Synthetic risk-transfer (“SRT”) trades have moved from a specialist capital management tool to a mainstream pillar of bank, investor and supervisory strategy. Their core attraction is simple: by transferring the credit risk of specified tranches synthetically—through guarantees, credit default swaps or credit-linked notes—banks generate regulatory capital relief while preserving client relationships and funding arrangements, and investors obtain diversified, leveraged exposure to granular pools of exposures that remain otherwise difficult to source.

From the first post-crisis European SME transactions in 2012 to the record SRT issuances recorded in recent years, the market’s rise has been both rapid and geographically broad, stretching today from the UK, EU and US to Brazil, Mexico, the Nordics and Chile.

Much of this growth rests on a more predictable regulatory architecture. In the European Union, the Capital Requirements Regulation (“CRR”) set the legislative backbone (as do the corresponding post-Brexit UK rules).

To obtain capital relief an originator must demonstrate that minimum amounts of the mezzanine risk-weighted exposure amount—or, where no mezzanine exists, the first-loss tranche—has been transferred to third parties and that the credit protection is legally effective and enforceable in every relevant jurisdiction.

In parallel, the European Banking Authority has pressed for convergence: its various reports, guidance and its technical standards on synthetic excess spread and risk-retention RTS collectively codify best practice on credit events, verification mechanics, replenishment and early terminations. The European Central Bank is currently testing a “fast-track” process intended to give significant institutions comfort that capital relief will be recognised within weeks rather than months when a transaction follows the standard templates.

Four structural archetypes now dominate.

The unfunded bilateral guarantee remains the simplest solution and is still favoured where the protection seller is a multilateral institution. However, the high counterparty credit quality requirements limits the pool of investors.

Direct issuance of credit-linked notes by a bank short-circuits counterparty risk and accompanying counterparty regulatory capital burdens, but incurs securities-laws disclosure overheads and legal costs.

Funded bilateral trades—in which an investor posts collateral under a credit derivative arrangement and receives a floating return—deliver day-one credit substitution and are popular with private-equity and hedge-fund providers of protection.

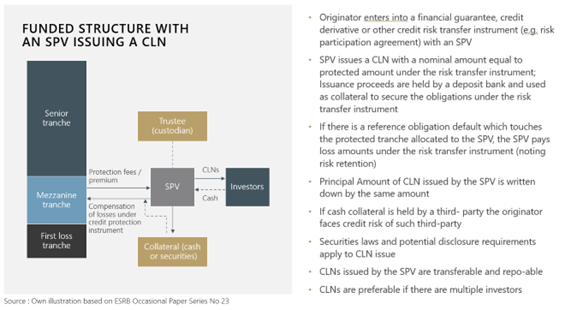

Finally, the SPV-issued CLN format, married to a credit derivative between the originator and the SPV, allows multiple investors to participate and supports secondary liquidity.

Whichever route is chosen, the capital rules have complex and strict requirements including for loss-settlement: objective credit events, prompt estimated protection payments, verifications, and final true-ups at the end of a contractual workout period.

Transaction economics hinge on tranche geometry, premium calibration and the handling of excess spread. The mezzanine tranche is rarely a thick than portion of the reference portfolio, yet it absorbs the lion’s share of unexpected loss and therefore commands the highest premium. Where synthetic excess spread is used to shield investors against high-frequency defaults, originators must comply with highly complex rules.

Investor demand has changed profoundly. Hedge funds accounted for almost 40 per cent of distributed tranches between 2008 and 2023, but recently pension funds and large asset managers have re-entered, encouraged by better public disclosure—ESMA templates, loan-level data and liability cash-flow models are now standard deliverables even for private deals—and by the prospect of balanced-sheet synthetic transactions achieving the “simple, transparent and standardised” (“STS”) label.

Approximately a quarter of 2024 EU issuance was STS-compliant, a proportion, a figure which is widely expected to increase.

At the same time, the United States has become a major player, with regional banks stepping-in together with global institutions. Structures follow, to a large extent, familiar European patterns, but must navigate US-specific frictions: regulatory capital rules contained in Regulation Q, Commodity Exchange Act swap classification concerns, and other nuances.

Emerging markets are increasingly active. In Mexico and Brazil, multilateral development banks such as the IFC provide unfunded guarantees that qualify for zero risk weight under the CRR, enabling European parent banks to achieve capital relief on Latin-American exposures. Frameworks often couple the trades with ESG-linked key-performance indicators.

The IACPM’s Global SRT Insurance Survey confirms insurers are now integral to the capital-relief ecosystem. The survey notes that in 2024, 14 global (re)insurers underwrote protection on 82 SRT investments—nearly double the previous year—and supported €3 billion of tranche notional after syndication. The outstanding insured book now exceeds €6 billion.

In practical terms, insurers now represent a credible alternative—or complement—to hedge funds and asset managers for mezzanine risk, bringing highly rated counterparty credit. For arrangers these attributes can translate into broader market access and a diversified investor base that is less correlated with traditional credit-market cycles. However, involvement of insurance contracts and/or insurers and reinsurers in SRT arrangements are accompanied by additional complex rules and requirements.

Mayer Brown is one of the market-leaders amongst law firms advising on SRT Transactions. We are almost alone in advising on both EU/UK transactions and US transactions. We are also a market leader in Latin America advising on landmark deals in Mexico, Brazil, and Chile. We combine a leading derivatives and structured-finance practice with top-tier insurance and regulatory expertise, extensive deal experience and market knowledge to provide our clients with excellent service.