How to Invest in AI Fintech: Factors to Consider

Summary of Key Points

- Artificial intelligence (“AI”) is one of several technologies being developed and deployed across fintech sectors.

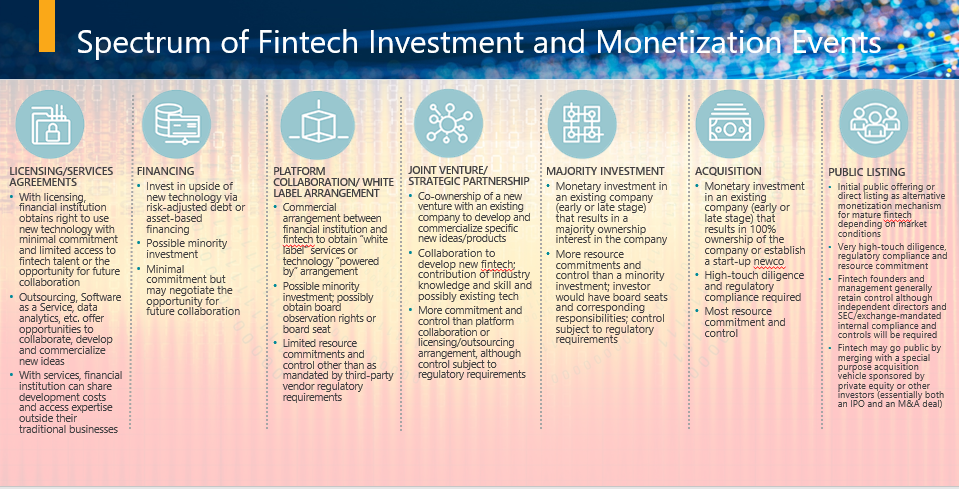

- Transactions that enable these activities can take a variety of forms, including joint ventures and strategic partnerships, minority and majority investments, M&A-style acquisitions and public listings.

- Financial institution investors should first define their AI goals and strategy, and then attempt to align their investment tactics with their AI strategy. As these AI strategies evolve, so will the transactions for investing in AI.

- Whether you are a financial institution, emerging fintech company or an investor focused on fintech, this article provides an assessment of the structural, risk and legal considerations to balance in these transactions.

Artificial intelligence has long since graduated from science fiction and speculative use cases to widespread and diverse development across fintech sectors. CB Insights reported that financings for AI startups showed continued robust activity through Q2 2022, despite changes in market sentiment from the exuberance of 2021.1 Financial institutions of all types, and their business partners, customers and investors, view AI as an essential element of their long-term goals of staying competitive and relevant in a rapidly changing market.

Transactions among market participants can provide the missing piece each party needs to catapult its strategy forward. Different market participants bring different advantages and needs to the table, which impact the types of transactions each may employ at any given time. For example, large financial institutions often have financial resources, expertise to manufacture compliant financial products and a wealth of data about their customers’ financial activities. On the other hand, companies seeking to disrupt in this space, including those offering AI products and services relating to financial services (“AI fintech companies”),bring a singular focus on a sector or product and the flexibility of a small and nimble organization but often need resources to achieve scale and viability for their products. At the same time, financial sponsors and other investors in the space often have a higher risk appetite and the ability to deploy capital quickly. However, these investors also need to monetize their investments periodically.

While there is no one-size-fits-all approach for developing and deploying AI in new/updated financial products and services, there is a common set of tools that can be used to collaborate, invest in and monetize AI in business models. Given the increasing speed at which AI and fintech are developing, the older sourcing strategies of “build versus buy” are being replaced with strategies that allow for flexible and rapid collaboration across a variety of acquisition models.

This article will examine some of the strategies or “tools” on the spectrum of AI investment and monetization events: joint ventures and strategic partnerships, minority and majority investments, M&A-style acquisitions and, finally, public listings. An illustration of the full spectrum of transactions and arrangements is shown below:

We will outline some of the due diligence, structure and contractual considerations for each type of transaction. We will focus on these considerations from the point of view of the buyer of, or the investor in, an AI fintech company. We will also review a public listing as an alternative monetization opportunity, whose availability and attractiveness will depend on market conditions.

Joint Ventures and Strategic Partnerships

The term “joint venture” is quite broad and is often used colloquially. Depending on the goals of the venture and its owners, it can involve creating a new entity, an ongoing contractual relationship or a combination of both. As distinguished from a strategic investment or an M&A transaction, a joint venture typically involves two or more parties that come together to achieve a common goal for profit.

Regulatory hurdles make it less likely for large financial institutions to joint venture or partner with an AI fintech company in the traditional sense, but other large, non-bank finance companies may consider the joint venture structure more attractive and feasible. As discussed below, a large financial institution, such as a bank holding company or an insurance company, is typically highly regulated and seeks to avoid obtaining “control” of the AI fintech company, in most cases by keeping a minority equity investment below 5 percent (or 10 percent in the case of an insurance company) of the AI fintech company’s voting shares and otherwise avoiding indicia of control. Indicia of control include holding a voting seat on the company’s board of directors, having certain veto or consent rights, entering into a management agreement or entering into significant business or commercial relationships with the AI fintech company. If the financial institution seeks a control relationship, it may be simpler to acquire complete control through an acquisition as opposed to a joint venture or partnership. On the other hand, the financial institution may forego any equity investment in order to avoid these control questions and seek only a commercial or financing arrangement as discussed elsewhere in our AI & Financial Services Symposium materials.

Advantages of Joint Venture.

Assuming that the joint venture partners are willing to have their joint venture entity be treated as a regulated entity or the joint venture entity is otherwise not subject to what may be viewed as burdensome bank or insurance regulations, there can be a number of advantages to using a joint venture entity as opposed to a contractual joint venture. These advantages include:

(a) The joint venture will have access to technology, subject matter experts such as data scientists, and products contributed to the joint venture as well as distribution channels and markets with greater economies of scale.

(b) A joint venture allows regulatory risks that accompany financial institutions to be shared by the joint venture partners, especially when entering a new market.

(c) Internal and external constituencies (e.g., employee talent in the joint venture and end users of the technology) will perceive a separately identifiable and visible enterprise conducting the joint venture business, with the venture lending itself more to AI innovation than to regulated bank or insurance activity.

(d) Interests in a joint venture are generally easier to sell or transfer than a collection of contractual relationships.

(e) The joint venture entity creates an independent vehicle with greater flexibility and convenience for capital-raising activities.

(f) The joint venture entity provides a familiar structure (e.g., a corporation, limited liability company or limited partnership) in which management and governance rules can be established and in which directors, officers and employees typically play familiar roles in making decisions and implementing them, with this level of oversight likely being important in the developing area of AI.

(g) The joint venture entity provides a convenient vehicle for measuring profits and allocating and distributing them to the joint venture parties.

(h) The joint venture entity can be an independent employer providing identification and focus for employees, including incentive compensation such as equity interests and the opportunity to work on cutting-edge AI projects.

(i) The joint venture entity largely enables the joint venture parents to insulate themselves from the liabilities of the joint venture business.

(j) The joint venture entity creates the potential for flexibility in addressing tax matters.

Disadvantages of Joint Venture.

Disadvantages of the joint venture structure, in addition to the perhaps overriding concern that the AI fintech joint venture will become a regulated entity based on its control by a regulated financial institution, include:

(a) The joint venture structure will likely be more complex because establishing a separate joint venture entity often involves initial and ongoing issues, tasks and costs that are not necessarily present in a contractual association, with time-consuming oversight required by senior managers of the alliance participants.

(b) The unwind process will likely be more complicated because assets, contracts, employees and other resources of the joint venture business may be property of, or affiliated with, the joint venture entity.

(c) The joint venture partners may lose control because the joint venture business will normally be, in large part, conducted by the joint venture entity and the rights and ability of the joint venture entity and its activities will be limited by the governance rules of the joint venture entity.

(d) Difficult fiduciary duty and conflict of interest issues may arise with a joint venture entity that may not arise in a contractual joint venture (although these can largely be handled contractually).

(e) The contractual joint venture can allow more flexibility in staging and developing the joint venture by establishing an initial “let’s get our feet wet” relationship without the more substantial commitment involved in establishing, and providing assets and other resources to, a separate joint venture.

Minority Investments and M&A Transactions

Strategic investments and M&A transactions offer a large financial institution, such as a bank or insurance company, some additional flexibility to tailor an investment to its specific business strategy, with each structure having its own unique advantages and disadvantages. Two general concerns applicable to each structure are (1) the “control” analysis described above in the “Joint Ventures and Strategic Partnerships” section and the effect of bank or insurance regulatory control on the AI fintech company and (2) the level of diligence a potential investor should complete with respect to each structure. In this section, “investor” refers to financial institutions as investors in or acquirers of AI fintech companies.

Advantages of Minority Investment.

A passive, non-controlling investment can offer a large financial institution investor and the AI fintech company a number of advantages. These advantages include:

(a) allowing the investor to leverage the AI offerings of the AI fintech company in its business with relatively low risk to the investor due to a limited commitment of resources;

(b) potentially less stringent due diligence requirements of the AI fintech company, in general, than majority investments and M&A transactions, but this can vary depending on the cost/benefit analysis and risk tolerance of each individual investor;

(c) the imposition of fewer regulatory burdens on the AI fintech company;

(d) allowing the AI fintech company to leverage the infrastructure and expertise of the investor; and

(e) the AI fintech company’s retention of a certain level of autonomy.

Disadvantages of Minority Investment.

Disadvantages of this structure include:

(a) very limited investor control over the AI fintech company’s activities (e.g., generally no board seat or board observer, few consent rights over activities of the AI fintech company, etc.);

(b) limited investor protective provisions (e.g., lead investor controls vote, future capital raises possibly diluting and subordinating the investment, etc.);

(c) requiring the investor to conduct a relatively complex and ongoing control analysis for regulatory purposes; and

(d) tension created due to the differing goals of the investor (financial return) and the AI fintech company (long-term viability).

The obligation of the investor to continually assess its level of control over the AI fintech company to avoid subjecting the AI fintech company to regulatory oversight is a key disadvantage to a minority investment. For example, a bank holding company investor must ensure its equity investment remains below 5 percent in addition to monitoring other means of exercising control over the AI fintech company, such as the appointment of a board member, veto rights over certain actions of the AI fintech company, ownership of 25 percent or more of any class of voting securities, rights of first refusal and ownership of convertible securities.2 As a protective measure, a minority bank holding company investor should seek to include certain transfer rights, such as a put right, for itself in connection with its investment to allow the investor to exit the AI fintech company if regulatory concerns arise.

Investments by insurance companies (or their affiliates) will potentially be subject to the laws governing insurance holding company systems in the states where the insurance companies are domiciled (or deemed commercially domiciled). Generally, those laws presume control, and thus an affiliate relationship, to exist where one person, directly or indirectly, owns 10 percent or more of the voting securities of another person, although that presumption can be rebutted by submitting a disclaimer of control to the domiciliary state insurance commissioner. In addition, other types of rights, such as the appointment of board members, may be deemed by an insurance commissioner to constitute control of an entity, so being below 10 percent should not be considered a “safe harbor” that automatically negates control. The laws in many states limit the ability of an insurance company to acquire a controlling minority interest in another entity. In addition, if an entity is treated, for insurance regulatory purposes, as an affiliate of an insurance company, that relationship will need to be disclosed in the insurance company’s statutory financial statements and annual holding company registration statements and enterprise risk reports, and the domiciliary state insurance commissioner will need to be notified in advance of material transactions between the insurance company and its affiliate, giving the commissioner an opportunity to review the transaction before it can go into effect.

Factors to consider when making a non-controlling, minority investment include: (a) when the financing round occurs in the lifecycle of the company (i.e., an early stage financing such as Series A or a later stage financing round such as Series D); and (b) whether the investor is the lead investor in the financing round. With respect to the financing round, investors should consider the potential regulatory risks that the AI fintech company may face because many startups operate with a focus on growth rather than regulatory compliance, and without a well-developed regulatory framework, it may be harder to ascertain the regulatory risks in an early-stage company as opposed to a more mature AI fintech startup. Further, lack of liquidity and valuation risks are common with all startups regardless of industry because these companies are hard to value when they are immature. On the other hand, investing into a later stage financing round also comes with its own issues and considerations. While more mature companies have potentially lower compliance risk exposures and more well-developed valuation methodologies, investing into a later stage financing round means entering into a more crowded capitalization table with lower returns upon an exit and potentially less control and protections than earlier investors have.

When making a minority investment, it is important to consider the benefits and disadvantages of being the lead investor in a financing round. A lead investor is generally the investor that is making the largest investment in the round, and therefore is the investor that is in charge of negotiating the terms of the round, coordinating the process between the parties, and conducting the most extensive diligence. The benefits of being a lead investor generally include the creation of a strong relationship with the AI fintech company due to the amount of interaction during, and after, the financing transaction. Additionally, the lead investor typically will have the right to negotiate a side letter with the AI fintech company, which will include contractual terms separate from the terms generally agreed upon in the financing related to the equity being purchased, and may have the advantage over other investors for negotiating a strategic alliance.

Advantages of Majority Investment/M&A Transaction.

Considerations to keep in mind when determining whether to be a lead investor include:

(a) the size of the investment in order to be considered the lead investor,

(b) the expenses associated with conducting the diligence process and engaging various advisors as part of the process and

(c) whether there are any other commercial relationships between the parties. The size of the investment can become substantial, especially in later stage financing rounds, and when there are potential venture capital funds involved, where a significant investment may be required in order to obtain the related benefits.

Similarly, the more complex the business, the more costly the diligence and negotiation processes become. A passive non-lead investor may be able to obtain most of the same benefits without incurring as many costs. Finally, if there are commercial relationships between the AI fintech company and an investor or if the investor must abide by specific regulatory restrictions on its investment, the investor may be able to negotiate additional contractual rights pursuant to a side letter without having to be the lead investor of the financing round. For example, it is typical for a passive bank holding company investor to put its bank regulatory representations and covenants in a side letter.

Alternatively, if a large financial institution seeks a control relationship, it can structure its investment as a majority investment or an M&A transaction. Some advantages of a majority investment include:

(a) providing more investor control over the AI fintech company than in a minority investment;

(b) allowing the investor the opportunity to enhance the operational efficiency of the AI fintech company and address any existing risks (e.g., amend existing material agreements to address deficiencies); and

(c) providing the AI fintech company with a greater opportunity to leverage the infrastructure and expertise of the investor.

Disadvantages of Majority Investment/M&A Transaction.

Disadvantages of a majority investment include:

(a) subjecting the AI fintech company to regulatory oversight;

(b) requiring a much larger resource commitment from the investor, which entails a higher level of risk, necessitating a much higher level of due diligence (raising the issue of whether it may be more advantageous to acquire the entire AI fintech company);

(c) requiring a higher level of investor responsibility and oversight with respect to the operations of the AI fintech company, including regulatory compliance; and

(d) integration issues with respect to the cultures of the investor and AI fintech company. The effect of the investor obtaining control of the AI fintech company is one of the most important factors for the investor’s consideration.

Generally, majority investments require a much more thorough due diligence investigation of the company than minority investments. The investor will need to assess the AI fintech company’s current operations and marketing strategies (including the AI fintech company’s website) and review its contracts, in each case with a particular focus on data security and regulatory compliance, as discussed more fully below. In extreme cases, it may be necessary to shut the AI fintech company down for a period of time to resolve any major issues identified in due diligence.

Lastly, a large financial institution may wish to acquire full ownership of an AI fintech company in an M&A transaction. Each of the advantages and disadvantages of a majority acquisition apply to an M&A transaction, often to a greater extent. A key additional advantage of an M&A transaction is the flexibility provided, more specifically the opportunity to use a number of different structures to address specific risks (e.g., the use of an asset sale to protect against pre-closing liabilities). Some key disadvantages of M&A transactions include: (a) an M&A transaction requires the highest level of due diligence; and (b) concerns related to retention of key employees are at their peak.

The buyer’s due diligence of an AI fintech company in an M&A transaction should include a confirmation of ownership of intellectual property and software, a personnel assessment, and an evaluation of regulatory, cybersecurity and data privacy risks. Analyzing the source code underlying the IP is critical. Open source code licenses may require disclosure to the public domain of all or a portion of the source code into which the open source code subject to any such license was incorporated. To reduce its risk, the M&A buyer should also seek to negotiate strong seller representations in the transaction documents with respect to matters such as ownership of IP, outbound licenses of the IP, use of open source code, the formatting of the source code (i.e., that it has been documented in a manner that enables a programmer of reasonable competence to understand it, manipulate it, etc.), compliance with cybersecurity and data protection laws and best practices, and other similar matters.

Due diligence of the technology and software of an AI fintech company may present amplified confidentiality issues given the competitively sensitive nature of the information being evaluated. A seller may not regard a traditional confidentiality agreement as sufficient to protect its interests where software is a large portion of the value of the business being sold. A “clean room” confidentiality agreement may be appropriate where only certain “clean team” members are permitted access to sensitive data. This is a familiar technique borrowed from transactions where antitrust issues exist because the buyer and seller are competitors. A key issue will be which individuals are permitted on the clean team. For example, will any of the buyer’s employees be given access or will the team only consist of individuals employed by legal advisors and technology consultants? Will the buyer be permitted to review reports prepared by these advisors and consultants or will additional restrictions on use or redaction be required?

The buyer of an AI fintech company should also seek to address due diligence issues and risks that are particular to AI providers through targeted representations and covenants. For example, the buyer should include compliance with law representations and covenants that allocate strict liability to the seller for machine learning output regardless of whether any breach is “intentional” or “negligent” or is known by the seller. Particularly where the AI fintech company engages in lending or making underwriting decisions, the buyer should address liability for discrimination and fair lending compliance, including for any disparate impact. The buyer may also seek a representation that decisioning criteria are “explainable” or at least diligence the design criteria of the AI fintech company for explainability. Cybersecurity and data privacy representations and covenants may also need to be augmented in light of data-intensive AI systems.

As part of its due diligence process, the M&A buyer should identify key employees to retain following the closing. As mentioned above, there may be substantial differences between the cultures of the financial institution buyer and the AI fintech company. Employees will often be moving from a relatively autonomous position with modernized infrastructure at the AI fintech company to a much more structured environment, often with restrictive and outdated legacy infrastructure, at the buyer. Considering the importance of key employees, such as lead software engineers, to the AI fintech company, the buyer should ensure it is offering attractive compensation packages to encourage these employees to remain following the closing.

The buyer may seek to impose covenants in an M&A transaction that obligate the AI fintech company to address certain issues prior to closing, such as requiring the AI fintech company to bring its operations into compliance with data protection laws (including implementing any necessary changes to its IT systems), engaging a consultant to undertake a review of open source code, making changes to its marketing materials, obtaining any additional state or third-party licenses to operate the business, or renegotiating or terminating certain problematic contracts. For example, the buyer may seek to engage a consultant to undertake an information security due diligence assessment between signing and closing of the transaction. The seller may require the consultant to agree to access and use protections directly with the seller even though the assessment will be performed for the buyer. Similar concerns as discussed above in connection with a “clean team” confidentiality agreement will arise. If deficiencies are discovered during the assessment, the buyer may seek a remediation plan with specific remediation steps required prior to closing. If only a portion of the seller’s business is being sold and some employees (such as founders or programmers) are being left behind, the buyer may seek strong non-compete protections so that the intellectual property and software it is buying cannot be replicated by the seller after closing.

Depending on the M&A buyer’s leverage, it should also consider including closing conditions related to technology matters to avoid being forced to close the acquisition and make these changes itself post-closing, which shifts the risks associated with any necessary shutdown to the buyer. If the seller is not selling its entire business, the buyer may require the seller to separate and stand up the technology of the purchased business prior to closing. The buyer may also seek to escrow the key software code it is purchasing, and any updates or enhancements to the code, in order to ensure that the source code remains intact exactly as reviewed during due diligence and with only those changes agreed by buyer and seller.

Public Listings

Depending on market conditions, the AI fintech company may eventually decide to go public through an initial public offering (“IPO”) instead of selling to an M&A buyer. The AI fintech company could also achieve public listing status through a direct listing (“DL”) or a transaction with a special purpose acquisition company (“SPAC”). Public listing, whether through an IPO, DL or SPAC transaction, is viewed by earlier stage investors in companies, including in the fintech space, as an attractive exit strategy when market conditions are good and allows the AI fintech company and its investors the benefit of a larger pool of money available in the public capital markets. An IPO can also be attractive because it does not require the founder or majority owner of the AI fintech company to give up complete control.

A public listing can help both with monetization of an investor’s equity interest as well as capital raising for the AI fintech company in connection with and after the listing event. One reason an AI fintech company may opt to go the public listing route instead of doing an M&A exit is because the public markets may offer a higher earnings multiple and enterprise value than an M&A buyer is willing to pay. The drawback of a public listing for existing stockholders is that it may take time to sell their shares in full, whereas existing stockholders can fully exit at the time of the consummation of the M&A transaction.

Before undertaking a public listing, an AI fintech company should ensure it has (i) a control structure in place and a leadership team with public company experience, (ii) the capabilities and organizational infrastructure to practice financial discipline and comply with public reporting requirements, (iii) processes and personnel to track compliance with the current and evolving regulatory landscape, and (iv) the capability to manage and mitigate operational, financial and regulatory risks. These four items will be scrutinized by potential investors in a newly public AI fintech company and by underwriters during the process of preparing for the IPO, including through due diligence. These factors may be particularly important for AI fintech companies due to the nature of fintech businesses. Fintech companies tend to be more highly regulated than companies in other industries due to their handling of money and data.

Because of their role in advising on and facilitating financial transactions and creating related products, AI fintech companies may have more complicated governance, disclosure and internal controls. Investors, regulators and auditors will expect AI fintech companies to have appropriate management and systems in place to monitor operational effectiveness, allow for reliable and timely financial reporting and other public disclosure, and provide for consistent regulatory compliance. In order to facilitate this, an AI fintech company will need to have documented procedures related to corporate governance, disclosure controls and internal control over financial reports that clearly outline roles and responsibilities for company leadership and employees.

The AI fintech company should ensure that it has leaders at the board of directors and officer level with public company experience, particularly in the financial services sector, who will have the familiarity and experience to guide the newly public company on business strategy and regulatory compliance. The company will also need a finance team in place that can achieve and maintain the profitability and timely disclosures expected of a public company. Ideally the AI fintech company’s compliance function will be sufficiently built out so as to allow it to identify, assess, test and monitor new regulations from US regulatory bodies such as the Federal Reserve, FDIC, OCC (or other applicable bank regulators), Consumer Financial Protection Bureau, applicable state regulators, and Securities and Exchange Commission (SEC) as they are proposed and adopted. Having these structures and personnel in place will provide comfort to potential investors and allow them to focus on the AI fintech company’s investment thesis and technology instead of on concerns over regulation and compliance.

Prior to a public listing, the AI fintech company, like other companies planning to go public, will need to establish a compelling investment thesis and demonstrate that it has foreseeable revenue growth and profitability and processes for making quarterly forecasts and reporting financial results. For a public listing with concurrent financing, the AI fintech company will select underwriters or placement agents that typically are banks with which the company has a pre-existing relationship. One gating item may be that the AI fintech company’s audits need to be conducted in accordance with Public Company Accounting Oversight Board standards.

Once the public listing process kicks off, the first major undertaking is due diligence. Due diligence will help the AI fintech company, the banks (if any) and their respective counsel prepare the registration statement that registers the offering and sale of securities for the IPO, DL or SPAC transaction. The due diligence process will also help identify any issues that the AI fintech company may need to address before it can become a public company. Common areas where issues sometimes arise include ownership structures, shareholder agreements and compensation arrangements. Ultimately, the AI fintech company’s auditors and officers will need to make certain assurances about the accuracy of financial information contained in the registration statement, and the process of verifying such information is completed through the due diligence process. Diligence will include providing documentation to verify data appearing in the registration statement as well as interviewing a company’s management and auditors and third parties such as customers and suppliers.

The key components to the registration statement, which will be informed by the diligence discussed above, include the (i) management’s discussion and analysis (MD&A), (ii) business overview, (iii) risk factors and (iv) description of offered securities. The MD&A will discuss the AI fintech company’s financial results and condition. The business overview will describe the AI fintech company’s business in detail, including information about the company’s key products and services, competitive strengths, properties and human capital. In the risk factors section, the AI fintech company will describe the risks and challenges that may impact its financial condition and operations, including operational risks, regulatory and compliance risks, industry risks and risks related to the transition from a private to public company. For most IPOs and DLs, companies have the option to confidentially submit the registration statement to the SEC to obtain feedback prior to the registration statement being made publicly available.

Once diligence is complete and the registration statement is cleared by the SEC, the last step for a public listing depends on whether the mechanism is an IPO, a DL or a SPAC transaction.

In an IPO, the underwriters will market the offering in a process called a road show. This process will involve meetings between management, usually a company’s CEO and CFO, and potential institutional investors. The company also makes a recorded version of the road show publicly available for potential retail investors. The road show typically takes about two weeks. Through this process, the underwriters track indications of interest from potential investors to help gauge the demand for the stock being sold in the offering. The underwriters will then make a pricing recommendation (comprised of how many shares can be sold and at what price) to the AI fintech company. If the board of directors approves the pricing recommendation, the underwriters will purchase all offered shares at a discount from the company and immediately resell the shares to investors at the agreed upon price to the public. Unless the IPO includes a secondary component, existing investors continue to hold “restricted securities” and usually agree to a lock-up period of 180 days. Once the lock-up expires, existing investors usually may sell shares into the market pursuant to the exemption from registration contained in Rule 144.

In a DL, the AI fintech company’s stock is listed on a stock exchange without the participation of underwriters or placement agents because there is typically no concurrent financing. A DL may be desirable for a company that does not require additional capital but that wants to provide liquidity to a large investor base. Therefore, the registration statement for the DL is a resale registration statement for existing investors. In some circumstances, the AI fintech company will hold an “investor day” prior to the DL that is similar to a roadshow in order to provide potential public investors with information about the company that is consistent with the registration statement, including financial guidance. Once the SEC declares the resale registration statement effective and the stock exchange approves the listing, existing investors may sell stock directly into the market.

In a SPAC transaction, the AI fintech company merges with a SPAC that has already completed an IPO and is an SEC reporting company. The AI fintech company and the SPAC will enter into a business combination transaction that is publicly announced and after that file a registration statement to register the offer and sale of the SPAC’s securities in exchange for the AI fintech company’s securities.3 If the AI fintech company needs to raise capital, including to cover potential redemptions of SPAC shares, the companies may engage a bank to act as placement agent for a private investment in public equity (PIPE) transaction. The PIPE shares will typically be registered for resale shortly after the SPAC transaction is completed. Once the registration statement for the business combination transaction is finalized, the stockholders of both companies will need to approve the transaction. Then the companies will consummate the merger and the AI fintech company’s stockholders will receive freely tradable shares, subject to any agreed lock-up period.

In each case (IPO, DL or SPAC transaction), the AI fintech company’s stock will commence trading, and the company will begin its next chapter as a public company.

Conclusion

As shown in our discussion above, transactions involving investments in AI fintech companies include a wide spectrum of possible structures, with legal and business issues that vary based on the transaction type. Financial institution investors should first define their AI goals and strategy and then attempt to align their investment tactics with their AI strategy. As these AI strategies evolve, so will the transactions for investing in AI.

*The authors, partners at Mayer Brown LLP, gratefully acknowledge the assistance of fellow partner Lawrence R. Hamilton and associates Olivia Altmayer and Thomas Wu in preparing this article.

1 CB Insights, State of AI – Global Q2 2022, pages 8 and 17

2 Note that a potential alternative path for a bank holding company that has elected “financial holding company” status to invest in AI fintech companies is under the merchant banking authority in section 4(k)(4)(H) of the Bank Holding Company Act. This article will not attempt to address merchant banking authority, in part because its requirements (including with respect to the “routine management or operation” of a merchant banking portfolio company) are relatively restrictive.

3 In some cases, the SPAC transaction will be accomplished by issuing restricted securities to the AI fintech company’s stockholders in exchange for the AI fintech company’s securities. The SPAC will only file a proxy statement to solicit SPAC stockholder approval of the transaction and will not file a registration statement. The AI fintech company’s stockholders will either need registration rights or will rely on the exemption from registration contained in Rule 144 to sell the shares into the market.