Before you is the Autumn edition of 2025. This edition features many tax changes resulting from governments, especially in Indonesia, Korea, the Philippines, and Vietnam, raising taxes in order to make ends meet, while India is looking to replace the old income tax law by a rewritten new law with more user-friendly language. Hong Kong is considering various tax reforms in order to attract more investment in commodity trading and investment funds (including family offices) and Hong Kong, Korea and Vietnam have issued legislation and guidance in respect of the Global Minimum Tax that took effect previously. On a positive note, the PRC has relaxed its rules for withholding tax exemption if a foreign company reinvests a Chinese company’s profits in China and it has relaxed its rules for input VAT credits if a Chinese company exports goods abroad.

We trust you will find something of interest in this bulletin and as always, please do not hesitate to contact your Mayer Brown lawyer if you have any questions.

Dividend reinvestment tax incentive

Courtesy Garrigues in Shanghai, the Ministry of Finance, the State Administration of Taxation (SAT) and the Ministry of Commerce have jointly released an announcement on the tax credit policy for direct investment by overseas investors using distributed profits (the "Tax Credit Policy") on June 27, 2025, in order to boost the economy, further encourage overseas investments, and promote continuing operations within China on a long-term basis. The Tax Credit Policy provides the overseas investors tax credit on distributed profits that are re-invested directly in China by satisfying certain conditions.

There are prevailing tax preferential policies introducing deferred withholding tax on distributed profits reinvested directly by overseas investors in China under:

-

Cai Shui (2018) No. 102, Circular on Expanding the Applicable Scope of the Policy of Temporarily Not Levying the Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investment (Circular 102), issued by The Ministry of Finance, the State Administration of Taxation (SAT), the National Development and Reform Committee and the Ministry of Commerce; and

-

SAT (2018) No.53, Announcement of the SAT on Issues Concerning Expanding the Applicable Scope of the Policy of Temporarily Not Levying Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investments (Announcement 53), issued by the SAT.

Circular 102 and Announcement 53 are collectively referred to as “Tax Deferral Policies”.

To illustrate the additional benefits offered by the Tax Credit Policy, we hereby make an example below for reference.

Example

A Chinese resident company, A, distributes dividends of CNY 10 million to its overseas investor B in July 2025.

B uses the dividends of CNY 10 million to reinvest in a Chinese resident company C in August 2025 and withdraws the investment in January 2031.

A distributes dividends of CNY 2 million to B every July from 2026 to 2030.

B, as a non-resident taxpayer in China, the applicable taxation in the given example includes the followings (assuming that treaty benefit is not applicable):

Tax deferral for dividend reinvestment = CNY 1 million (withholding EIT at 10%)

Tax credit obtained in 2025 from dividend reinvestment = CNY 1 million

Withholding EIT at 10% on dividends per year from 2026 to 2030 = CNY 0.2 million

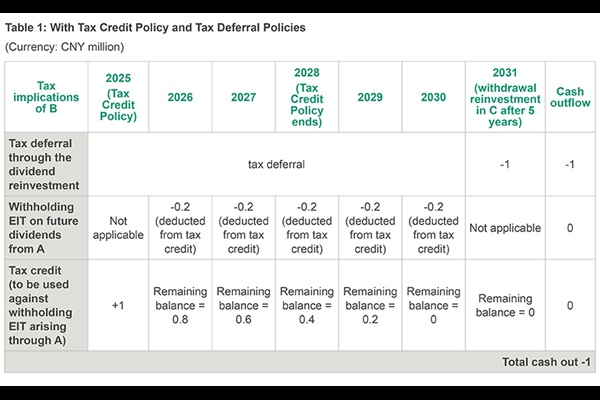

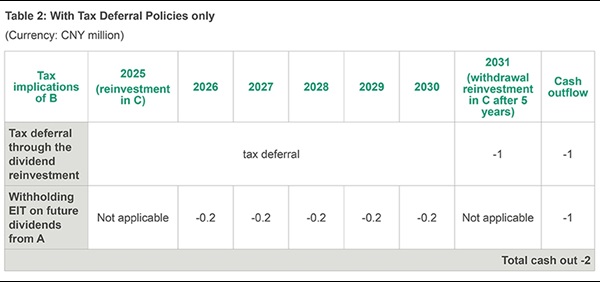

The following tables show the tax impact under different scenarios: (1) Table1: applying both Tax Credit Policy and Tax Deferral Policies; and (2) Table 2: applying Tax Deferral Policies only.

In Table 1, the deferred tax of CNY 1 million is paid when the reinvestment is withdrawn in 2031. However, the withholding EIT on future dividends distributed from A to B (i.e., CNY 0.2 million per year from 2026 to 2030) are not paid to the Chinese tax authority by exploiting the Tax Credit Policy. The total cashflow impact in Table 1 is CNY 1 million cash out.

In Table 2 there is CNY 2 million cash out in total, due to the absence of CNY 1 million tax credit to offset the withholding EIT arising from the dividend distribution for the period from 2026 to 2030.

The Tax Credit Policy offers an additional benefit on top of the Tax Deferral Policies to overseas investors for direct dividend reinvestment in China in terms of tax savings and improving the cash flow efficiency of the overseas investors. Overseas investors that have existing investment in China and intend to carry out a new investment in China from January 1, 2025 to December 31, 2028 may draw special attention to the Tax Deferral Policies and Tax Credit Policy.

Indirect tax policies for Hainan Free Trade Port

The Ministry of Finance, General Customs and State Taxation Administration has jointly issued a notice to stipulate the policies for goods entering and leaving the "first line" and "second line" of the Hainan Free Trade Port (HFTP).

The "First Line"

For the purposes of customs and indirect taxes, the entrance (import) of goods into or leaving the HFTP can be divided into the "first line" and the "second line". The "first line" is established between the HFTP and foreign countries or regions outside the customs territory of China. Goods entering the HFTP through the "first line" will be exempt from import duties, value added tax (VAT) at the import stage, and consumption tax, unless the goods concerned are listed in the catalogue of taxable goods or import of which is prohibited by the national laws and regulations. The exempted goods are called "zero-tariff" goods and will be recorded and administered in digital accounts separately from the normal customs procedure.

The taxpayers eligible for exemption include enterprises with legal personality, public institutions, and the approved private non-enterprise entities in science, technology and education registered in the HFTP. The eligible taxpayer can elect to opt out from the "zero-tariff" policy. Once the election is made, the decision cannot be revoked within 12 months. The list of eligible taxpayers will be determined by the provincial government of Hainan.

Yachts, vehicles and aviation are also exempted from import duty, VAT at the import stage, and consumption tax imported by the enterprises in transportation and tourism sectors for their own use within the HFTP if they are imported for their own use in their businesses within the HFTP.

The "Second Line"

The "second line" is established between the HFTP and other regions with the customs territory of China. The goods and processed products entering the mainland through this "second line" are subject to import duty, VAT at the import stage, and consumption tax in accordance with standard national custom declaration procedures. However, exemptions apply when such taxes have already been paid at the "first line" or during inter-transactions between eligible taxpayers within the HFTP. If VAT has been paid on the transfer of goods within the HFTP, no additional VAT will be levied at the "second line" at the time of the entrance into the mainland of China.

The processed products containing imported components the added value of which exceeds 30% are exempt from import duty when entering the mainland through the "second line" if they are produced by the enterprises engaged in the encouraged industries within the HFTP.

Transfer of Goods and Processed Products Within the HFTP

The transfer of goods and processed products between the taxpayers within the HFTP are exempted from import duties, VAT at the import stage, and consumption tax.

Goods Entering the HFTP From the Mainland or Leaving the HFTP to Go Abroad

Goods entering the HFTP from the mainland through the "second line" will be treated as domestic transactions and taxed accordingly, and goods leaving the HFTP to abroad through the "first line" will be considered as export.

The policies are announced in Announcement of the Ministry of Finance, General Customs and State Taxation Administration [2025] No. 12 and will apply from the date of the operation of the bonded zone, from 18 December 2025. Additionally, China also published a catalogue listing the taxable goods (not exempted goods) in a separate announcement via Announcement of the Ministry of Finance, General Customs and State Taxation Administration [2025] No. 13.

New tax-related information reporting regime for online platforms

In a landmark development for internet platforms, the Chinese government has recently introduced a new regime mandating internet platforms to regularly report tax-related information to Chinese tax authorities. This new regime, formulated by the Provisions on the Reporting of Tax-related Information by Internet Platform Enterprises promulgated by the State Council (State Council Decree No. 810, and the accompanying State Taxation Administration (STA) Announcement on the Matters Relevant with Reporting of Tax-related Information by Internet Platform Enterprises (STA Bulletin [2025] No. 15), will significantly impact online platforms that are engaged in online transactions, covering both China domestic and overseas platforms.

Amendments to the input VAT refund policy

China has released its latest updated VAT refund policy via Announcement of the Ministry of Finance and State Taxation Administration [2025] No. 7. Under the current VAT regime, the input VAT is generally offset against the output VAT with some exceptions. Effective from the VAT filing period for the month of September 2025 onwards, VAT taxpayers that satisfy the conditions may apply for a partial or full refund of the uncredited input VAT remaining at the end of the filing period.

Full Refund for Four Industries

Taxpayers engaged in manufacturing, scientific research and technology service, software and information technology, and ecological protection and environmental management may claim a full refund of uncredited input VAT on a monthly basis.

Partial Refund for Real Estate Developers

Taxpayers engaged in real estate development may claim a 60% refund of the newly increased uncredited input VAT accrued over 6 consecutive months preceding the end of the 6th month, provided the following conditions are met:

- the newly increased amount, in comparison with the amount at the end of 31 March 2019, is greater than zero; and

- the balance of the newly increased uncredited input VAT at the end of the 6th month exceeds CNY 500,000.

A taxpayer engaged in real estate development applies for the input VAT refund in the tax return of September 2025. The amounts of uncredited input VAT of the 6 preceding consecutive months are as per the table below.

|

Month |

Uncredited input VAT (CNY) |

|

April 2025 |

300,000 |

|

May 2025 |

400,000 |

|

June 2025 |

500,000 |

|

July 2025 |

250,000 |

|

August 2025 |

500,000 |

|

September 2025 |

800,000 |

The balance of the uncredited input VAT of the filing period in March 2019 (the reference period) amounts to CNY 200,000. In this example, all the monthly balance is greater than zero and the balance of the newly increased amount at the 6th month (i.e., September 2025) is CNY 800,000 and exceeds CNY 500,000. The real estate developer qualifies for the partial VAT refund under the policy.

Partial Refund for Other Enterprises

Taxpayers other than those specifically mentioned above may claim the partial 60% refund and may be eligible for a partial refund, subject to conditions. If the monthly balance of the uncredited input VAT over the six preceding consecutive months is greater than zero, and the newly increased balance at the end of the sixth month period exceeds CNY 500,000, the taxpayer may claim a refund. If the increased amount is up to CNY 100,000 million, 60% of the newly increased amount may be refunded, and 30% may be refunded for the portion exceeding CNY 100,000 million.

Tax plans to promote investments

On 15 September 2025, Hong Kong SAR's Chief Executive delivered the 2025 Policy Address serving as a roadmap for Hong Kong to strive for a vibrant economy, pursue development and improve the livelihood of the population. The government outlined a series of tax reforms aimed at boosting strategic industries, enhancing cross-border investment and strengthening digital economy oversight.

Strategic Enterprise Incentives

The government will offer customized tax packages to attract high-value-added enterprises in sectors such as advanced manufacturing, new energy, life and health technology, and artificial intelligence. A new mechanism will allow the Chief Executive and Financial Secretary to introduce targeted tax incentives that comply with international standards.

Asset and Wealth Management Enhancements

To strengthen Hong Kong's role in global asset management, the government will enhance tax incentives for funds, single family offices and carried interest. Currently, Hong Kong has lost terrain to Singapore in this sector. Expectations are that the new proposals will seek to include more asset classes and types of income (other than just gains on the sale of equity securities) within the scope of tax-exempt income for qualifying private equity funds.

The Capital Investment Entrant Scheme (CIES) will also be enhanced. The CIES grants investors residency rights through investment in specified assets, and applicants of this scheme are currently required to invest at least HKD 30 million in Hong Kong, which includes a maximum amount of investment in real estate (both residential and non-residential) of HKD 10 million. The maximum amount of investment will be increased from HKD 10 million to HKD 15 million for the purchase of non-residential properties with no transaction price threshold. For the purchase of residential properties, the investment to be counted will continue to be capped at HKD 10 million, but the transaction price threshold will be lowered from HKD 50 million to HKD 30 million.

Commodity Trading Tax Concessions

A 50% profits tax concession will be granted to commodity traders establishing businesses in Hong Kong to drive demand for shipping and professional maritime services. Legislative amendments to implement this measure are expected in the first half of 2026.

Digital Economy and Tax Transparency

The government will enhance international tax cooperation to address cross-border tax evasion in digital asset markets. The Securities and Futures Commission will introduce automated reporting and data surveillance tools to mitigate tax risks associated with digital assets in Hong Kong.

Green Finance and Carbon Trading

Hong Kong will deepen its collaboration with the Greater Bay Area on carbon market development, including cross-border trade settlement, voluntary carbon credit standards and methods, as well as the registration, trading and settlement of carbon emissions reduction.

Fertility Tax Incentive

The government proposes to extend the claim period of additional child allowance for newborns from 1 year to 2 years. Starting from the 2026/27 assessment year, a taxpayer may claim HKD 260,000 (i.e., the current allowance HKD 130,000 for two years) for each child in the first 2 years following childbirth.

The above measures will only be implemented after completion of the relevant legislative processes.

Tax treaty with Jordan

On 4 September 2025, Hong Kong signed a double tax treaty with Jordan. Based on the tax treaty, the withholding tax on dividends, interest and royalties will be reduced in Jordan from 10% to 5%. Presently, Hong Kong only levies a withholding tax on royalty payments. The treaty will take effect after it has been ratified by both jurisdictions.

Global Minimum Tax – Pillar 2

On 6 June 2025, Hong Kong enacted legislation to implement the Pillar Two rules with both the Income Inclusion Rule (IIR) and Hong Kong Minimum Top-Up Tax (HKMTT) effective for fiscal years beginning on or after 1 January 2025 and the Undertaxed Profits Rule (UTPR) to be implemented at a later stage. Hong Kong’s Pillar 2 rules are consistent with the OECD’s Pillar 2 rules.

New income tax law: 'business connection', associated enterprises

The Income-Tax (No.2) Bill, 2025 (the "Bill"), passed by the lower house of Parliament (Lok Sabha) on 11 August 2025, introduces amendments to the terms "business connection" and "associated enterprise", and expands the tax authorities' powers to inspect virtual digital spaces during search and seizure proceedings. The existing principles of taxation are preserved in the Bill without any major changes to the Income Tax Act, 1961 (the "existing Act"). However, certain provisions of the existing Act are re-drafted for greater clarity or to reflect the intent of the government.

Business Connection

Currently, the income of a non-resident taxpayer from a business connection in India is taxable in India. However, the existing Act does not explicitly define the term "business connection". The Bill seeks to define this term to include (i) any business operations that are wholly or partly carried on in India; or (ii) a significant economic presence in India. It is expected that this should be limited under an applicable tax treaty given that the definition of permanent establishment under India’s tax treaties has a higher threshold as it generally requires a fixed presence with a degree of permanence.

Associated Enterprises

Entities are considered associated enterprises (AEs) for transfer pricing purposes if they meet certain conditions. The existing Act provides that these conditions must be met "at any time during the year". However, the Bill proposes to retain this phrase only for two categories where AEs are constituted directly or indirectly by virtue of shareholdings carrying at least 26% voting power.

Tax Administration

The Bill seeks to rationalize various administrative provisions under the existing Act. Some of the key provisions include:

- exemption from tax audit requirements for non-residents subject to presumptive taxation, as established by the Finance Act 2025. This applies to non-residents who provide services or technology for electronics manufacturing facilities in India, taxed at 25% of the revenue from such operations; and

- empowering the tax authorities to inspect virtual digital spaces during search and seizure operations. The term "virtual digital space" is widely defined and includes email servers, social media accounts, online investment and trading accounts, banking accounts, any website used for storing details of ownership of any asset, remote server or cloud servers, digital application platforms, etc.

The Bill is expected to come into force from 1 April 2026 and will replace the existing income tax law.

Fixed Place PE in India

The Apex Court of India (SC), in the case of Hyatt International Southwest Asia Ltd. V. ADIT, upheld the High Court (HC) ruling that the taxpayer had a fixed place permanent establishment (PE) in India under art. 5 India-U.A.E. Income and Capital Tax Treaty, and the income was attributable to such PE was taxable in India. Further, the SC emphasized the principle of "substance over form" in evaluating the presence of personnel as a key factor in determining the existence of a fixed place PE.

The taxpayer, a tax resident of the UAE, entered into strategic oversight services agreements (SOSAs) with Asian Hotels Limited, India, to provide strategic planning services and "know-how" to develop a hotel and operate it as an international full-service hotel. The taxpayer filed a "nil" tax return for the relevant tax years, considering that:

- the payments received under the SOSA were not taxable under the Income Tax Act, 1961 as there was no specific article under the Treaty for taxing fees for technical services (FTS); and

- the taxpayer did not have a PE in India under article 5 of the treaty; hence, business income was not taxable in India under article 7 of the Treaty.

The division bench of the HC held that the amount received by the taxpayer was in the nature of business income. The full bench of the Delhi High Court held that said income is attributable to a PE regardless of the profits or losses made by the global entity. Subsequently, the taxpayer appealed before the SC.

The SC examined whether the taxpayer had a PE in India under article 5(1) of the treaty, and consequently, whether its income derived under the SOSA is taxable in India.

The SC upheld the earlier decisions of the HC that the taxpayer had a PE in India with observations set out below.

On Strategic Oversight Services Agreement (SOSA)

As per the SOSA, the taxpayer's role was not confined to mere policy formulation. The agreement vested the taxpayer with powers to:

- appoint and supervise the General Manager and other key personnel;

- implement human resource and procurement policies;

- control pricing, branding, and marketing strategies;

- manage operational bank accounts; and

- assign personnel to the hotel without requiring the owner's consent.

On the Constitution of Fixed Place PE

For constitution of a fixed place PE, the place through which the business is carried on must be 'at the disposal' of the taxpayer (disposal test). In this case, the 20-year duration of the SOSA, coupled with the taxpayer's continuous and functional presence, satisfied the tests of stability, productivity and dependence.

Further, the SC rejected the following arguments of the taxpayer for the non-constitution of a PE:

- the absence of an exclusive or designated physical space within the hotel;

- the absence of a specific clause in the SOSA permitting the conduct of business from the hotel premises; and

- the fact that daily operations were handled by a separate legal entity in India.

Role of Personnel in the Constitution of a Fixed Place PE

The functions performed by the taxpayer, through its staff operating from the hotel premises, were not just limited for setting up a pattern of activities for the hotel. The activities were core and essential functions, clearly establishing their control over the day to-day operations of the hotel. Moreover, these activities were carried out continuously over a period of 20 years, under an agreement which includes revenue sharing.

The taxpayer's executives and employees made frequent and regular visits to India to oversee operations and implement the SOSA. The travel logs and job functions establish continuous and coordinated engagement, even though no single individual exceeded the 9-month stay threshold. Under article 5(2)(i), the relevant consideration is the continuity of business presence in aggregate – not the length of stay of each individual employee. Once it is found that there is continuity in the business operations, the intermittent presence or return of a particular employee becomes immaterial and insignificant in determining the existence of a PE.

Judicial Precedents

The SC referred to the decisions of Formula One World Championship Limited v. Commissioner of Income Tax, International Taxation-3, Delhi & Anr. (2017) 15 SCC 602 and Union of India & Anr. v. U.A.E Exchange Centre (2020) 9 SCC 329 on the determination of PE.

Final Observations

The taxpayer's ability to enforce compliance, oversee operations, and derive profit-linked fees from the hotel's earnings demonstrated a clear and continuous commercial nexus and control with the hotel's core functions. Accordingly, the SC held that the extent of control, strategic decision-making, and influence exercised by the taxpayer clearly establish that business was carried on through the hotel premises, satisfying the conditions under article 5(1) of the treaty.

Turnover tax reform

The Goods and Services Tax (GST) Council, at its 56th meeting on 3 September 2025, approved a sweeping overhaul of the GST rate structure. Effective from 22 September 2025, the reform introduces a simplified 2-tier rate system of 18% and 5%, while imposing a 40% rate on items such as aerated and caffeinated beverages, aircraft and yachts, tobacco products, and gambling services. The GST rates for various essential goods is reduced from 28%/18%/12% to 5% to improve affordability and support small businesses. The Council has also recommended streamlining compliance through simplified registration schemes. These recommendations will be implemented via circulars and notifications that amend the relevant laws. The key recommendations of the GST Council are set out below.

2-Tiered Rate Structure

The current 4-tiered tax rate will be restructured to a 2-tiered rate as follows:

- standard rate of 18%;

- merit rate of 5%; and

- de-merit rate of 40% for selected goods and services.

GST Levy at 40%

The Council recommends a GST levy of 40% on the following:

- aerated waters and other beverages containing added sugar or sweetening agents, other non-alcoholic beverages;

- carbonated fruit drinks or fruit juices;

- caffeinated beverages;

- specific tobacco products, including cigars, cheroots, and cigarettes;

- personal use vehicles, including motor cars (including hybrid vehicles) and other motorcycles, except for certain smaller and hybrid models taxed at 18%, aircraft and yachts, revolvers and pistols;

- leasing or rental services for goods subject to 40% GST;

- admission to casinos, race clubs, venues offering such facilities, or sporting events such as the Indian Premier League (IPL); and

- specified actionable claims including betting, casinos, gambling, horse racing, lottery, and online money gaming.

GST Exemptions

The Council recommends a GST exemption or a 0% rate for the following goods and services:

- individual life and health insurance policies, including reinsurance, to enhance affordability and expand the insurance coverage across the country;

- specific lifesaving drugs and medicines, including those used in the treatment of cancer, rare, and severe chronic diseases; and

- ultra-high temperature (UHT) milk, cottage cheese and Indian breads.

Reduction in GST Rates

The Council recommends a reduction in GST rates across a wide range of goods and services, as follows:

- reduction of the current GST rates of 18%/12% to 5% on:

- common-use items such as hair oil, soap, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles;

- food items such as packaged snacks, sauces, pasta, noodles, chocolates, coffee, preserved meat, cornflakes, and butter;

- agricultural machinery and tractors;

- labour intensive goods such as handicrafts, marble, travertine and granite blocks, and leather goods;

- various medical apparatus, devices and other non-exempted drugs and medicines;

- renewable energy devices and their components;

- manmade yarn and fibre;

- industrial chemicals such as sulphuric acid, nitric acid and ammonia;

- hotel accommodation services priced up to INR 7,500 per unit per day; and

- beauty and physical well-being services;

- reduction of GST from 28% to 18% on cement, home appliances, small cars and motorcycles, buses, trucks, and ambulances; and

- a uniform GST rate of 18% on all automobile parts.

Concessions for Small Businesses

The GST Council recommends the introduction of an optional and simplified registration scheme for small, low-risk businesses by enabling automated registration within 3 working days. This scheme will apply to taxpayers whose output tax liability on supplies to registered persons does not exceed INR 250,000 per month.

Further, the Council approved a simplified registration process for small suppliers operating on e-commerce platforms, easing the requirement to maintain a physical place of business in every state.

New income tax law

The Lower House of Parliament (Lok Sabha) passed The Income-Tax (No. 2) Bill, 2025 (the Bill) on 11 August 2025. The President of India gave assent to The Income-Tax (No. 2) Bill, 2025 on 21 August 2025. The Income-Tax Act, 2025 is now enacted and will be effective from 1 April 2026. Among other things, the Bill seeks to re-introduce the deduction for inter-corporate dividends for dividend-distributing companies, rationalize transfer pricing provisions and simplify the language and structure of the existing Act.

The previous Income Tax Bill, 2025, which was presented to Lok Sabha on 13 February 2025, has been withdrawn.

The existing principles of taxation are preserved in the Bill without any major tax policy changes or modifications to tax rates. Some of the significant aspects of the Bill are as follows:

- re-instatement of the benefit of claiming deduction for inter-corporate dividends (available to dividend-distributing companies that receive dividends from other companies);

- no levy of alternate minimum tax (AMT) on limited liability partnerships (LLPs);

- rationalization of transfer pricing provisions and the manner of determination of associated enterprises;

- clarification on the application of the 30% standard deduction while computing income from house property;

- alignment of the definitions of micro enterprises and small enterprises under the Bill with the said definitions under the Micro, Small and Medium Enterprises Development Act, 2006;

- adoption of "tax year" instead of "financial year" and "assessment year";

- enabling tax refunds on late filing of tax returns; and

- simplification of the language of the Bill and a reduction of the number of sections from 819 to 536.

The Bill is expected to be passed by the Upper House of Parliament (Rajya Sabha) shortly. Subsequently, it will be enacted by a notification in the Official Gazette.

International tax developments

Brazil. On 18 October 2025, the amending protocol, signed on 24 August 2022, to the India/Brazil tax treaty will enter into force. The protocol generally applies from 1 January 2026 in respect of Brazil and from 1 April 2026 in respect of India. Details of the protocol will be reported subsequently.

E-Commerce platforms must withhold income tax from domestic traders

On 14 July 2025, the Ministry of Finance issued a regulation requiring electronic trading platforms to withhold income tax (article 22 of the Income Tax Law) on behalf of domestic traders conducting business on such platforms.

Minister of Finance Regulation Number 37 Year 2025 (PMK 37/2025), which came into effect on 14 July 2025, appoints domestic and qualifying foreign e-commerce platforms as income tax collectors for transactions conducted through such platforms. This measure aims to enhance tax compliance in the rapidly growing digital economy and ensure fair taxation of income earned online by domestic sellers.

Under the new rules, platforms such as online marketplaces, ride-hailing apps, and other digital intermediaries, must withhold 0.5% of the gross turnover (excluding VAT and luxury goods tax) from domestic traders. The tax is due at the time of payment and must be reported and remitted monthly.

- The regulation applies to domestic traders (individuals or companies) using electronic platforms to sell goods or services. Foreign electronic platforms may be subject to the withholding requirement if they meet certain thresholds in transaction value or user traffic and use escrow accounts to collect payments.

- Online traders with an annual turnover not exceeding IDR 500 million (approximately USD 30,000), online traders with a valid tax exemption certificate, and specific transactions (e.g. sale of gold, real estate transfers, prepaid phone credit) are excluded from the withholding obligation.

- Domestic traders must provide their tax identification numbers or national identification numbers, declare their annual turnover status and submit a tax exemption certificate (where applicable) to the appointed tax collector i.e. the e-commerce platform. The domestic traders must notify the e-commerce platform when they exceed the IDR 500 million threshold, becoming subject to tax withholding from the following month.

- E-commerce platforms must issue billing documents that serve as proof of withholding, submit detailed transactions and taxpayer data to the Directorate General of Taxes, and file unified monthly tax returns.

- Non-compliance by e-commerce platforms or domestic traders may result in penalties under the relevant laws.

Tax Changes

Courtesy Yulchon it was reported that on July 31, 2025, the Korean Ministry of Economy and Finance released the 2025 Tax Law Amendment Proposal, which includes reversing tax cuts implemented under the Yoon Suk Yeol administration by increasing the corporate income tax rates and securities transaction tax rates, and introducing a qualified domestic minimum top-up tax (QDMTT) under the Korean Global Anti-Base Erosion (GloBE) rules. The proposed amendments are subject to approval by the National Assembly (Korean Parliament) and, if approved, will mostly become effective from January 1, 2026.

Corporate income tax rates. The 2025 Tax Law Amendment Proposal includes a 1% increase in corporate income tax rates across all brackets, effectively restoring them to the rates that applied in 2022. The maximum corporate income tax rate will be 25% with a surcharge of 10% resulting in a rate of 27.5% on annual taxable income of KRW 300 billion.

The securities transaction tax rates, which had been gradually reduced each year from 0.30% in 2019 to 0.15% in 2025 (including the special tax for rural development), will be restored to 0.20%, the rate in effect in 2023. This proposed amendment follows the repeal of the financial investment income tax, which was the basis for the earlier securities transaction tax rate reductions.

Pillar 2

Following the OECD’s Pillar Two model rules for domestic implementation of the 15% global minimum tax, Korea is introducing a domestic minimum top-up tax (DMTT). The DMTT applies first, at the level of source jurisdiction, in respect of any low-taxed profits arising in that jurisdiction; the income inclusion rule (IIR) and the under-taxed profits rule (UTPR) only apply in respect of any remaining low-taxed profits (after the DMTT).

Accordingly, if the effective tax rate of a Korean constituent entity of an MNE group falls below 15%, the low-taxed excess profits of that Korean constituent entity will be brought into tax in Korea under the DMTT, before those excess profits can be taxed in the jurisdiction of the ultimate parent entity under the IIR or in the jurisdictions of other constituent entities within the same MNE group under the UTPR. The OECD and Korean GloBE rules apply to MNE groups that have revenues equal to or in excess of the EUR 750 million in two of the past four years. The Korean DMTT applies to constituent entities located in Korea that are members of MNE groups subject to the Korean GloBE rules.

Unlike the IIR, the DMTT also 3 applies to Korean constituent entities of an MNE group whose ultimate parent entity is located in Korea (including the ultimate parent entity itself). To secure Korea’s taxing rights over certain special entities, an exceptional rule will also be introduced to treat stateless constituent entities (e.g., transparent entities established or registered in Korea) as if they were located in Korea, requiring them to separately calculate a DMTT liability. The newly introduced DMTT will be structured to meet the requirements of a QDMTT (qualified domestic minimum top-up tax) under the OECD’s Commentary to the Pillar Two GloBE rules. This means that a DMTT paid in Korea will be fully creditable when MNE groups determine their top-up tax liability under the GloBE rules in other jurisdictions. Korea already has a minimum tax regime (17% for large corporations) under the Act on Restriction of Special Taxation (often referred to as the Tax Preferential Control Act (TPCA)). Further, in 2019, corporate tax reductions and exemptions for foreign-invested companies were abolished. As a result, the Korean DMTT is expected to apply only to a limited number of companies; specifically, those not subject to the TPCA minimum tax but benefiting from significant tax incentives, such as the tax credit for relocation to non-metropolitan / regional areas. The Korean DMTT will apply to fiscal years beginning on or after January 1, 2026

Shareholder personal income tax

Under the PITA, if a controlling shareholder of a Korean company (as defined in PITA Enforcement Decree §167-8(1)) permanently relocates to a foreign country, the shareholder is deemed to have sold his or her shares on the date of departure and is taxed on the capital gain arising from such deemed disposal. The purpose of such “exit tax” is to prevent residents from avoiding capital gains tax on shares by changing their tax residency. Accordingly, exit tax only applies when a resident becomes a non-resident for tax purposes. In light of growing overseas investments by Korean residents, the 2025 Tax Law Amendment Proposal adds foreign shares to the scope of assets subject to exit tax. Notably, unlike Korean shares, exit tax on foreign shares will apply regardless of whether the shareholder is a controlling shareholder or not. This approach is consistent with the fact that, unlike Korean shares, foreign shares are subject to capital gains taxation in Korea regardless of whether the shareholder selling the shares is a controlling shareholder or not. The exit tax on foreign shares will apply to residents permanently leaving Korea on or after January 1, 2027. This amendment is likely to impact the timing of emigration for Korean residents with substantial foreign shareholdings.

Transfer pricing refunds

Under the Korean transfer pricing regime, transactions between related parties must be conducted at arm’s length. If a related party transaction is not conducted at arm’s length, the tax authority can adjust the taxable income and impose additional tax (LCITA §7), and the taxpayer can request a correction of the tax return and a tax refund (LCITA §6), based on the arm’s length price. Currently, the LCITA does not require a corresponding adjustment or additional tax payment in the counterparty jurisdiction as a precondition for tax refund applications. Taxpayers have argued that, in a self-assessment tax system, a request for correction of a tax return and a tax refund should be allowed if taxpayers can reasonably demonstrate that the transaction prices originally reported were incorrect. In practice, however, the tax authority has often treated a corresponding adjustment in the counterparty jurisdiction (or the repatriation of the adjusted income amount) as a de facto prerequisite for approving tax refund requests based on transfer pricing adjustments. The 2025 Tax Law Amendment Proposal formally introduces an additional documentation requirement for transfer pricing-related tax refund claims. Going forward, taxpayers seeking a tax refund based on a transfer pricing adjustment must submit documentation demonstrating that double taxation has arisen as a result of a corresponding adjustment in the counterparty jurisdiction. The additional documentation requirement will apply to tax refund claims filed on or after January 1, 2026.

Korean liaison offices of foreign companies

In 2022, an annual information reporting requirement was introduced for Korean liaison offices of foreign corporations (CITA § 94-2). Each year, a Korean liaison office is required to submit specified information regarding the liaison office itself, the foreign headquarters and its Korean subsidiaries, and details of the counterparties to its Korean transactions. However, since no enforcement measures were in place for failure to comply with this annual reporting obligation, many liaison offices have not so far submitted the required information to the Korean tax authority. The 2025 Tax Law Amendment Proposal introduces an administrative penalty up to KRW 10,000,000 for Korean liaison offices of foreign corporations that fail to the required information or submit false information (specific penalty amounts will be prescribed by Presidential Decree). The proposed penalty will apply from January 1, 2026.

Applying for tax treaty reduced withholding tax

Currently, non-resident taxpayers seeking to apply a reduced withholding tax rate under an applicable tax treaty between Korea and their country of residence) are required to provide an “Application for Reduced Treaty Rate on Korean-Sourced Income” and an “Overseas Investment Vehicle Report” (if applicable), together with specified attachment(s), to the relevant withholding agent (i.e., the income payor in Korea). Upon receipt of the application form(s) and attachment(s), the Korean withholding agent is only required to keep them on file for 5 years and does not have an obligation to submit them to the tax authority. Going forward, withholding agents will be required to annually submit to the tax authority the application forms (“Application for Reduced Treaty Rate on Korean-Sourced Income” and, if applicable, “Overseas Investment Vehicle Report”) and any attachments received from non-resident individuals and corporations seeking to apply reduced treaty rates. The submission deadline is the last day of February of the year following the year in which the non-resident taxpayer receives the relevant Korean-sourced income. The proposed amendment will apply to applications filed on or after January 1, 2026.

Internal restructuring of foreign subsidiaries

Under the 2025 Tax Law Amendment Proposal, where a Korean company (the “contributing company”) contributes shares of a foreign subsidiary (the “contributed asset”) to a foreign company (the “recipient company”), the capital gain arising from such in-kind contribution may be deferred for 4 years and be subsequently taxed over a 3-year period. In order to qualify for the proposed tax deferral, the following conditions must be satisfied:

- The “contributing company” must be a Korean company that has continuously been in business for at least 5 years.

- The “contributed asset” must be shares of a foreign subsidiary in which the contributing company holds an equity interest of 20% or more.

- The “recipient company” must be a foreign company that satisfies both of the following conditions: (a) at least 80% of its equity interest is held by the contributing company; and (b) it continues, until the end of the relevant fiscal year, to carry on the business conducted (before the in-kind contribution) by the foreign subsidiary whose shares it receives as the contributed asset.

If, after benefiting from the tax deferral, (i) the contributing company disposes of the shares of the recipient company, (ii) the recipient company disposes of the contributed shares, or (iii) the contributing company, the recipient company, or the foreign subsidiary (whose shares were contributed) discontinues its business or is liquidated, the contributing company must recognize the deferred capital gain as taxable income in the year in which such event occurs. The special tax deferral will apply to in-kind contributions made on or after January 1, 2026, and will be available until December 31, 2028.

AI tax credits

As of March 14, 2025, the TPCA was amended to include AI-related technologies in the scope of national strategic technologies eligible for tax credits. Accordingly, both “AI-related technologies designated as national strategic technologies” and “facilities for the commercialization of such designated AI-related technologies” were specifically added to the list of technologies and facility investments eligible for tax credits.

Tax audit penalties

Courtesy Lee & Ko it was reported that with effect from September 15, a new provision of the Framework Act on National Taxes (FANT) will authorize the Korean tax authorities (NTS) to impose an enforcement penalty on taxpayers who, without justifiable cause, do not provide requested information and documents during an audit (New Enforcement Penalty Provision).

The New Enforcement Penalty Provision differs from the existing fine provision for failure to submit materials in that it does not have an upper limit on the amount imposed, whereas the existing fine provision had a cap of KRW 50 million. In addition, while the existing fine could, according to court precedents, be imposed only once in the same tax audit, the newly introduced enforcement penalty may be imposed repeatedly every 30 days. Furthermore, the New Enforcement Penalty Provision also differs from the existing fine provision in that the enforcement penalty is imposed following deliberation by the newly established Enforcement Penalty Deliberation Committee, and any challenge must be made through administrative litigation.

The new enforcement penalty may be imposed only after deliberation by this committee. In addition, the head of the tax office may, taking into account the degree of effort made to submit the requested materials and the reasons for non-submission, reduce the amount of the enforcement penalty by up to one-half or grant an exemption, following deliberation by the Enforcement Penalty Deliberation Committee. The Enforcement Penalty Deliberation Committee will be established within the regional tax office, and the head of the regional tax office serves as its chairperson. The members will consist of (i) up to six officials of the regional tax office designated by the head of the regional tax office, and (ii) up to thirteen external experts appointed by the head of the regional tax office (hereinafter, External Members). For each meeting, the chairperson will designate six members (including at least four External Members) to convene the meeting of the Enforcement Penalty Deliberation Committee.

The New Enforcement Penalty Provision is expected to have its details supplemented and refined after it takes effect from September 15, 2025. In particular, the Presidential Decree to the FANT grants the Commissioner of the NTS the authority to prescribe, by public notice, matters necessary for the imposition and collection of the new enforcement penalty that are not otherwise specified in the Regulations. Taxpayers should keep a careful watch on forthcoming notices and monitor how the penalty will enforced in practice, as well as how appeals will be resolved. In addition, for taxpayers expecting a tax audit in the near future, it will be prudent to conduct a pre-tax audit review/health check not only to assess overall tax risks, but also to distinguish in advance between materials that can and cannot be submitted, and, where submission is possible, to consider the practical preparation time required in order to respond efficiently to the New Enforcement Penalty Provisions. In particular, for multinational enterprises, it is important to review in advance and establish response strategies regarding whether the new enforcement penalty may be imposed on documents that the Korean subsidiary is not required to maintain under the tax law, materials of foreign affiliates that are not possessed or managed, or materials whose collection and organization would require a significant amount of time.

The New Enforcement Penalty Provision is expected to have its details supplemented and refined after it takes effect from September 15, 2025. In particular, the Presidential Decree to the FANT grants the Commissioner of the NTS the authority to prescribe, by public notice, matters necessary for the imposition and collection of the new enforcement penalty that are not otherwise specified in the Regulations. Taxpayers should keep a careful watch on forthcoming notices and monitor how the penalty will enforced in practice, as well as how appeals will be resolved. In addition, for taxpayers expecting a tax audit in the near future, it will be prudent to conduct a pre-tax audit review/health check not only to assess overall tax risks, but also to distinguish in advance between materials that can and cannot be submitted, and, where submission is possible, to consider the practical preparation time required in order to respond efficiently to the New Enforcement Penalty Provisions. In particular, for multinational enterprises, it is important to review in advance and establish response strategies regarding whether the new enforcement penalty may be imposed on documents that the Korean subsidiary is not required to maintain under the tax law, materials of foreign affiliates that are not possessed or managed, or materials whose collection and organization would require a significant amount of time.

Payment of royalties under the US tax treaty

On September 18, 2025, the Korean Supreme Court issued an en banc decision in Case No. 2021 (the “En Banc Decision”), changing its long-standing position on the taxation of royalties for patents not registered in Korea (“foreign-registered patents”). In its prior decisions (for example, Supreme Court Decisions 91 dated May 12, 1992, 2005 dated September 7, 2007, 2012 dated November 27, 2014, 2013 dated December 11, 2014, 2016 dated December 27, 2018, 2018 dated February 10, 2022, 2019 dated February 10, 2022, and 2019 dated February 24, 2022), the Supreme Court consistently held that the “use” of a patent right for purposes of Articles 6(3) and 14(4) of the Korea-US tax treaty means “use within the country in which the patent right is effective”, and therefore, the use in Korea of a patent not registered in Korea cannot be recognized.

However, in the En Banc Decision, the Supreme Court overturned this legal principle, holding that for foreign-registered patents, the determination of whether a patent is used in Korea should be based not on whether the patent rights are exercised in Korea under the “territoriality principle”, but on whether the “patented technology” is actually used in Korea for activities such as manufacturing and sales. In many tax disputes involving patent royalties paid by Korean companies to US companies, the key question has been how to determine what portion of the royalties constitutes “Korean-source income” subject to taxation in Korea; in other words, how to calculate the portion attributable to the use of the patent in Korea (i.e., royalties arising from a source within Korea) versus the portion attributable to its use outside Korea. The Supreme Court’s En Banc Decision directly addresses and clarifies this question.

Stamp duty on employment contracts

The Inland Revenue Board (IRB) has recently issued frequently asked questions (FAQs) regarding stamp duty on employment contracts in Malaysia, following the announcement of an exemption available for employment contracts executed before 1 January 2025 due to a policy decision by the Ministry of Finance (MoF).

- an employment contract is an instrument of agreement that establishes the relationship between an employer and an employee. As such, the contracts must be stamped and are subject to duty under the First Schedule of the Stamp Act 1949 at MYR 10 per instrument;

- an employment contract with the following characteristics is liable to stamp duty:

- existence of parties identified as "employer" and "employee";

- periodic payment of remuneration or salary;

- specification of working hours and workplace;

- compliance with employer's policies and regulations;

- provision of benefits such as Employee Provident Fund contributions, Social Security payments, and annual leave;

- work performed under the instruction and supervision of the employer; and

- prohibition from working with third parties without permission;

- if the document is not stamped within the prescribed 30-day period, a penalty will be imposed based on the delay period as follows:

- MYR 50 or 10% of the deficient duty, whichever is higher, if the stamping is done within 3 months after the expiry of the 30-day period; or

- MYR 100 or 20% of the deficient duty, whichever is higher, if the stamping is done more than 3 months after the expiry of the 30-day period;

- in the case of a job offer letter (including for interns or trainees), if the offer letter is the only document binding the relationship between the employer and the employee, it will be subject to stamp duty;

- the first person to sign the document is liable to pay the stamp duty. Since the employer typically signs the offer letter first, the employer is responsible for the payment; and

- employment contracts exempted under the MoF's policy may be submitted to the IRB for adjudication and endorsement to obtain a certificate of stamp duty exemption.

Ruling on Group Relief for companies

The Inland Revenue Board (IRB) has recently issued an updated public ruling (PR) on group relief for companies. The updated PR reflects amendments to the group relief mechanism following changes to the Income Tax Act 1967. The key items provided under PR No. 2/2025 (Group Relief for Companies) are the following.

- Effective from the year of assessment (YA) 2019, a surrendering company that has just commenced operations may only surrender current year adjusted business losses for group relief purposes to the claimant company for up to 3 consecutive YAs (the time limit).

- The time limit is determined as follows:

- immediately following the basis period for a first YA the surrendering company commenced operations, provided that the basis period consists of a period of 12 months; or

- immediately following the second basis period the surrendering company first commences operations (i.e. the second basis period), if the basis period for the first YA the surrendering company commences operation is less or more than 12 months and the second basis period consists of a period of 12 months.

- In determining whether a surrendering company and a claimant company are related and eligible for the group relief mechanism, the following two-tier test applies:

- first-level test: shareholding test (all companies must be incorporated and resident in Malaysia), where (i) at least 70% of the shares of the surrendering / claimant company is directly or indirectly owned by the claimant / surrendering company; or (ii) at least 70% of the shares of the surrendering / claimant company is directly or indirectly owned by another company; and

- second-level test: residual profit and assets test, where the surrendering / claimant company must be beneficially entitled (directly or indirectly) to at least 70% of the residual profits and residual assets of the claimant / surrendering company as an equity holder.

- It is clarified that a Labuan company incorporated under the Labuan Companies Act 1990 (LCA) is considered incorporated in Malaysia. This includes a foreign Labuan company registered under the LCA.

- In determining the 70% ordinary shareholding threshold, any direct or indirect ordinary shareholdings by companies that are not incorporated and not resident in Malaysia are disregarded.

Transfer Pricing tax audits and penalties and surcharges

The Inland Revenue Board (IRB) has recently issued the latest Transfer Pricing (TP) Tax Audit Framework (the framework), which clarifies the application of penalty and surcharges for TP adjustments.

- The penalty of 15% to 45% on tax undercharged for TP adjustments is applicable to basis periods commencing before 1 January 2021 (previously, it was applicable to tax audit cases commencing prior to 1 January 2021).

- The 5% surcharge (or 0% - 4% in the case of voluntary disclosure) for transfer pricing adjustments under subsection 140A(3C) of the Income Tax Act 1967 (the Act) is applicable to basis periods commencing on or after 1 January 2021 (previously, it was applicable to tax audit cases commencing on or after 1 January 2021).

- The penalty under section 113B of the Act would be applicable for the failure to submit contemporaneous TP documentation (the previous framework only referred to submission of TP documentation).

The framework came into effect on 31 July 2025 and revoked the previous framework dated 24 December 2024.

Updated guidelines on capital gains tax on sale of unlisted shares

The Inland Revenue Board (IRB) has recently updated the guidelines for capital gains tax (CGT) on unlisted shares (the "updated guidelines") which clarified, among other things, that chapter 9 (Gains or profits from the disposal of capital assets) of the Income Tax Act 1967 (the Act) does not apply to gains or profits from the disposal of foreign capital assets received in Malaysia.

- the term "capital asset" is defined as:

- movable or immovable property situated outside Malaysia, including any rights or interests thereof; or

- movable property situated in Malaysia, being shares in a company incorporated in Malaysia not listed on the stock exchange (including any rights or interests thereof) that are held by a company, limited liability partnership, trust body or co-operative society;

- example 9 is inserted into the updated guidelines to illustrate the utilization of unabsorbed CGT losses;

- to align with recent updates to the Act, the term "another controlled company" is included in the updated guidelines, meaning a controlled company that owns real property situated in Malaysia (including any right or interests thereof) or shares in another controlled company, or owns both, with the defined value of the real property or shares, or both, not being less than 75% of the value of its total tangible assets;

- "subsequent acquisition" refers to the acquisition of real property or shares that result in the controlled company becoming a relevant company, provided that the defined value owned by that controlled company is not less than 75% of the value of its total tangible assets. A shareholding is deemed to be a relevant company shareholding starting from the date when the controlled company becomes a relevant company; and

- in determining the date and price of the acquisition of real property company (RPC) shares before 1 January 2024, it is clarified that:

- the acquisition date of RPC shares before 1 January 2024 is determined under subparagraph 34A(2), Schedule 2 of the Real Property Gains Tax Act 1976 (RPGTA); and

- the acquisition price of RPC shares before 1 January 2024 is determined under subparagraph 34A(3), Schedule 2 of the RPGTA.

The updated guidelines replace the previous guidelines issued on 1 March 2024

Labuan offshore companies economic substance requirement

The Labuan Business Activity Tax (Requirements for Labuan Business Activity) (Amendment) Regulations 2025 (the “Amendment Regulations”) were gazetted on 9 September 2025, amending the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021 (the “Principal Regulations”) as follows:

Regulation 2 of the Principal Regulations is amended by substituting the words “full time employees” with the words “fit and proper full time employees”. A new regulation 2A is inserted into the Principal Regulations to prescribe the requirements for a “fit and proper” full time employee. A Labuan entity carrying on a Labuan business activity must ensure that such employee shall:

- carry out work that is appropriate in respect of the Labuan business activities of the Labuan entity;

- have adequate and appropriate competency and ability in respect of the Labuan business activities of the Labuan entity;

- not have personal interests or other responsibilities that may interfere with the performance of his duties in respect of the Labuan business activities of the Labuan entity;

- be employed on a permanent or contractual basis by the Labuan entity; and

- carry out his work physically in Labuan.

The Amendment Regulations introduce a new requirement that the full time employees of a Labuan entity must be “fit and proper” as provided in the new Regulation 2A. The amendments elevate the compliance standard for Labuan entities by prescribing clear conditions relating to the suitability, competency, and presence of employees engaged in Labuan business activities. Labuan entities should review their staffing arrangements to ensure compliance with the new “fit and proper” criteria, particularly the requirements relating to competency and the physical presence of employees in Labuan.

Key tax reforms for capital markets income

Courtesy Cruz, Marcelo and Tenefrancia in Manila it was reported that on 29 May 2025, the Philippine government enacted Republic Act No. 12214, otherwise known as the Capital Market Efficiency Promotion Act (CMEPA), introducing comprehensive amendments to the National Internal Revenue Code of 1997. CMEPA aims to enhance the efficiency, simplicity, and competitiveness of the Philippine capital markets through targeted tax reforms.

CMEPA is grounded on the recognition that robust and efficient capital markets are essential to economic development. Accordingly, it advances several core policy objectives: (i) simplifying the tax system to ease compliance; (ii) promoting equitable taxation of passive income to eliminate arbitrage opportunities; (iii) enhancing the Philippines’ regional competitiveness; (iv) encouraging investment through favorable treatment of equity and debt transactions; and (v) supporting corporate entities in capital formation through the capital markets.

CMEPA clarifies definitions relevant to capital market transactions, including terms such as “shares of stock,” “securities,” and “passive income”, to ensure consistency in tax administration. A notable change is the standardization of the tax treatment on interest income and royalties. Previously subject to varying rates, all interest income from Philippine-sourced deposits, trust funds, and similar financial instruments are now subject to a flat 20% final withholding tax. This also applies to winnings and prizes exceeding PhP 10,000.00. Additionally, interest from foreign currency deposits, formerly taxed at 15%, is now taxed at the same 20% rate to align the treatment of domestic and foreign currency instruments.

CMEPA also provides clarity on royalties, subjecting them to a 20% final tax, except those derived from books, literary works, and musical compositions, which benefit from a reduced 10% rate to support cultural and creative industries. Meanwhile, the previous exemption from tax on income earned by non-residents under the Expanded Foreign Currency Deposit System has been removed, eliminating certain preferential treatments and leveling the playing field.

In terms of investment income, dividends are now subject to a final tax of 10%, while capital gains from the sale or other disposition of shares not traded on the stock exchange, whether involving domestic or foreign corporations, are uniformly taxed at a 15% final rate. This harmonization encourages fair competition between domestic and foreign investments.

To improve market liquidity and reduce transaction costs, the stock transaction tax on the sale or exchange of listed domestic shares has been significantly reduced from 0.6% to 0.1% of the gross selling price. This lower rate now applies not only to local stock exchange transactions but also to those conducted through foreign stock exchanges, boosting regional competitiveness and investor appeal.

Further, CMEPA reduces the documentary stamp tax (DST) on original issuances of shares of stock and debt instruments from 1% to 0.75%. This reduced DST rate also covers bonds, debentures, and similar instruments issued both locally and internationally. To further ease investment activity, the following transactions are now exempt from DST: (i) the sale, exchange, or redemption of listed shares on local or foreign stock exchanges; (ii) original issuances and redemptions of shares in mutual fund companies; and (iii) the issuance of certificates or other evidence of participation in mutual funds or unit investment trust funds.

CMEPA also provides additional incentives for retirement savings under the Personal Equity and Retirement Account framework. Employers contributing an amount equal to or greater than their employee’s contributions may claim an additional tax deduction equivalent to 50% of their actual contribution, subject to the allowable maximum of PhP100,000.00 or its foreign currency equivalent.

To ensure effective implementation, CMEPA imposes stricter compliance obligations, including timely filing and payment of capital gains taxes. These requirements aim to promote transparency, improve enforcement, and reinforce investor confidence.

Finally, the Department of Finance, in coordination with key regulatory bodies such as the Securities and Exchange Commission, the Bangko Sentral ng Pilipinas, and the Bureau of Internal Revenue, is mandated to issue the implementing rules and regulations within sixty (60) days from CMEPA’s effective date of 1 July 2025.

CMEPA marks a landmark reform in the Philippine tax and capital market landscape. By streamlining taxation on passive income, lowering transaction and issuance costs, and reinforcing investor protections, it fosters broader participation in capital markets, enhances financial inclusion, and supports long-term economic growth.

New regime for large-scale metallic mining

Courtesy IBFD it was reported that on 4 September 2025, the President signed into law the Enhanced Fiscal Regime for Large-Scale Metallic Mining Act (Republic Act No. 12253, the “Act”). The Act introduces a simplified and transparent tax framework aimed at ensuring a fairer distribution of mining revenues between the government and mining operators.

Key measures of the Act are as follows:

- a 5% royalty will be imposed on the gross output of mining companies operating within the government's designated mining sites;

- a 5-tier, margin-based royalty at rates ranging from 1% to 5% will be imposed on income from metallic mining operations outside mineral reservations, and a minimum royalty rate of 0.1% on gross output for mines below the margin threshold;

- a 5-tier, margin-based windfall profits tax at rates ranging from 1% to 10% will be imposed on the income from metallic mining operations;

- a 2:1 debt-to-equity ratio or thin capitalization rule is applicable to related-party debt, to limit the amount of tax-deductible borrowing costs arising from the debt; and

- a ring-fencing rule is applicable on a per-project basis to prevent taxpayers from consolidating income and expenses across mining projects, thereby disallowing companies from offsetting losses against profits from more profitable projects.

The Act will come into effect 15 days after the completion of its publication on the Official Gazette.

Strengthening technological competitiveness and security

Taiwan’s Industrial Innovation Statute has undergone several significant amendments in recent years. The Statute aims to foster digital innovation, support industry growth, and enhance regulatory efficiency. In 2023, Article 10-2 was introduced, often referred to as Taiwan’s version of the Chips and Science Act, offering tax incentives and funding to drive technological advancements. In April 2025, the Legislative Yuan passed a further amendment to the Statute, which aims at accelerating industrial digitalization, enhancing startup fundraising opportunities, and preventing critical technology outflows — reinforcing Taiwan’s role as a global high-tech hub.

The introduction of Article 10-2 in January 2023 strengthens Taiwan’s industrial competitiveness, particularly in the semiconductor sector. It allows domestic companies that engage in technological innovation in Taiwan, hold key positions in the global supply chain, and meet certain conditions to receive a 25% tax credit on forward-looking R&D expenses, offsetting up to 30% of their profit-seeking enterprise income tax for then-current year. Moreover, these companies can receive a 5% tax credit on new equipment for advanced manufacturing expenditure, offsetting up to 30% of their profit-seeking enterprise income tax for then-current year. The Ministry of Finance further illustrated the qualification criteria of the forward-looking R&D tax credit: (1) R&D expenses reach NT$ 6 billion. (2) The rate of R&D expenses for net operating revenue reaches 6%. (3) The effective tax rate reaches 15%. As for the advanced equipment tax credit, in addition to meeting these three requirements, the equipment expenditure has to reach NT$ 10 billion.

Article 10-2 is mainly set for domestic semiconductor industry, solidifying its leading position in global supply chains. Taiwan plays a crucial role in the global semiconductor industry, producing over 60% of the world’s chips and more than 90% of advanced semiconductors, which are essential for cutting-edge technologies like AI and high-performance computing. Its dominance has made Taiwan an indispensable player in the global tech supply chain and made the island a focal point in geopolitics. Therefore, the government seeks to ensure that advanced manufacturing processes remain within its border through R&D tax incentives, securing the country’s core position in high-tech development.

In December 2024, the Executive Yuan proposed amendments to align the Statute with AI advancements and global net-zero emissions trends. On April 18, 2025, the Legislative Yuan passed three readings of the amendments. The key changes include:

Expansion of Investment Tax Deductions

The current Article 10-1 allows companies that meet certain compliance requirements to claim tax credits for investments in hardware, software, technology, or technical services related to smart machinery, 5G network implementation, or cybersecurity. This tax incentive, which permits companies to offset a percentage of their enterprise income tax with a maximum eligible expenditure of NT$1 billion per taxable year, is set to expire at the end of 2024. The amendment of Article 10-1 expands the scope of eligible investment tax credits to include AI products or services and energy-conservation and carbon-reduction initiatives, raises the maximum eligible expenditure for tax credits to NT$ 2 billion, and extends the implementation period of these tax incentives to December 31, 2029.

Enhancing Startup Fundraising Opportunities

The original Article 23-1 sets a threshold for capital contributions eligible for “fiscally transparent taxation”, a tax mechanism where qualifying limited partnerships are exempt from paying enterprise income tax but subject partners to individual income tax upon profit distribution. The amended Article 23-1 lowers the threshold: The minimum paid-in capital requirement for limited partnerships is reduced from NT$ 300 million to NT$ 150 million.

Article 23-2 is amended to enhance tax incentives for angel investors in high-risk startups. It increases the maximum personal income deduction to NT$ 5 million, extends the eligible startup period from less than two years to less than five years, lowers the minimum investment threshold from NT$ 1 million to NT$ 500,000, and raises the required holding period for shares from two to three years. These changes aim to encourage greater and longer-term investments, helping startups secure funding.

Preventing Critical Technologies Outflows

The amendment to Article 22 requires prior government approval not only for overseas investments exceeding NT$ 1.5 billion but also for investments in designated countries, regions, industries, or technologies. The central competent authority may deny or conditionally approve investment applications if the proposed investment poses risks to national security, negatively impacts economic development, affects compliance with international agreements, or involves unresolved major labor disputes. Article 67-3 introduces the corresponding penalties for non-compliance. If a company violates Article 22 by carrying out an investment without prior approval, it shall be subject to a fine ranging from NT$ 50,000 to NT$ 1 million and may be ordered to rectify the violation, cease or withdraw the investment.

Taiwan’s latest amendments to the Statute for Industrial Innovation underscore its commitment to maintaining a competitive edge in the global technology landscape. By expanding tax incentives for R&D and high-tech investments, strengthening startup financing, and tightening controls on outbound investments, Taiwan is positioning itself as a key player in industrial innovation while safeguarding national security and economic interests. These policy changes will not only bolster domestic industries but also shape Taiwan’s role in the evolving global semiconductor and technology supply chain.

International tax developments

Kazakhstan. The agreement on free trade in services and investments between Kazakhstan and Singapore, signed on 22 May 2023, entered into force on 1 March 2025.

Personal income tax exemption on capital gains from sale of digital assets

On 5 September 2025, Ministerial Regulation No.399 under the Revenue Code was enacted, granting an exemption from personal income tax for capital gains made from the sale of cryptocurrencies and digital tokens for five years, starting from 1 January 2025 and ending on 31 December 2029.

The tax exemption applies to gains made from the sale of cryptocurrencies and digital tokens through a digital asset exchange, digital asset broker or a digital asset dealer, licensed under Thailand's digital asset business laws.

The capital gains tax exemption is part of a series of tax measures to support the government's policy to promote Thailand as a global digital asset hub and encourage investment in digital assets in the country, to enhance the country's overall competitiveness.

Incentives to promote return of Thai nationals working abroad

The Director General of the Revenue Department recently issued Notification No. 460 (the "Notification") to supplement Royal Decree No. 793 under the Revenue Code which introduced incentives to attract Thai nationals working abroad to return to work in Thailand.

Under the Royal Decree, qualifying employees will be eligible to a flat personal income tax rate of 17% on employment income whilst employers are eligible for a 150% corporate income tax deduction for the salary costs of the employee. To benefit from the personal income tax incentive, employees must submit tax return Por.Ngor.Dor. 95 detailing the eligible assessable income and retain supporting documents verifying educational qualifications and work experiences.

Employers that are eligible for the corporate income tax deduction must submit the required information to the Revenue Department using the form prescribed by the Notification. The form must be submitted before the first salary payment to the employee.

The Notification was issued on 19 August 2025 and is effective from 25 March 2025.

Reduced VAT rate of 7% to be continued

On 9 September 2025, the Thai Cabinet approved in principle a draft Royal Decree to be issued under the Revenue Code to extend the reduced value added tax (VAT) rate of 7% for another year to 30 September 2026, for the sale of goods and the provision of services and imports. The new Royal Decree is required because the 7% VAT rate is set to expire on 30 September 2025. This decision confirms what has seemingly now become a routine annual extension of a reduction of the 10% standard VAT rate since 2000.

New Corporate Tax Law

On 14 June 2025, Vietnam's National Assembly adopted Law No. 67/2025/QH15 on Corporate Income Tax (CIT) (the "CIT Law"). The new CIT Law took effect starting 1 October 2025 and applies to the 2025 tax year, thereby repealing the previous CIT Law.

Notable tax changes in the new law are:

- An expanded definition of CIT taxpayers: Foreign suppliers engaging in e-commerce and digital business are included in the list of CIT taxpayers.

- An expanded definition of Permanent Establishment (PE): an e-commerce or digital platform through which a foreign enterprise provides goods or services in Vietnam will be deemed a PE of that enterprise in Vietnam. However, this definition under domestic law cannot prevail over the PE definition provided under tax treaties.

- New rule on capital gains tax for corporate sellers: Income from capital transfers in Vietnam by foreign corporate sellers may now be subject to a percentage of CIT on sale proceeds instead of the current 20% on gains. A government decree will provide more details on the applicable CIT rate (2%), taxable revenue determination, timing and entities responsible for tax filing and payment.

- Credit of IIR tax: where an enterprise is subject to additional CIT under the Income Inclusion Rule (IIR) in accordance with the law applicable to Vietnamese affiliates of large global businesses with annual global turnover of EUR 750 million, the additional CIT payable shall be deducted from the CIT payable in Vietnam as stipulated under the CIT Law.

- Expanded list of incomes exempt from CIT: The expanded list includes sponsorships received from enterprises that do not have a related-party relationship and from domestic and foreign organizations or individuals, to be used for activities related to scientific research, technological development, innovation and digital transformation; direct support from the state budget and from the Investment Support Fund established by the government; and compensation from the state in accordance with legal regulations, etc.

- Deductible expenses:

- The new law does not specify a threshold for noncash payments of VND 20 million like the current law. This will be detailed in the implementing regulations, likely matching the VND 5 million threshold of the new VAT Law.

- It legalizes the current practice of tax authorities whereby expenses that do not meet the expenditure conditions and expenditure contents prescribed by specialized laws shall not be deducted.

- Notable amendments to CIT rates and CIT incentives:

- Preferential rates for small revenue enterprises:

- 15% for enterprises with total annual revenue not exceeding VND 3 billion.

- 17% for enterprises with total annual revenue over VND 3 billion tbut not exceeding VND 50 billion.

- CIT rates applicable to specific cases: oil and gas prospection, exploration and exploitation: 25-50% (specific rate decided by the prime minister).