China's Anti-Monopoly Enforcement Authorities ("AMEAs") look set to ramp up their enforcement activities in relation to the Anti-Monopoly Law ("AML") following the publication of significant AML-related guidance and procedural documents.

In particular, the Ministry of Commerce ("MOFCOM") has recently published finalised Guidelines and Opinions relating to the AML's merger filing regime, while it is understood the State Administration of Industry and Commerce ("SAIC") and the National Development and Reform Committee ("NDRC") have circulated drafts of several documents that will eventually clarify key substantive and procedural aspects relating to the AML's prohibition of monopoly agreements and the abuse of a dominant market position.

MOFCOM's new Guidelines and Opinions

Three significant new documents relating to the AML merger filing regime have been published by MOFCOM in recent days. Those documents are:

- the Directive Opinions for Notification of Concentration of Undertakings ("Procedural Opinion"), which sets out certain procedural requirements that apply to businesses proposing to engage in notifiable concentrations;

- the Directive Opinions on Documents and Information Submitted for Notification of Concentration of Undertakings ("Content Opinion"), which specifies the documents and information that are required to be included in merger filings; and

- the Guidelines for Anti-Monopoly Review of Concentrations of Undertakings ("Guidelines"), which touches on the required content of filings and related matters.

The publication of these new documents will be widely welcomed, as they provide significant clarifications and guidance in relation to MOFCOM's new merger filing procedures and the obligations that apply to filing parties. However, certain aspects of the documents also raise considerable concerns. In particular, the Content Opinion appears to impose significant new burdens on filing parties, as explained further below.

Key matters clarified by the new MOFCOM documents

Some of the key matters clarified by the new MOFCOM documents are set out below:

1. The documents clarify which parties bear the obligation to submit a filing

The Procedural Opinion provides that:

(a) in relation to a merger required to be notified to MOFCOM, all parties involved in the merger must jointly submit the filing; and

(b) in other cases, where the concentration is in the form of an acquisition of shares, assets or controlling rights in respect of a target's operations etc, the filing must be submitted by the acquiring party (or parties). However, the other parties involved in the concentration are required to render assistance to the acquirer(s) in relation to the filing.

Unfortunately, the new MOFCOM documents do not clarify whether there is a deadline by which filings must be submitted to MOFCOM. Under the pre-AML merger control regime, MOFCOM specified that certain filings should be made either before public announcement of a relevant acquisition plan, or contemporaneous with any pre-merger filing with the competent authority of the target party's home country.

2. The documents clarify certain procedural steps relating to pre-filing consultations

The Procedural Opinion specifies that parties must follow certain procedural steps if they wish to engage in pre-filing consultation with MOFCOM, which include providing MOFCOM with "necessary documents and information" relating to the consultation.

Accordingly, it appears MOFCOM will continue to demand that parties provide written background information about a relevant transaction, and any specific queries they have regarding filing issues before they will participate in a formal consultation. MOFCOM commonly insisted on this process under the pre-AML merger filing regime.

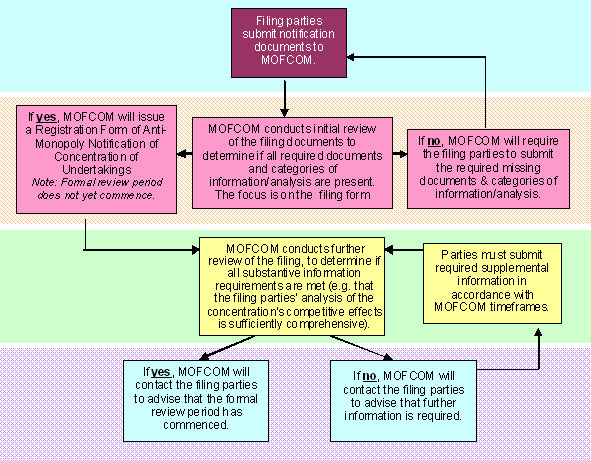

3. The documents clarify MOFCOM's procedures relating to initial receipt and acceptance of filings

According to the information contained in the Procedural Opinion and in the Guidelines, and current filing practice, it appears that MOFCOM's procedures in relation to newly submitted filing documents can be explained as follows:

The Procedural Opinion also notes that MOFCOM has the right to refuse any filings or to cancel its acceptance of a previously submittedfiling if it determines that it contains false or incomplete information.

4. The documents clarify specific technical requirements in relation to the form and nature of the filings

The new MOFCOM documents note that filings must be submitted in the Chinese language, as was the case under the pre-AML merger filing regime. Where original foreign language documents are required to be submitted (such as Certificates of Incorporation), they must be accompanied by Chinese translations.

Both confidential and non-confidential versions of filings must be provided, with any commercial secrets contained in such documents and information clearly highlighted. MOFCOM is under a duty to keep confidential commercial secrets obtained during its review and any related consultation processes.

Filings are also required to be in appropriately formatted paper and electronic forms (i.e. in compact disks).

5. The documents and information that must be submitted in filings

Each of the Procedural Opinion, Content Opinion and Guidelines list documents and information that must be submitted to MOFCOM in concentration filings, however the Content Opinion contains the most detailed specifications.

Mostly, these specifications mirror the requirements outlined in previous filing guidelines issued by MOFCOM in the context of the pre-AML merger control regime. For example, filings must include application documents with detailed information about the parties involved in the concentration andtheir affiliates, as well as significant explanation of both the method and purpose of the concentration, and its effect on competition in relevant markets. Further, the filing must be accompanied by copies of a range of documents such as incorporation certificates of the filing party, business licences and approval certificates of affiliates incorporated or registered in China, and the concentration agreement and various financial reports.

However, the Content Opinion sets out a new and expansive list of factors that filings shouldaddress when explaining the impact the concentration may have oncompetition. Additionally, it may impose some significant new forms of information requirements.

For example, Article 13of the Content Opinion seems to require that filings include certain internal documents of the parties to the concentration, such as internally produced or commissioned analysis, feasibility, forecasting and due-diligence reports that "facilitate the assessment of the concentration".

It is not clear whether the Content Opinion requires filing parties to produce to MOFCOM any and all information that could be deemed to fit within this description of documents, in which case the effect of Article 13 may be similar to the "Item 4(c)" requirement which applies to certain U.S. filings. If this is the case, the information-production burden imposed on filingparties could be very significant, particularly as it may not be constrained by the application of principles like legal professional privilege.

Alternatively, it may be that Article 13 is meant to merely describe a category of information that the filing parties can incorporate in filings - for the purpose of fulfilling their obligation to provide a detailed explanation of the effect of the concentration on competition in the relevant market. This would clearly be the more desirable interpretation for filing parties.

Further, Article 14 maybe read as requiring that the filing explain how the parties will be impacted if MOFCOM prohibits the concentration, while Article 16 may be read as necessitating the inclusion in the filing of the views of relevant "concerned" third parties. Again, it may be that MOFCOM is merely specifying these items as categories of information that may be includedin filings, however the wording of the Content Opinion does not appear to make them 'optional'.

Obtaining clarification from MOFCOM on these issues will be a pressing requirement going forward.

Further matters

MOFCOM has also circulated several further draft documents to key stakeholders for comment, including Interim Measures for Collecting Evidence on Suspected Monopolistic Concentration of Undertakings below the Thresholds, Interim Measures for Investigating and Disposing of Suspected Concentration of Undertakings Failing to File Notification in Accordance with the Law, Interim Measures for Notification of Concentration of Undertakings and Interim Measures for Review of Concentration of Undertakings.

It is expected that these documents will clarify some significant unresolved issues relating to the AML's merger control regime, such as how the turnover of parties to a concentration is required to be calculated in the context of the new turnover threshold tests that are applied to determine when relevant concentrations must be filed.

The NDRC has circulated for comment relevant documents that will explain how the AML's several pricing-related prohibitions may be applied, and finalised versions of these and other rules and guidelines are expected to be published in the near future by theAMEAs.

The publication of the finalised Procedural Opinion, Content Opinion and Guidelines will be regarded as welcome developments by those parties who have been grappling with a number of uncertainties relating to the new AML merger control regime since it commenced on 1 August2008. However, many uncertainties remain - both in relation to merger control issues and the other key prohibitions in the AML. It is hoped that relevant further clarifying documents will be published shortly.

In the meantime, it can be expected that MOFCOM, the SAIC and NDRC will be preparing to significantly ramp up their investigation and implementation activities in relation to the AML. The law's "soft launch" phase appears to be ending, and more substantive enforcement is likely moving forward.

For further information, please contact:

Hannah Ha (hannah.ha@mayerbrown.com)

Gerry O'Brien(gerry.obrien@mayerbrown.com)