Amendments to the Securities Market Law and the Mutual Funds Law

On November 15, 2023, the plenary session of the Mexican Chamber of Deputies approved an initiative previously approved by the Senate(the "Reform") to amend, repeal and add various provisions of the Mexican Securities Market Law (the "Securities Law") and the Mutual Funds Law (the "MFL"), with the main purpose of providing greater depth, as well as increasing the competitiveness and dynamism of the Mexican securities market for both issuers and investors.

The Reform proposes, among other things: (i) the introduction of a simplified regime for the registration of securities in the National Securities Registry (Registro Nacional de Valores, the "RNV") with the primary objective of providing access to the securities market to small and medium-sized companies and, thus, expanding their capitalization capacities and sources of financing; (ii) the legal strengthening of the recognition of the principle of autonomy of will (autonomía de la voluntad) of the shareholders, in general, and the implementation of corporate decisions, in particular, through amendments related to the issuance, transfer and scope of share certificates, as well as the elimination of certain restrictions and, notably, current minority rights; (iii) new rules and requirements for obtaining the registration of investment advisors and the expansion of the Securities Law’s regulatory regime; and (iv) the expansion of collective investment mechanisms through the introduction of a new legal type of investment fund, better known in the US market as hedge funds (the "Hedge Funds").

The Reform will come into effect the calendar day following its publication in the Official Gazette (Diario Oficial de la Federación). The Nation Banking and Securities Commission (Comisión Nacional Bancaria y de Valores) and the Central Bank (Banco de México) must issue general provisions on the matter within 365 calendar days.

Amendments to the Securities Law

I. Simplified Regime for Registration of Securities in the NSR

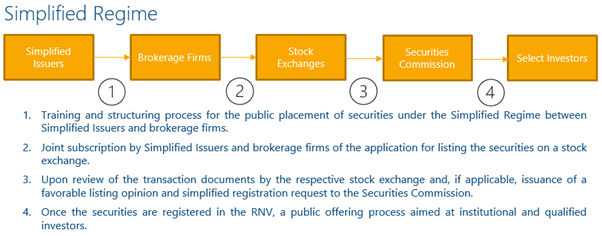

A simplified securities registration regime (the "Simplified Regime") is introduced to streamline the securities registration procedure in the RNV, and thus allow small and medium-sized companies to have easier and more efficient access, both operationally and in terms of costs, to the stock market and alternative sources of financing.

Here, the Reform, through a novel regulatory scheme, will relieve the National Securities Commission (Comisión Nacional Bancaria y de Valores, the “Securities Commission”) of its supervisory functions over issuers that access the stock market using the Simplified Regime (the "Simplified Issuers") through a co-responsibility of the different participants of the securities market (e.g., brokerage firms and stock exchanges) involved in the registration processes under the Simplified Regime. Under the Reform, the process of public placement of securities under the Simplified Regime would consist of the following fundamental steps: (i) structuring the corresponding transaction jointly between the Simplified Issuers and the brokerage firms that are to act as placement intermediaries of the securities involved1; (ii) application for subsequent listing of the securities to be placed on an authorized exchange; and (iii) a review process by the corresponding exchange of the compliance of the transaction and of the respective Simplified Issuer with the listing criteria established by such exchange in its internal regulations and, if applicable, issuance of a favorable listing opinion by the respective exchange and application for registration in the RNV by that exchange to the Securities Commission.

It is important to mention that (i) companies that already participate in the securities market through the current registration regime cannot participate in the simplified registration of securities,2 which is to discourage corporate practices that are contrary to the interests of the investing public; (ii) securities subject to simplified registration may be offered and brokered exclusively to institutional or qualified investors3; (iii) the Securities Commission will not supervise Simplified Issuers, leaving such supervision functions to the brokerage firms and exchanges under their self-regulatory regime4; and (iv) the Simplified Regime will not be applicable to securities intended to be registered preemptively in the RNV.5

The amendments to the Securities Law due to the introduction of the Simplified Regime are diverse, since they not only regulate the process of public offering and simplified registration of securities, but also the cancellation processes, as well as various provisions related to the obligations of Simplified Issuers.

II. Amendments to the Securities Market Corporations Regime

The Reform also introduces important amendments to provisions related to the regime applicable to Stock Exchange Corporations (Sociedades Anónimas Bursátiles, "SAB") and Stock Investment Promotion Corporations (Sociedades Anónimas Promotoras de Inversión Bursátil, “SAPIB”).

With respect to the SAB, the Reform proposes to eliminate the prohibition on issuing shares representing their capital stock with differentiated rights, thus allowing the establishment of any rights or restrictions per series or class of shares other than common shares, without any additional requirements (e.g., not exceeding a certain percentage of the capital stock placed with the investing public), in order to guarantee the preservation of control and the continuity of the fundamental decisions of the business. Likewise, SABs are authorized to acquire shares representing their capital stock without any restriction whatsoever.6

On the other hand, with respect to the SAPIB, the Reform provides for the repeal of the obligation to (i) adopt the SAB modality within 10 years from its registration in the RNV or before such period if the stockholders' equity exceeds 250 million Investment Units (approximately 1,944 million pesos), and (ii) establish a program for the progressive adoption of the regime applicable to SABs, for purposes of listing their shares in the exchanges.

In addition, the Reform proposes to add Article 55 Bis in order to allow the shareholders' meeting of SABs and SAPIBs to delegate to the board of directors the power to increase the share capital and determine the terms of the subscription of shares, including the exclusion of the preemptive subscription right. Likewise, it is provided that, in the event that such issued shares are offered to institutional and qualified investors or shareholders with preemptive subscription rights, their placement will not require a placement prospectus or the prior update of registration in the RNV; however, the company carrying out the offering must disclose to the public the terms of the capital increase and the subscription of issued shares through the exchange where its securities are listed.

III. Clauses to Prevent Hostile Takeovers

As mentioned above, one of the objectives of the Reform is to strengthen the existing legal mechanisms in the exchange legislation to allow controlling shareholders of public companies to retain such control (e.g., allowing the issuance of shares with differentiated rights by series or classes). Another of the amendments aimed at achieving this objective is the increased number of people needed for a quorum for voting against resolutions adopted at the general shareholders' meeting, to incorporate in the bylaws of SABs clauses aimed at preventing the acquisition of shares that grant control of the SABs (better known as poison pills), by third parties or the shareholders themselves, from 5% to 20%.

In addition, the Reform proposes eliminating two sections of Article 48 of the LMV, allowing for (i) the exclusion of one or more shareholders (other than the one who intends to take control) from the economic benefits resulting from the adoption of the corresponding poison pill and (ii) an absolute ban on hostile takeovers or the establishment of criteria to be met by third parties attempting to acquire control of the respective company.

IV. Miscellaneous Modifications

The Reform includes amendments of a different nature from those mentioned above which, although they are not part of the fundamental objective of the Reform (e.g., the introduction of the Simplified Regime and the strengthening of legal mechanisms aimed at retaining control of the stock exchange companies by their respective control groups), are relevant since they are intended to eliminate existing legal requirements for different corporate processes that, in many cases, restrict the dynamism with which issuers can face different situations in the ordinary course of their business. The most relevant amendments are (i) elimination of the requirement to previously update the registration with the RNV in order to carry out capitalizations or capital calls (in the case of trusts issuing trust certificates subject to the capital call regime),7 (ii) exceptions to the obligation to carry out a mandatory tender offer for the purpose of requesting the cancellation of the registration of securities in the RNV,8 (iii) introduction of the legal obligation to issue secondary ESG (Environmental, Social & Governance) regulations,9 (iv) an increase in the Securities Commission’s list of powers with respect to the disclosure of relevant information to the investing public,10 (v) increased requirements to obtain registration as an investment advisor, and (vi) various operational and programmatic modifications for the correct implementation of the aforementioned amendments.

Amendments to the Mutual Funds Law

The main proposed change for the MFL consists of the phasing out of Limited Purpose Investment Funds (Fondos de Inversión de Objeto Limitado) and the creation of Hedge Funds. Hedge Funds will be able to operate with any investment asset that they indicate in their prospectus to potential investors, and their investment strategies may be subject to change according to market circumstances or the needs of the Hedge Fund. Some of the peculiarities of the Hedge Funds are as follows:

- The shares representing the share capital of Hedge Funds may only and exclusively be offered to qualified and institutional investors; therefore, they may not be offered to the general investing public.

- Hedge Funds are exempt from the obligation to establish maximum holding limits per shareholder.

- Hedge Funds can be formed and operated by investment advisors authorized under the terms of Articles 225 and 225 Bis of the Securities Law, in which case they are exempted from the obligation to have an investment fund operating company.

In addition to the creation of Hedge Funds, the Reform also proposes (i) that operators be obliged to annually evaluate the performance of contracted service providers and communicate the results to shareholders; (ii) to expand the reporting obligations to shareholders to include the requirement to inform them about the value of their shareholdings; (iii) empower Banco de México to establish maximum limits on the amounts of repurchase agreements, securities lending, loans and credits, securities issuance, derivative financial transactions and foreign currency transactions; and (iv) allow mutual fund operating companies to carry out, exceptionally, certain transactions for which the intermediation of a brokerage firm is typically required; (v) allow mutual fund operating companies to carry out, exceptionally, certain transactions for which the intermediation of a brokerage firm is typically required.

Finally, the Reform also provides for expanding the list of parties that may incur civil liability, which may (i) be sanctioned through an administrative infraction or (ii) be considered as officers or employees of a Hedge Fund to include mutual fund share distribution companies, entities that provide the service of distribution of Hedge Fund shares and investment advisors authorized under the terms of the Securities Law.

1 This implies an increase in the duties and responsibilities of the brokerage firms in the process of placement of securities through the Simplified Regime. Such functions and responsibilities, among others, include: (i) review and verification of compliance with the requirements necessary to participate in the Simplified Regime, (ii) review of the information included in the disclosure documents for dissemination to the investing public, and (iii) joint subscription with the Simplified Issuer of the application for listing in the corresponding exchange.

2 Either directly or indirectly, since the Reform establishes that trusts issuing trust certificates may not register them under the Simplified Regime in the event that a company that is an issuer (e.g., a company that is not a Simplified Issuer) has contributed all or part of the assets of the trust in question.

3 Presumably through restricted public offerings, although we do not yet have secondary regulations in this respect.

4 This includes, for example, the possibility of disseminating information related to securities subject to a simplified public offering without requiring prior authorization from the Securities Commission, provided that such information is consistent with and refers to the disclosure documents of the transaction (e.g., placement prospectus, information supplement, document with key investment information, etc.) and the dissemination is carried out through an exchange, in accordance with its internal regulations.

5 This means that the securities intended to be offered under any of the three modalities of the preventive registration in the RNV (i.e., generic modality, placement program and prior listing of shares).

6 The previous text of the Securities Law allowed SABs to acquire their own shares as long as the amount of such acquisitions never exceeded 25% of the total paid-in capital stock of the corresponding SAB.

7 In the case of capitalizations by SABs, the Reform establishes that such exemption applies only to share placements made to institutional or qualified investors or to shareholders with preemptive subscription rights. This amendment is especially relevant since it will allow capitalization processes and capital calls of CKDS, CERPIs, etc., to be carried out in an agile and efficient manner, avoiding that such processes are hindered by the process of updating the registration of securities prior to the actual placement of the securities in question.

8 The purpose of this is to avoid situations that frequently occur in which issuers that do not comply with one or more of the requirements to maintain their listing on the exchanges and due to various circumstances (e.g., pulverization of shareholdings, lack of resources, etc.) are unable to comply with such requirement, thus falling into a vicious circle that keeps them in permanent involuntary non-compliance with regulatory obligations.

9 The Reform introduces Article 9 Bis, which establishes the obligation of the Ministry of Finance (with the prior opinion of the Securities Commission and the Banco de México) to issue secondary regulations applicable to all participants in the securities market regarding sustainable development, as well as to strengthen gender equity.

10 The Reform provides for the inclusion of a new paragraph in Article 105 of the LMV that allows the Securities Commission or the respective exchange to require issuers to publish a relevant event when the information existing in the market, in the opinion of the Securities Commission or the exchange in question, is insufficient, imprecise or confusing, or to rectify, ratify, deny or expand on an event that has been disclosed by third parties to the public.