination of double taxation.

In general, re-domiciled companies will be regarded as companies incorporated in Hong Kong, with the same rights as similar Hong Kong-incorporated companies, and will be required to comply with the relevant requirements under the Companies Ordinance.

The Companies Registry will provide the application details and relevant information on its website, and the Integrated Companies Registry Information System will also be enhanced to process applications.

Global minimum tax (Pillar 2)

The Bills Committee on the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Bill 2024 has issued a report on its deliberations following the completion of its scrutiny of the Bill. The 19 May 2025 report summarizes the concerns raised and suggestions made by the Committee members, the Legal Adviser to the Bills Committee and organizations that provided written submissions to the Committee, as well as the responses from the government.

Following the gazetting and introduction of the Bill into the Legislative Council, the Bills Committee was formed to scrutinize the Bill and started considering the draft legislation on 5 February 2025. In April 2025, the government proposed various amendments to the Bill after taking into account comments and suggestions from stakeholders and the latest Administrative Guidance issued by the OECD (LC Paper No. CB(3)487/2025(01)). The main amendments are summarized as follows:

- applying the sole or dominant purpose test under section 61A of the Inland Revenue Ordinance (IRO) with modifications as the general anti-avoidance rule (GAAR) instead of the main purpose test. As noted in the report, section 61A is a long-standing GAAR in the tax laws of Hong Kong and applying a modified section 61A to the minimum tax regime will

- provide certainty, simplicity and consistency to taxpayers;

- providing for a fixed time limit for raising top-up tax assessment (8 years for non-evasion cases, and 12 years for evasion cases);

- extending the time limit for taxpayers' applications to correct errors or omissions in top-up tax returns and that for claiming refunds of tax paid in excess of the amount of top-up tax chargeable, from 6 years to 8 years;

- shortening the record-keeping period from 12 to 9 years after the completion of the transactions, acts or operations to which the records relate;

- reducing the compliance burden by extending the time limit for filing Global Anti-Base Erosion (GloBE) information returns from 30 days to at least 60 days if the exchange

- mechanisms fail, and relieving a Hong Kong constituent entity from the relevant filing requirement under certain conditions;

- removing the proposed section 80Q of the IRO on offences by directors, etc., and providing for a time limit (8 years) for initiating proceedings under the proposed sections 80O and 80P of the IRO on offences by in-scope entities and service providers respectively;

- including the requirement that no prosecution in respect of an offence under the proposed section 80O of the IRO may be initiated except with the sanction of the Commissioner of Inland Revenue;

- extending the proposed section 25A on reimbursement for top-up tax to cover top-up tax under the income inclusion rule (IIR) and relaxing the reimbursement limit subject to certain conditions;

- providing the necessary clarity on the application of the GloBE rules, commentaries and administrative guidances promulgated by the OECD, such as safe harbours and the calculation of the Hong Kong minimum top-up tax (HKMTT), and the possibility of using the qualified domestic minimum top-up tax (QDMTT) payable in other jurisdictions as a tax credit in Hong Kong; and

- incorporating the requirement of mandatory e-filing for profits tax returns into the Bill.

In its report, the Bills Committee concluded that it has no objection to these amendments and does not propose any further amendments to the Bill.

The Legislative Council passed Hong Kong's Global Minimum Tax legislation (Pillar Two) on 28 May 2025. The law is expected to be gazetted as an amendment ordinance on 6 June 2025. The move ushers in the implementation of the global minimum tax (GMT) and the Hong Kong minimum top-up tax (HKMTT) in Hong Kong for financial years starting on or after 1 January 2025. This move aligns with the Base Erosion and Profit Shifting (BEPS) 2.0 package introduced by the Organisation for Economic Co-operation and Development (OECD) to address tax evasion risks associated with the digitalization of the economy

Stamp duty

The Hong Kong Legislative Council passed the Stamp Duty (Amendment) Bill 2025 on 7 May 2025, which gives effect to the 2025/26 Budget proposal to raise the maximum value of properties chargeable to the HKD 100 stamp duty, from HKD 3 million to HKD 4 million, to ease the burden on buyers of properties at lower values.

The adjustment, which took effect on 26 February 2025, applies to instruments executed on or after the same day.

Tax treaty with Bahrain

On 28 April 2025 the IRD announced that Hong Kong's Comprehensive Avoidance of Double Taxation Agreement (CDTA) with Bahrain signed in March 2024 came into force on March 4, 2025, after completion of relevant ratification procedures. The CDTA will be applicable to Hong Kong tax for any year of assessment beginning on or after April 1, 2026.

Tax authority issues list of luxury goods subject to 1% Tax Collection at Source (TCS)

The Central Board of Direct Taxes (CBDT) has issued a list of "specified goods" for which sellers are required to collect tax at source (TCS) of 1% if the value of the goods exceeds INR 1 million. Buyers are allowed to claim a credit when filing their income tax returns.

The specified goods include wristwatches; art pieces (like antiques and paintings); collectibles (such as coins and stamps); watercraft and aircraft (including yachts and helicopters); sunglasses; bags (including handbags and purses); shoes; sportswear and equipment (such as golf kits and ski wear); home theatre systems and horses used for racing or polo.

The TCS on the specified goods applies from 22 April 2025. The full text of the update is available in Notification Nos. 35/2025 and 36/2025 dated 22 April 2025.

US service charges not subject to withholding tax

The Delhi bench of the Income Tax Appellate Tribunal (ITAT) has ruled, in the case of Crocs Inc. vs. ACIT (ITA No.2389/Del/2022), that the service charges received by a US taxpayer from its Indian affiliate (ICO), though considered fees for technical services (FTS), were not chargeable to tax in India under the "make available" clause as per article 12(4) of the India-United States Income Tax Treaty (1989) (the Treaty).

The taxpayer, a tax resident of the United States, had provided administrative and support services to ICO under a service agreement. The taxpayer claimed that such services were not taxable in India under article 12(4) of the Treaty. The tax authority disagreed and stated that income from such services was in the nature of FTS under section 9(1)(vii) of the Income Tax Act, 1961 (the Act) and, hence, taxable in India. The ITAT examined whether the income was taxable in India as FTS under section 9(1)(vii) of the Act and as fees for included services (FIS) under article 12(4) of the Treaty.

The ITAT ruled in favour of the taxpayer with observations set out below.

It was held that the services rendered by the taxpayer to ICO were in the nature of FTS under the Act as (i) they were not general services because the services were rendered by the competent technical and qualified professionals; and (ii) the services were customized to cater to the specific needs of ICO and such services were not made available globally to other affiliate recipients.

However, the ITAT concluded that the condition of "make available" was not fulfilled and the said services could not be considered as fees for included services (FIS) under article 12(4) of the Treaty based on following reasons:

- the service agreement was only for the provision of services and not for the supply of technical designs or plans;

- no expertise, skills or know-how had been transferred by the taxpayer to ICO that would equip ICO with specialized knowledge related to the service provided; and

- the extended tenure of the service agreement, i.e. 15 years, further supported the fact that it did not involve the transfer of knowledge or skills to the ICO.

The ITAT further emphasized that the distinction between FTS and FIS has been outlined in the Memorandum of Understanding to the Treaty, which states that a technology is "made available" when the recipient of the service is enabled to utilize the technology independently.

While arriving at its decision, the ITAT considered the decision of the Delhi High Court in the case of International Management Group (UK) (ITA 1013/2018).

Waiver of withholding tax on advisory, professional fees to Units in Financial Centres

The Central Board of Direct Taxes (CBDT) has issued Notification No. 67/2025 exempting withholding of tax deducted at source (TDS) on specific payments made to a payee that is a unit in an International Financial Services Centre (IFSC) eligible for tax deduction under section 80LA of the Income Tax Act, 1961. This exemption will be effective from 1 July 2025.

- The specific payments that will be exempt from TDS include:

- interest on lease, freight or hire charges paid to a finance company;

- portfolio management fees, investment advisory fees, and management or performance fees paid to a fund management entity;

- professional, consulting or advisory fees for services such as bookkeeping, accounting, taxation, and financial crime compliance; and

- payments made to recognized clearing corporations, stock exchanges and depositories.

The TDS exemption is available to a payee within a period of 10 consecutive tax years, for which an election for a deduction must be made under section 80LA. The payee must furnish a statement-cum-declaration in Form No. 1 to the payer and provide details of the elected tax years for claiming such deduction.

Tax audits

Courtesy of Assegaf Hamzah & Partners it was reported that Indonesia's Ministry of Finance recently issued a new regulation on tax audits, Minister of Finance Regulation No. 15 of 2025 on Tax Audit ("PMK 15"), effective from 14 February 2025. This regulation is a significant part of Indonesia's ongoing tax reform, aiming to simplify and harmonise existing tax audit provisions under various tax regulations into a single framework. In general, PMK 15 seeks to enhance audit efficiency, promote legal certainty, and streamline administrative processes by introducing substantial changes to the audit framework.

|

Aspect |

Old Regulation (PMK184/PMK.03/2015) |

New Regulation (PMK15/PMK.03/2025 |

Legal Basis |

|

Types of Audit |

Not explicitly classified; but commonly known based on location:

|

Categorised based on scope and objective:

|

PMK 184 (old regulation): Article 5(1) PMK 15 (new regulation): Article 2(2) |

|

Audit Timeframe |

|

|

PMK 184 (old regulation): Article 15, Article 15, Article 17 PMK 15 (new regulation): Article 6 |

Previously, there were two types of audits: field audits (with an assessment period of six months plus an extendable period of two to six months, totalling a maximum of 12 months) and office audits (with an assessment period of four months plus an extendable period of two months, totalling a maximum of six months).

PMK 15 introduces three types of audits designed to assess taxpayer compliance and serve other specific purposes, each with a distinct audit period. The audit period consists of two main phases: (i) an assessment period, during which the tax authority conducts its examination, and (ii) the closing conference and reporting period, where findings are discussed, and the audit report is finalised.

Below is the detailed scope of the three types of audits under PMK 15:

- Comprehensive audit (pemeriksaan lengkap): A full-scope examination of all items reported in the tax returns, with an assessment period of a maximum of five months.

- Focused audit (pemeriksaan terfokus): A deep dive review into one or several specific items in the tax returns, with an assessment period of a maximum of three months.

- Specific audit (pemeriksaan spesifik): A simplified audit on targeted items, data, or obligations, with an assessment period of a maximum of one month.

For audits involving taxpayers in a group company and/or transfer pricing issues and/or financial transaction engineering, the assessment period may be extended by up to four additional months, provided that the taxpayer is officially notified of such extension.

PMK 15 introduces a new mandatory procedure: a discussion of preliminary audit findings (Pembahasan Temuan Sementara) between the tax auditor and the taxpayer. This allows taxpayers to clarify or respond to the auditor's initial findings before the audit progresses further. This discussion must be conducted no later than one month prior to the end of the assessment period. During the discussion of preliminary audit findings, the taxpayer may present documents, records, electronic data, written explanations, and/or witnesses to clarify or respond to the preliminary findings raised by the auditor.

Under the previous regulation, taxpayers were given up to seven working days (plus a three-working-day extension) to respond to the SPHP (Surat Pemberitahuan Hasil Pemeriksaan) or Notification Letter of Audit Findings. PMK 15 shortens this response period to five working days, with no extension available. Taxpayers will need to act quickly and strengthen their audit readiness to meet the shortened timeframe effectively.

The timeframe for the PAHP (Pembahasan Akhir Hasil Pemeriksaan) or Final Discussion Period has been shortened compared to the previous regulation, which allowed a maximum of two months, counted from the date the SPHP was delivered until the issuance of the tax audit report (laporan hasil pemeriksaan or LHP). PMK 15 reduces this period to a maximum of 30 working days. The compressed timeline requires taxpayers to coordinate more efficiently with the tax auditors and respond promptly to finalise discussions and conclude the audit process within the stricter deadline.

If a taxpayer decides to refuse a tax audit, the taxpayer must file a written statement of refusal, signed by the taxpayer or their authorised representative, no later than seven calendar days after the delivery of the audit notification letter (surat pemberitahuan pemeriksaan or SP2). The purpose of refusing a tax audit is to assert the taxpayer’s right to not undergo the audit process when they believe it lacks legal basis or procedural fairness.

Importantly, refusal to cooperate does not stop the audit process; on the contrary, it may escalate the matter. If the audit aims to assess tax compliance, the tax authority will proceed with a 'deemed tax assessment' (penetapan pajak secara jabatan), meaning they will determine the tax liability based on available data without the taxpayer's assistance.

Furthermore, if the taxpayer's refusal is accompanied by indications of a potential tax crime, the Directorate General of Taxes may escalate the situation further into a 'preliminary evidence audit' (pemeriksaan bukti permulaan or Bukper), which is a step towards a criminal investigation.

PMK 15 emphasises the separation between tax audits (i.e., comprehensive audit (pemeriksaan lengkap), focused audit (pemeriksaan terfokus), specific audit (pemeriksaan spesifik)) and criminal tax procedures, avoiding the overlap between these procedures. Specifically, if a taxpayer is undergoing a Bukper or a formal tax crime investigation for a particular fiscal year, the Directorate General of Taxes is prohibited from carrying out a conventional tax audit for that same year. A tax audit may only resume once the relevant criminal procedure has been resolved, whether through the discontinuation of the preliminary evidence audit (pemeriksaan bukti permulaan), the formal closure of the investigation, or the issuance of a final and binding court verdict that has been duly received by the Directorate General. The provision aims to avoid procedural duplication and ensure that the administrative and criminal processes are clearly separated.

In line with Indonesia's ongoing tax administration reform, PMK 15 reinforces the use of the electronic system for managing and exchanging documents during the tax audit process. The regulation allows taxpayers and the Directorate General of Taxes to deliver audit-related documents electronically, while also allowing physical filing, either in person or via registered post/courier services. Specifically for the delivery or filing of (i) the Notification Letter of Audit Findings (SPHP), (ii) the List of Preliminary Audit Findings, and (iii) the taxpayer’s written response to both the notification letter and the list, these must be conducted by electronic means, in person, or by facsimile.

PMK 15 ushers in a more efficient and streamlined tax audit regime in Indonesia. To navigate these changes effectively, taxpayers should:

- Prioritise Audit Readiness: The shortened deadlines for responding to audit findings and finalising discussions necessitate quicker internal coordination and decision-making during audits. Proactive preparation of necessary documents and data will be crucial.

- Cooperate Strategically: While taxpayers have rights, non-cooperation during an audit can lead to adverse consequences, including a deemed tax assessment or the escalation to a preliminary evidence audit (Bukper) if there are indications of tax crime.

- Anticipate Scrutiny: Taxpayers with complex structures, intercompany transactions, or those seeking tax refunds may face increased scrutiny under the risk-based selection approach.

- Embrace Digital Processes: The emphasis on the Coretax system and electronic document exchange highlights the importance of digital readiness for managing audit-related documents and communications efficiently.

Global Minimum Tax: Japan will implement UTPR and QDMTT

Japan has recently enacted the 2025 Tax Reform Laws and Regulations which includes key corporate tax amendments to implement the Under Taxed Profits Rule (UTPR) and the Qualified Domestic Minimum Top-up Tax (QDMTT) effective 1 April 2026.

Japan's UTPR is broadly aligned with the OECD GloBE Model Rules. However, since the OECD GloBE Model Rules do not prescribe a specific method for allocating UTPR tax liability among constituent entities within a jurisdiction, Japan has established its own domestic approach whereby the UTPR liability will be apportioned to each Japanese constituent entity based on a formula that considers both the number of employees and the net book value of tangible assets.

Japan's UTPR will first apply in the 2027 accounting year (i.e. 1 January 2027 to 31 December 2027). For MNE groups using a traditional Japanese fiscal year ending in March, Japan's UTPR will first apply in the 2026 accounting year (i.e. from 1 April 2026 to 31 March 2027).

Although the administrative guidance from the OECD provides for a transitional UTPR safe harbour for fiscal years beginning on or before 31 December 2025, Japan has opted not to introduce this safe harbour domestically, as Japan's UTPR will only come into effect after the transitional period ends.

Japan's QDMTT rules also closely follows the OECD guidance. While the OECD permits a degree of customization, Japan has adopted a straightforward, standardized version of the QDMTT that will apply to accounting years beginning on or after 1 April 2026.

Global Minimum Tax: Japan aligns IIR legislation with OECD guidance

On 31 March 2025, Japan enacted the 2025 Tax Reform Laws and Regulations, which, among others, include amendments to its Income Inclusion Rule (IIR) framework under the global minimum tax regime which will apply from fiscal years beginning on or after 1 April 2025. These amendments incorporate elements of the OECD's additional administrative guidance, including detailed provisions for the 5-year recapture rule applicable to deferred tax liabilities.

Previously, one notable area of divergence of Japan's IIR legislation from the OECD GloBE Model Rules concerns the push down of deferred taxes to constituent entities (CEs). Under the GloBE Model Rules, both current and deferred taxes may be pushed down to relevant CEs, such as those subject to Controlled Foreign Company (CFC) legislation or Permanent Establishments (PEs). However, Japan's legislation only permits the push down of current taxes, excluding deferred taxes from this mechanism.

When Japan introduced its IIR in the 2023 tax reform, government officials explained that the exclusion of deferred tax push down was due to the fact that international discussions on the detailed application of the push down mechanism for deferred taxes under the GloBE Model Rules were still ongoing. This issue was subsequently addressed by the OECD in its June 2024 administrative guidance, which clarified the treatment and allocation of cross-border deferred taxes.

As a result, the 2025 tax reform amended Japan's IIR legislation to reflect the OECD's position above and allow for deferred tax push down in line with the guidance.

However, Japan has not applied the amendment to the IIR legislation retroactively. The 2025 amendments will apply only to fiscal years beginning on or after 1 April 2025, whereas Japan's IIR is already effective from 1 April 2024. As such, for fiscal year 2024, the push down of deferred taxes as recommended by the OECD may not be permitted under Japanese rules, creating a potential misalignment between domestic law and the GloBE Model Rules.

Tax Reform laws and regulations enacted

Japan's 2025 Tax Reform Laws, along with the related governmental regulations and ministerial rules, were promulgated in the Official Gazette on 31 March 2025.

The reform package covers various tax areas and includes the following items related to corporate tax, international tax and personal tax:

- the undertaxed profits rule (UTPR) under the global minimum tax rules;

- the controlled foreign company (CFC) regime;

- implementation of the special defence tax;

- beneficial tax measures for small and medium enterprises; and

- enhanced personal income tax exemptions.

'Interest-Equivalent' payments under earnings stripping rules

Japan's Financial Services Agency (FSA) recently announced that it had consulted the National Tax Agency, in coordination with the Ministry of Finance, regarding the interpretation of payments considered "economically equivalent to interest" under Japan's earnings stripping rules.

Japan's earnings stripping rules expand the scope of covered interest to include items defined by government regulations as "interest-equivalent." These regulations specifically list examples such as promissory note discount fees and more broadly refer to payments considered "economically equivalent to interest." The FSA's announcement of 24 June 2025 clarifies the interpretation of this term.

The announcement cited the OECD BEPS Project Action 4 Final Report, which underscores that notional interest amounts arising from derivative instruments or hedging arrangements related to an entity's borrowings should fall within the scope of interest limitation rules, as described in Chapter 2, paragraph 36. In contrast, amounts from derivatives unrelated to borrowings, such as commodity derivatives, should be excluded under chapter 2, paragraph 39.

In line with these recommendations, the FSA explained that arrangements must be assessed in a holistic manner to determine whether payments are economically closely linked to financing transactions, in which case they would be treated as "economically equivalent to interest."

To illustrate this approach, the announcement stated that when an entity enters into an interest rate swap to hedge future interest rate fluctuations on a loan, the payments are generally regarded as economically linked to the borrowing and therefore fall within the scope. On the other hand, interest rate swaps without such a connection to financing may not be categorized as payments "economically equivalent to interest."

The FSA also emphasized that this approach could encompass a broader range of payments than the legal definition of "interest." However, whether an amount is recorded in accounting as "interest expense" is not a decisive factor. Additionally, merely referencing market interest rates to calculate payments, such as when forward exchange rates reflect interest differentials between currencies, does not in itself result in a payment being classified as "economically equivalent to interest."

BEPS Pillar 1

On 30 June 2025, the National Tax Agency (NTA) of Japan released a set of FAQs regarding the Simplified and Streamlined Approach (SSA) developed by the OECD/G20 BEPS Inclusive Framework.

The SSA (also referred to as Pillar One Amount B) is a simplified and streamlined approach for applying the arm's length principle to in-country baseline marketing and distribution activities. Japan has decided not to implement the SSA for the time being.

Nevertheless, the NTA published the five FAQs to clarify the Japanese tax treatment in cases where jurisdictions in which Japanese multinational enterprise (MNE) groups have foreign subsidiaries or other related parties have implemented the SSA.

The first question provides an overview of the SSA. The second question clarifies that, since Japan does not implement the SSA, taxpayers are required to determine arm's length prices in accordance with the existing transfer pricing methods, regardless of whether the jurisdiction of the foreign related party has adopted the SSA or whether that jurisdiction is a covered jurisdiction.

The third question addresses unilateral Advance Pricing Agreements (APAs). The NTA states that, because Japan does not implement the SSA, any APA request must be based on the existing arm's length pricing methods without applying the SSA. This treatment is not affected by whether the foreign related party's jurisdiction is a covered jurisdiction.

The fourth question concerns Mutual Agreement Procedures (MAP). The NTA explains that MAP discussions between competent authorities will also be conducted on the basis of the existing arm's length pricing methods rather than the SSA, even where the other jurisdiction is a covered jurisdiction. However, consistent with the recommendations in the Amount B guidance, if the foreign related party's jurisdiction is a covered jurisdiction, Japan will, to the extent permitted under its domestic law and administrative practice, respect the outcomes of the SSA applied in that jurisdiction.

The fifth question relates to transfer pricing documentation. Because Japan does not implement the SSA, transfer pricing documentation prepared under the SSA in the foreign related party's jurisdiction will not be considered compliant with Japan's transfer pricing documentation requirements. However, the NTA notes that if such documentation includes an analysis and determination of arm's length prices using the existing methods in parallel with the SSA results, and if those results are consistent with the SSA outcomes, the documentation may be regarded as satisfying Japan's transfer pricing documentation requirements.

Increased tax rates and tax collection efforts

Courtesy of Kim & Chang it was reported that the new president, Lee Jae Myung, was elected and took office on 1 June 2025 and it is widely expected that large corporations and high net worth individuals based in Korea will likely face increased corporate income tax, capital gains tax and dividend withholding tax rates and they should expect increased pressure on the Korean tax authorities to collect taxes in order to fund increased social welfare initiatives.

As a result of the 21st presidential election in Korea held on June 3rd, Lee’s pledges and the Democratic Party of Korea’s platform include a variety of tax-related policies. These policies can be broadly classified into three categories: economic security and focus on new industries; establishment of a foundation for growth and stable living/balanced national development; tax reform to address low birth rates and aging society. The detailed pledges are as outlined below.

Major structural transformation of advanced industries driven by innovation

This includes a plan to implement the “Future Advanced Manufacturing K-Quantum Jump Project” to secure global leadership in AI and other advanced industries. The project covers a wide range of new and advanced industries, such as advanced semiconductors/nanotechnology, future mobility, next-generation secondary batteries, renewable energy, next-generation displays, AI, quantum computing, advanced biotechnology/digital healthcare, intelligent robotics, green hydrogen, and aerospace. Furthermore, various support measures will be implemented to strengthen the industrial ecosystem, boost export and industrial competitiveness, and further stabilize supply chains, all aimed at bolstering economic security and securing future growth engines. While concentrating an investment of KRW 100 trillion in AI and other advanced strategic industries at home, bold tax benefits including individual income tax and corporate tax reductions/deductions will be granted for investments made by the general public and enterprises. Additionally, AI data centers will be designated as national strategic technology commercialization facilities, with additional tax reductions/deductions granted to corporate investors in private venture funds to promote the venture investment market.

Introduction of “Tax System to Promote Domestic Production in Strategic Industries”

The “Tax System to Promote Domestic Production in Strategic Industries” offers corporate tax deductions based on domestic production and sales volume, to those who domestically manufacture and sell advanced products designated as national strategic or new growth/source technologies to end consumers in Korea. It also examines measures to refund a portion of tax deductions in cash under certain conditions when necessary to protect strategic industries. This is somewhat in line with the "Tax Incentive for Promoting Domestic Production of Advanced Strategic Industries" proposed by the five major economic organizations in May, including the Korea Chamber of Commerce and Industry, ahead of the 21st presidential election, although there appear to be differences in the specific targets and levels of support. In addition, related bills to amend the Restriction of Special Taxation Act have already been proposed by National Assembly members Jeong Il-young, Kim Tae-nyeon, and Jin Seong-jun. Therefore, if the details of the tax incentives for promoting domestic production of strategic industries are finalized, it is likely that they will be discussed together with the already proposed amendment bills as early as this year's regular session of the National Assembly.

Expanded tax incentives for the “Contents Industry”

As the Koreas cultural contents industry becomes more competitive and gains greater influence worldwide, a number of pledges have been made to increase tax incentives as part of the expanded national support system for cultural contents industry. First, the tax deduction system for video content production cost, currently set to expire at the end of this year, will be extended, with tax deductions newly applied to music and various other performing contents and webtoon production, currently not eligible for tax deductions. Also, measures to increase tax deductions for published content will be examined, taking into account the unique nature of the publishing industry, alongside measures to further apply tax deductions to fields prescribed under the Framework Act on the Promotion of Cultural Industries as well as production, investment, and equity participation in platforms. Support is also expected to be provided for investments and equity participation between large corporations and small/medium sized enterprises (SMEs) in companies specializing in the cultural industry and cultural content companies. Additionally, to strengthen support for content R&D, the scope of new growth/core technology support will be expanded to include AI content, content platforms, music, publishing, characters, performances, etc. Additional Tax support for OTT content production will also be implemented. The pledge also includes supporting reimbursement-type incentives when the purpose is reinvestment in the contents industry, but the specific method and details of support are expected to be clarified during the subsequent review process.

Compliance with statutory limit on national tax reduction/exemption rates

The National Finance Act stipulates that the national tax reduction/exemption rate for the current year should be maintained at no more than 0.5 percentage points above the average reduction/exemption rate of the previous three years. Meanwhile, the Special Tax Treatment Control Law includes provisions on the performance evaluation of tax expenditures and the improvement of related systems to ensure the efficient management of tax expenditures. That said, the national tax reduction/exemption rate for each year currently exceed the national tax reduction/exemption limit stipulated in the National Finance Act. In light of these circumstances, actively managed tax expenditure items that meet the substitutability and abolition standards and subject to tax exemption/reduction adjustment will be adjusted to ensure compliance with the statutory national tax reduction/exemption limit. Meanwhile, exemption requirements will be tightened for preliminary feasibility studies necessary for large-scale tax expenditures exceeding KRW 30 billion, with the results of these studies required to be reported to the National Assembly.

Strengthening tax incentives for a stable everyday livelihood

At the same time as strengthening the ultimate safety net for daily livelihood, such as the National Basic Livelihood Security System, the policy promises to expand both the eligibility and payment amounts of the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC), thereby supporting the self-sufficiency of low-income working households. The income threshold for monthly rent tax deductions will also be raised to reduce the monthly rent burden on urban workers, while at the same time strengthening oversight of tax sources related to rental income. For families with multiple children, the eligible housing size and related benefits will be increased. The policy also includes the creation of new tax credits for mobile phone expenses paid by workers themselves, their children, and parents aged 65 or older. The “Good Landlord” tax credit will be made permanent, and measures such as the extension of VAT exemptions to lower dormitory/housing costs and restructuring the education tax burden borne by financial companies (to alleviate interest burdens for consumers, as education taxes are commonly paid by borrowers in financial loans) will be pursued.

Support for SMEs and balanced national development

To boost SMEs’ competitiveness through digital transformation, the budget for SME smart factories will be greatly increased while providing tax benefits and other incentives to large corporations and SMEs participating in mutually beneficial smart factory projects. Also, investment-related tax support will be expanded to prevent industrial accidents and ensure workplace safety to make SMEs safer workplaces.

Meanwhile, to support a balanced national development, companies will be encouraged to relocate their headquarters to provincial regions outside the greater Seoul metropolitan area through expanded corporate tax reductions/exemptions, prioritized housing provision for employees, etc. Additionally, improvements will be made to the “Hometown Love Donation” system, such as increasing the amount of tax deductions, improving donation procedures, and diversifying use, to strengthen local provincial finances.

Phased implementation of “Our Children’s Independence Fund”

The policy pledge is a phased introduction where the government creates a fund account in the name of a child and makes regular deposits. For this fund, parents will also be allowed to make matching contributions, and tax benefits will be provided on financial income generated by the fund. To achieve the policy’s goals, withdrawals will be prohibited until the account holder becomes an adult, and the use of the funds will be restricted to purposes such as educational expenses or start-up business costs. In addition, the program will be linked with schools’ financial and economic education programs to enhance the educational effect.

Improved Individual Income Tax System with a family-friendly approach

The administration will promote the introduction of a married couple based tax system. Through the couple-based individual income tax, various deductions—such as basic deductions for dependents, deductions for credit card spending for household expenses, and deductions for education and medical expenses—will be applied to the entire income of the married couple. Therefore, this will eliminate the need for determining which income-earner to assign such deductions, thus increasing convenience for the public. In designing the system, measures will be taken to ensure that progressive taxation does not arise from combining the couple’s incomes, and taxpayers will be allowed to choose between individual-based and couple-based taxation. In addition, the administration plans to develop a new tax system that comprehensively considers both spouses’ incomes and the number of children, and to establish a plan to revise various tax exemption and deduction items in line with the transition to this new system.

Enhancing tax benefits for child rearing

In consideration of the increasing living expenses that come with raising children, the administration plans to expand tax benefits based on the number of children and to broaden the scope of those eligible. First, the plan includes increase in both the individual income tax credit rate and the deduction limit for credit card use, based to the number of children. Specifically, the administration plans to raise the credit card deduction rate by 5 percentage points for each child, up to a maximum of 20% per child, and increase the deduction limit by KRW 1 million. Additionally, the administration will include expenses for elementary school children’s participation in arts, music, and sports academies or facilities in the education tax credit scheme, thus strengthening tax support for working parents who may have difficulty providing direct childcare.

Dividends received by individuals are taxable

Further to the announcement in the Malaysian Budget 2025, the Ministry of Finance has gazetted the Income Tax (Determination of Chargeable Income of an Individual in Respect of Dividend) Rules 2025 (“Rules”) on 7 May 2025. The Rules take effect from the year of assessment 2025.

The Rules were made to support the implementation of the 2% tax on dividend income exceeding RM100,000, which was introduced under a new Part XXII of Schedule 1 of the Income Tax Act 1967 (“ITA”), to deal with cases where a taxpayer has both dividend income and income from other sources.

Under these Rules, where dividend income exceeds RM100,000 and the taxpayer also has another source of income, the portion of the chargeable income attributable to dividends is determined using the statutory formula below:

For tax residents, the chargeable income from dividends is calculated using the following formula:

Chargeable Dividend Income =

![]()

For non-residents, the chargeable income from dividends is calculated using the following formula:

Chargeable Dividend Income =

![]()

In the case of a combined assessment under subsection 45(2) of the ITA (which applies to resident individuals who elect for joint assessment with a spouse, and to non-residents only if they are Malaysian citizens), the aggregate income includes the income of the spouse, and the formula applies to the combined figure.

Any portion of chargeable income attributed to dividends under this method is subject to the applicable tax rate based on residency status.

The rules expressly apply only to dividends deemed to be derived from Malaysia under section 14 of the ITA. As a result, dividends from foreign sources are not subject to the 2% tax under Part XXII of Schedule 1.

The formulae under the Rules for determining chargeable income in respect of dividends apply only where the residents and non-residents also have income from another source in the same year of assessment. Where an individual has only dividend income and no other Malaysian-source income, the formula does not apply. In such cases, paragraph 1 of Part XXII of Schedule 1 to the ITA applies directly - the entire dividend income exceeding RM100,000, if deemed derived from Malaysia under section 14, is subject to tax at the flat rate of 2%.

As outlined in the Malaysian Budget 2025, several categories of dividend income will be excluded from this new tax. These include dividends from companies with pioneer status or reinvestment allowances, shipping companies, cooperatives, closed-end funds, Labuan entities, and distributions by Kumpulan Wang Simpanan Pekerja (KWSP), Lembaga Tabung Angkatan Tentera (LTAT), Amanah Saham Nasional Bumiputera (ASNB), or any unit trust. These exclusions are expected to be formalised via exemption orders issued by the Minister of Finance.

Financial services now subject to Service Tax

On 9 June 2025, the Ministry of Finance (MoF) announced in a media release that the expansion of scope for sales and service tax as proposed in Budget 2025, will be implemented from 1 July 2025.

The revision of the sales tax rate and the expansion of the services tax scope include the following:

- the sales tax rate remains unchanged on essential goods consumed by the public;

- the sales tax rate of 5% or 10% is imposed on discretionary and non-essential goods; and

- the scope of service tax is expanded to now cover rental or leasing services, construction services, financial services, private healthcare, education and beauty services. This expansion is accompanied by selected exemptions to avoid double taxation, as well as to ensure that certain essential services for Malaysian citizens are not taxed.

Sales Tax

- Sales tax will remain at 0% for essential items such as chicken, beef, mutton, fish, prawns, squid, local fruits and vegetables, rice, barley, oats, wheat, flour, canned sardines, sugar, salt, white bread, pasta, noodles, instant noodles, milk, cooking oil, medicine, medical devices, books, newspapers, and pet food. Basic construction materials such as cement, stones, and sand, as well as agricultural inputs including fertiliser, pesticides, and agricultural and livestock machinery will continue to be subject to sales tax at 0%.

- Non-essential items such as king crab, salmon, cod, truffles, imported strawberries, essential oil, silk and heavy machinery will now be subject to 5% sales tax (previously, 0% sales tax).

- Items such as tungsten scrap waste, racing bicycles, and antique hand paintings, will now be subject to 10% sales tax (previously, 0% sales tax).

Service Tax

- Rental or leasing of tangible asset services for service providers with a revenue threshold exceeding MYR 500,000 will be subject to the service tax at 8%, with exemptions applicable for services related to residential buildings, business-to-business (B2B) transactions, and group relief mechanism.

- Construction work services for service providers with revenue thresholds exceeding MYR 1.5 million will be subject to the service tax at 6%, with exemptions applicable to services related to residential buildings, and B2B transaction.

- Financial services based on fee or commission will be subject to the service tax at 8%. However, certain services are exempt, e.g., financial services such as basic banking and interest, or profit-based Islamic financing and B2B transactions for shariah-compliant fee arrangements, service providers for Bursa Malaysia, and entities regulated under the Labuan Financial Services Authority, subject to conditions.

- Private healthcare services, traditional and complementary medicine services, and services related to allied health for service providers with revenue thresholds exceeding MYR 1.5 million, provided to non-citizens will be subject to the service tax at 6%;

- Education services will be subject to the service tax at 6%, for:

- the provision of pre-school, primary school, lower secondary, upper secondary or post-secondary education services with fees exceeding MYR 60,000 per student for each academic year; and

- tertiary education and language centre services provided to a non-citizen;

- Beauty services such as facial treatments and hairdressing for service providers with revenue thresholds exceeding MYR 500,000 will be subject to the service tax at 8%.

E-Invoice Implementation for smaller businesses postponed

Courtesy IBFD it was reported that the Inland Revenue Board (IRB) has recently announced the Ministry of Finance's (MoF) decision to exempt taxpayers with annual turnovers not exceeding MYR 500,000 from e-Invoicing requirements for the present time. The decision was made to provide more time for taxpayers, especially micro, small and medium enterprises, to prepare for the implementation of e-Invoice.

The MoF has also revised the e-Invoice implementation schedule and income thresholds for the following:

- taxpayers with annual turnover of more than MYR 1 million (previously MYR 500,000) and up to MYR 5 million: from 1 July 2025 to 1 January 2026; and

- taxpayers with annual turnovers not exceeding MYR 1 million (previously MYR 500,000): from 1 January 2026 to 1 July 2026.

The latest timeline for e-Invoice implementation issued by the IRB is as follows:-

|

Targeted taxpayers |

Implementation date |

|

Taxpayers with an annual turnover or revenue of more than |

1 July 2025 |

|

Taxpayers with an annual turnover or revenue of more than |

1 January 2026 |

|

Taxpayers with an annual turnover or revenue of up to |

1 July 2026 |

- The 6-month grace period previously provided also applies to the above timeline. During this period, taxpayers are allowed to issue consolidated e-Invoices for all transactions, subject to conditions.

- During the grace period, no prosecution will be taken under section 120 of the Income Tax Act 1967 (the Act) for non-compliance with e-Invoice regulations if taxpayers comply with the requirements for consolidated e-Invoices as stated above.

- With effect from 1 January 2026, taxpayers involved in the implementation of e-Invoices must issue an e-Invoice for each sale of goods or provision of services exceeding MYR 10,000 (consolidated e-Invoices will not be allowed).

Stamp duty on employment contracts

The Inland Revenue Board (IRB) has announced that, following a policy decision by the Ministry of Finance, employment contracts executed before 1 January 2025 will be exempted from stamp duty.

- following the issuance of the stamp duty audit framework, the IRB has been carrying out stamp duty audit activities and one of the key findings are in relation to the employment contracts executed between employers and employees that were not stamped at MYR 10 as required under Item 4, First Schedule of the Stamp Act 1949 (the Act); and

- to ease the compliance burden on taxpayers, the MoF has decided to provide the following concessionary measures:

- employment contracts executed 1 January 2025 are exempted from stamp duty;

- employment contracts finalized from 1 January 2025 to 31 December 2025 are subject to stamp duty at MYR 10. A remission of late stamping penalty will be granted, provided that the contract documents are stamped on or before 31 December 2025; and

- employment contracts finalized from 1 January 2026 onwards will be subject to stamp duty at MYR 10 and any delay in stamping the contracts would result in relevant penalties under the Act.

The IRB has also urged the employers to review and update all employment contract documents that have been or will be signed to ensure compliance with the stamping requirements under the Act.

Mandatory Employees Provident Fund contributions for foreign employees

The Employees Provident Fund (EPF) has announced that the new legislation mandating mandatory EPF contributions for non-Malaysian employees will take effect on wages from October 2025, for the contribution month of November 2025. The announcement was made on 25 June 2025.

The Employees Provident Fund (Amendment) Act 2025, published on 14 May 2025, provides for the mandatory EPF contributions for foreign employees where the contribution rate will be set at 2% of monthly wages for both employers and employees. The EPF contribution will apply to an employee who is not a Malaysian citizen, and who meets the following criteria:

- the employee's country of domicile is outside Malaysia; and

- the employee enters and remains in Malaysia temporarily under the authority of any pass issued under the provisions of any written law relating to immigration.

The EPF also clarified that the expansion of mandatory contribution coverage will include all non-Malaysian citizen employees working in Malaysia (excluding domestic servants) who hold a valid passport and an employment pass issued by the Immigration Department of Malaysia.

Convention and Protocol on Mutual Administrative Assistance in Tax Matters

On 1 May 2025, the multilateral Convention on Mutual Administrative Assistance in Tax Matters, as amended by the 2010 protocol, entered into force in respect of the Philippines. The convention and the amending protocol will generally apply from 1 January 2026 for the Philippines.

Philippines commits to implement CARF by 2028

According to a press release of 17 June 2025, published by the Department of Finance of the Philippines, the Philippines has committed to implement the Crypto-Asset Reporting Framework (CARF).

The Crypto-Asset Reporting Framework (CARF), developed by the OECD, establishes standards for the automatic exchange of tax-relevant information on crypto-assets. Jurisdictions aim to begin exchanges under CARF by 2027 or 2028, strengthening tax systems to address modern financial technologies and combat global tax evasion.

The Philippines aims to commence exchanges under CARF by 2028, in line with the OECD's agreed implementation timelines and transitional arrangements, joining 68 other countries that have committed to the initiative. Further developments will be reported as they occur.

Withholding tax exemption under the tax treaty with the Netherlands

The Dutch Tax Administration has published its position (KG:024:2025:4) on the application of the withholding tax exemption under article 4(2) of the Dividend Withholding Tax Act (DWTA) in the event a dividend is distributed that is not eligible for treaty benefits under a tax treaty. This is relevant if dividends are distributed to a company resident in Singapore. In practice, Singapore companies often are holding companies for investors investing in multiple jurisdictions including European countries and Dutch companies are often used as holding companies for investments in Europe and the Americas.

The case in question concerned a private limited liability company (BV) established in the Netherlands that had distributed a dividend to X Ltd. X Ltd. is established in a state with which the Netherlands has concluded a tax treaty such as e.g. Singapore. BV transferred the dividend payment to a bank account that X Ltd. held with a bank outside the state in which it is established. Because the dividend was not actually transferred to the territory of the state of which X Ltd. is a resident, the dividend is not subject to tax in the state of which X Ltd. is a resident. This would also apply if the dividend is paid to a Singapore-resident company.

The applicable tax treaty contains a dividend provision as referred to in article 4(2)(a)(2) of the DWTA. However, due to the remittance base provision in the applicable treaty, it follows that the dividend is not eligible for treaty benefits. All other requirements for applying the exemption of article 4(2) of the DWTA are met.

Article 4(2) of the DWTA provides that tax is not withheld in respect of the proceeds from shares, profit-sharing certificates, capital contributions and certain loans, if the beneficiary is a body established in a state, other than an EU Member State or a state party to the EEA Agreement, with which the Netherlands has a tax treaty containing a dividend article.

The question was whether the withholding tax exemption under article 4(2) of the DWTA applies if the beneficiary is established in a state with which the Netherlands has concluded a treaty that contains a dividend article, but the dividend concerned is not eligible for treaty benefits.

The Tax Administration stated that the withholding exemption under article 4(2) of the DWTA applies if the beneficiary is established in a treaty state and the treaty includes a dividend article. Whether the dividend qualifies for treaty benefits is irrelevant.

The Tax Administration further clarified that the law does not require the dividend to be eligible for treaty benefits based on the treaty. Treaty benefits may not always be claimed due to factors such as ownership percentage for participation dividends, requirements under a "limitation on benefits" provision, or a remittance base provision.

Additionally, the Tax Administration noted that parliamentary proceedings indicate that, as of 1 January 2018, the Dutch legislator intended to extend the withholding exemption to third countries with which the Netherlands has concluded a tax treaty that includes a dividend provision. Legislative history shows that it is not necessary for the dividend to be eligible for treaty benefits.

Corporate tax deduction for share awards

With effect from the Year of Assessment (YA) 2026 (generally: transactions occurring during 2025), a tax deduction for share awards granted to employees will be available for awards that are settled with newly issued shares, not just treasury shares. Additional clarifications from the Inland Revenue Authority of Singapore (IRAS) on the specific requirements and timing for the tax deduction are expected to become available by September 30, 2025.

Under existing law, companies granting share-based awards to employees in Singapore could claim a tax deduction in Singapore for awards only if the awards were settled with treasury shares. The rationale for this rule was that a deduction should be available only for actual costs incurred by the company in relation to the awards. If settling awards with newly issued shares, companies were not perceived to incur an actual cost – even in situations where a Singapore subsidiary reimbursed a non-Singapore parent company for shares issued by the parent.

By contrast, if the company settled awards with treasury shares, the company incurred a cost equal to the amount of the price paid to purchase the shares and such cost was generally deductible in Singapore (provided certain other conditions were met). In practice, this rule made it difficult for many companies to claim a tax deduction for share-based awards granted in Singapore. In some cases, local corporate law rules do not provide for the concept of treasury shares. And even for companies that did or could purchase shares to be held in treasury, tracking the purchase price for such shares and matching it to the shares issued in satisfaction of awards granted in Singapore was extremely challenging. Therefore, again, few companies were able to claim tax deductions for share-based awards granted in Singapore.

A Singapore company will be allowed to claim a deduction for the lower of the following (in both cases minus any price paid by employees to acquire the shares):

(i) the amount paid by the Singapore company, and

(ii) the fair market value, or net asset value of the shares (if the fair market value is not readily available), at the time the shares are applied for the benefit of the employee.

There are still a number of open questions that we expect the IRAS to provide guidance on by the third quarter of 2025. In particular, it is not clear if the new regime will apply as of January 1, 2025 (i.e., the beginning of the YA 2026) or a later date, and whether a deduction could be claimed only for share-based awards granted after the commencement of the new regime or for share-based awards settled after this date (even if granted before this date). Therefore, it may be premature for parent companies to enter into recharge agreements with their Singapore subsidiaries until further clarity is obtained on the precise mechanics for the administration of the new regime.

On a related note, the IRAS has taken the position that notional stock-based compensation (SBC) expenses are to be included in the cost base when computing service fees that are to be charged by a Singapore company to an intercompany affiliate where a cost-plus methodology is adopted. IRAS has taken this position even in situations where the notional SBC expenses are recorded on the Singapore subsidiary’s books solely from an accounting perspective and there is no actual recharge that has been incurred by the Singapore subsidiary to the issuing company for the shares. If the notional SBC expenses are included in the cost base, this increases the service fees that are to be recognized by the Singapore company. If there is no corresponding deduction for the Singapore subsidiary, the increase to taxable income could potentially be material.

Goods & Services Tax – electronic invoicing requirement

From 1 May 2025, GST-registered businesses can voluntarily transmit their invoice data to IRAS using InvoiceNow-Ready Solutions via the InvoiceNow network. By coming onboard early, such businesses will enjoy the benefits of using InvoiceNow-Ready Solutions sooner.

InvoiceNow is the nationwide e-invoicing network introduced by the Infocomm Media Development Authority (IMDA) that enables businesses of all sizes to boost productivity in invoice processing and seamlessly transmit e-invoices securely across different finance systems. The GST InvoiceNow Requirement is part of IRAS’ efforts to extend the digitalisation benefits under InvoiceNow to help businesses ease their GST compliance.

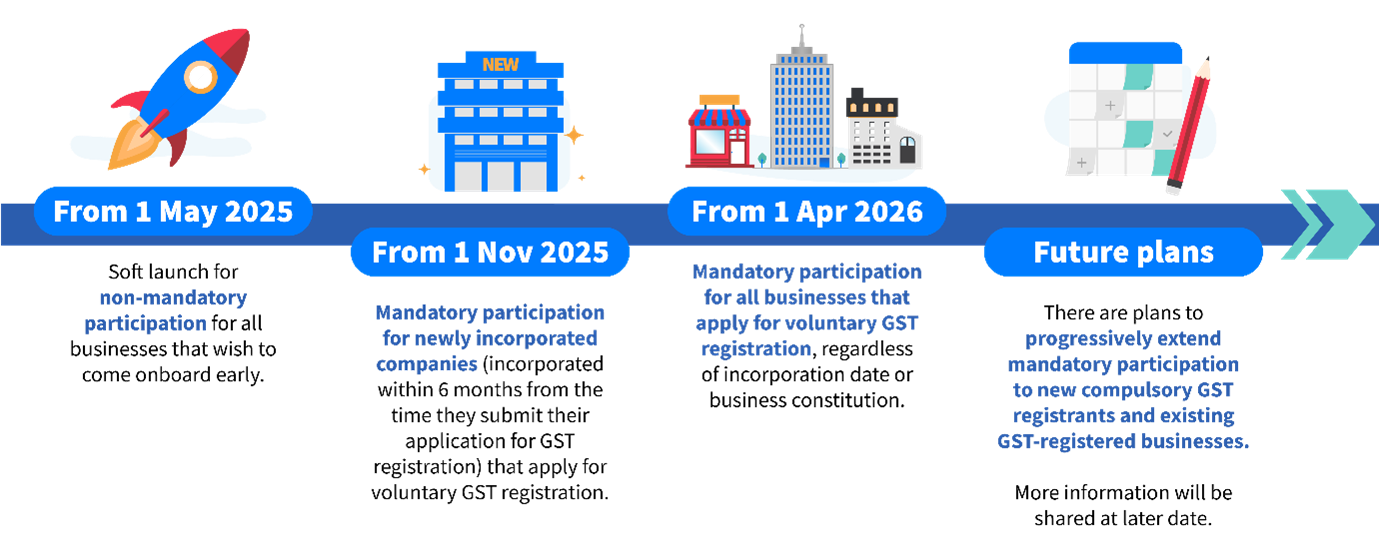

IRAS has announced 3 dates for a gradual roll-out of the GST InvoiceNow Requirement, and there are plans to progressively extend mandatory participation to new compulsory GST registrants and existing GST-registered businesses.

Extended time to apply for tax treaty benefits

The Ministry of Finance has extended the application period for income tax agreement benefits by amending Article 34 of the "Regulations Governing the Application of Agreements for the Avoidance of Double Taxation with Respect to Taxes on Income". The amendment, which took effect on 10 April 2025, allows foreign taxpayers to apply for tax treaty benefits up to 10 years from the date of the Taiwanese tax payment. The previous limit was 5 years.

Tax Incentives for AI, Energy Conservation and Startups

The Legislative Yuan (parliament) on 18 April 2025 has passed several amendments to the Industrial Innovation Act (IIA) to expand the incentives scope of the investment tax credit for certain industries and enhance tax incentives for startup fundraising. The key changes are as follows:

- products and services related to artificial intelligence (AI), energy conservation and carbon reduction have been newly added to the scope of the investment tax credit. The upper limit of the investment tax credit has been increased from TWD 1 billion to TWD 2 billion. According to article 10-1 of the IIA, the original scope of the investment tax credit is retained covering projects such as smart machinery projects, smart technology elements, 5G systems and information security projects. These new additions aim to encourage industries to adopt digital technologies such as AI and cloud computing, boost corporate resilience, and enhance carbon reduction efficiency across industries; and

- the applicable period for tax incentives for startup businesses will be extended from 2 years to 5 years following their business establishment. To assist new startups, the threshold of paid-in capital for limited partnership venture capital enterprises will be lowered from TWD 300 million to TWD 150 million. For "angel investors" benefiting from tax incentives for investing in startup businesses, the investment threshold will be reduced from the current TWD 1 million to TWD 500,000. If startups belong to any national development industries, the individual investors can claim up to TWD 5 million for tax credit annually.

The Ministry of Economic Affairs announced the plans to collaborate with the Ministry of Finance to complete the formulation of relevant sub-measures related to the new scope of application for the AI, energy-saving and carbon-reduction investment projects within 6 months. The new scope of incentives is set to be implemented from 1 January 2025 to 31 December 2029.

Board of Investment approves tax measures for data centres

Thailand's Board of Investment (BOI) has recently approved new measures on tax exemptions for the promotion of investment in data centres, support local small and medium size enterprises (SMEs)—especially in sectors facing high competition—and promote investments in tourism infrastructure businesses in second-tier provinces.

Data Centres, Data Hosting and Cloud Service Projects

The BOI approved a revision to the requirements and benefits for investment in data centres, data hosting and cloud service projects, to reflect recent technological developments, align with actual investment amount, and ensure clearer benefits to Thailand's economy, while helping workforce development and the appropriate management of natural and energy resources.

Projects that meet the power usage effectiveness (PUE) standards and offer data hosting using advanced computing capabilities such as graphic processing units (GPU), are eligible for the highest corporate income tax exemption of 8 years. Other projects will be eligible for tax exemption capped at 5 years.

Applicants for investment promotion in this sector must submit a plan detailing the project's contribution to Thailand's economy, including professional training, cooperation with local technical schools and universities in creating courses or conducting joint research and development projects, skill development programs for Thai SME entrepreneurs and support for strengthening the country's supply chains. The proposed plan must be implemented before exercising the corporate income tax exemptions.

Local SMEs and Entrepreneurs

The BOI approved measures to support Thai entrepreneurs including an increase in the corporate income tax benefits granted to BOI promoted SMEs, which will now receive a 5-year corporate income tax exemption equal to up to 100% of their investment in enhancing their capabilities and improvements (previously, 3-year corporate income tax exemption capped at 50% of the investment).

Tourism Businesses in 55 Second Tier Provinces

The BOI also approved measures to promote investments in tourism infrastructure businesses in 55 "second-tier" provinces of Thailand. The measures are in line with the Thai government's policy to upgrade tourism infrastructure and develop new tourist attractions, to promote the distribution of tourists in less visited areas and to spread nationwide the economic benefits of tourism.

Investment in tourism businesses—including large-scale quality tourist attractions; theme parks; Thai cultural centres; handicraft centres; museums; open zoos; international exhibition centres; large convention halls; cruise terminals; motor racing stadiums; cable cars and electric trams for tourism in the 55 designated provinces—are eligible for up to 8 years corporate income tax exemption (previously, 5 years). Investments in hotel business in these provinces are eligible for tax exemption for up to 5 years (previously, 3 years).

Reduced registration fees for property transfers and mortgages

The government has recently introduced two ministerial regulations providing for a significant reduction of the registration fees for certain property transfers and mortgages effective from 22 April 2025. These measures were introduced to ease the financial burden on Thai citizens and promote the sale of real estate.

The transfer registration fee on the sale of:

- condominium units;

- residential buildings in the form of detached houses, twin houses or townhouses;

- commercial buildings; and

- land, together with such residential or commercial buildings,